May 2nd news, according to Jin10 reports, stronger-than-expected U.S. employment data indicates that tariff uncertainty has not yet caused a substantial impact on the U.S. job market, prompting traders to reduce bets on Federal Reserve rate cuts, followed by a decline in U.S. Treasury bonds. After non-farm payrolls increased by 177,000, the two-year Treasury yield rose by 7 basis points to 3.77%. Traders reduced their bets on Federal Reserve rate cuts, expecting an overall rate cut of about 85 basis points this year, compared to the pre-report expectation of around 90 basis points.

Strong U.S. Job Market Leads to Reduced Bets on Fed