MELANIA Plunges to All-Time Low After $14.75 Million Sell-Off By Insiders

MELANIA crashes 97% as team-linked wallets dump $14.75 million in tokens, sparking renewed concerns over insider activity and market manipulation.

A wave of heavy sell-offs linked to the team behind the Melania meme coin (MELANIA) has raised fresh concerns about insider activity within the project.

These activities have contributed to the token’s value dropping to an all-time low, a staggering 97% down from its all-time high on Trump’s inauguration day back in January.

Heavy Insider Selling Sends MELANIA to Historic Low

On April 19, on-chain analyst EmberCN reported that wallets tied to the project offloaded nearly 3 million MELANIA tokens.

In return, the team received approximately 9,009 SOL, valued at around $1.2 million. The tokens were sold through unilateral liquidity provisions added to the MELANIA/SOL trading pair on Meteora.

This transaction is part of a broader pattern. In the past three days, the MELANIA team reportedly moved 7.64 million tokens, worth about $3.21 million, from both liquidity and community wallets.

The team systematically added these tokens to the same liquidity pool and sold them for SOL within a pre-defined price range. Out of the total, they sold 2.95 million tokens just hours before EmberCN’s disclosure.

“In the past 3 days, the $MELANIA project team has continued to transfer out 7.643 million $MELANIA tokens ($3.21M) from liquidity and community addresses, then added them to MELANIA/SOL one-sided liquidity on Meteora, selling $MELANIA within a set range for SOL. Of which, 2.95 million $MELANIA tokens were sold 7 hours ago for 9,009 SOL,” EmberCN stated.

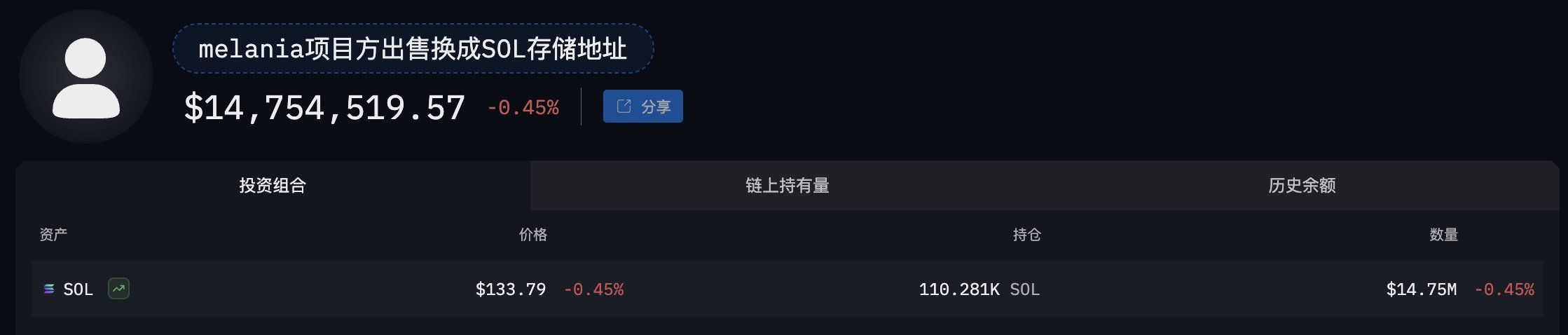

EmberCN further pointed out that the project’s team has sold over 23 million MELANIA tokens in the past month. The tokens were worth approximately $14.75 million.

Melania’s Team SOL Token Holding. Source:

EmberCN

Melania’s Team SOL Token Holding. Source:

EmberCN

These repeated sell-offs have added weight to concerns over internal dumping—suspicions that first emerged in March.

At the time, blockchain analytics firm Bubblemaps reported unusual movements of over $30 million in MELANIA tokens. Originally part of the community allocation, the tokens appeared to be gradually transferred to exchanges without explanation.

The firm linked these transactions to Hayden Davis, a co-founder of the meme coin. Davis previously worked on another controversial token, LIBRA, which briefly surged after Argentine President Javier Milei endorsed it, then quickly collapsed.

Bubblemaps also revealed that wallets tied to the MELANIA team control roughly 92% of the token’s total supply. Critics argue that this level of centralization raises red flags over potential market manipulation.

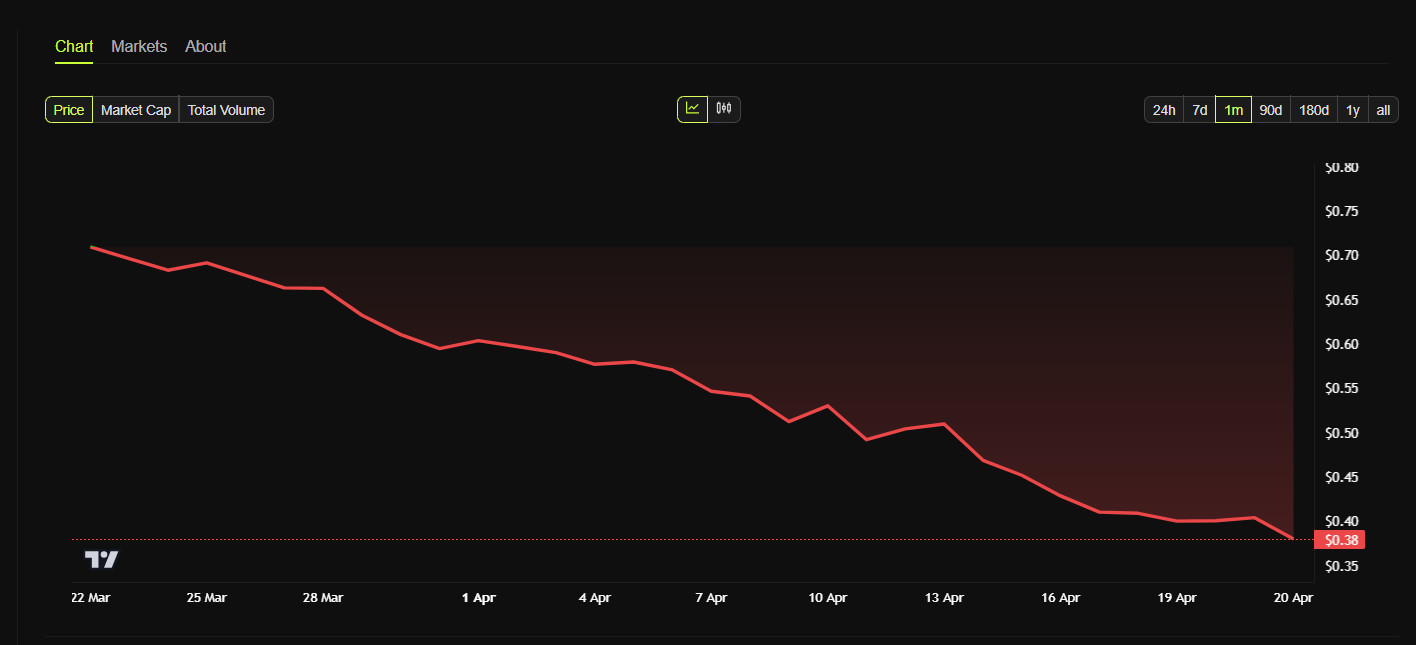

As a result of these concerns, MELANIA has seen its price collapse. After reaching a high of over $13 earlier this year, the token has dropped by over 96% to an all-time low of $0.38, according to data from BeInCrypto.

MELANIA Token Price Performance. Source: BeInCrypto

MELANIA Token Price Performance. Source: BeInCrypto

However, the steep decline reflects both internal turmoil and broader weakness in the meme coin sector. Investor appetite for high-risk tokens appears to be fading amid global uncertainty and a more cautious market sentiment

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum undergoes "Fusaka upgrade" to further "scale and improve efficiency," strengthening on-chain settlement capabilities

Ethereum has activated the key "Fusaka" upgrade, increasing Layer-2 data capacity eightfold through PeerDAS technology. Combined with the BPO fork mechanism and the blob base price mechanism, this upgrade is expected to significantly reduce Layer-2 operating costs and ensure the network’s long-term economic sustainability.

Down 1/3 in the first minute after opening, halved in 26 minutes, "Trump concept" dumped by the market

Cryptocurrency projects related to the Trump family were once market favorites, but are now experiencing a dramatic collapse in trust.

Can the Federal Reserve win the battle to defend its independence? Powell's reappointment may be the key to victory or defeat

Bank of America believes that there is little to fear if Trump nominates a new Federal Reserve Chair, as the White House's ability to exert pressure will be significantly limited if Powell remains as a board member. In addition, a more hawkish committee would leave a Chair seeking to accommodate Trump's hopes for rate cuts with no room to maneuver.

From panic to reversal: BTC rises above $93,000 again, has a structural turning point arrived?

BTC has strongly returned to $93,000. Although there appears to be no direct positive catalyst, in reality, four macro factors are resonating simultaneously to trigger a potential structural turning point: expectations of interest rate cuts, improving liquidity, political transitions, and the loosening stance of traditional institutions.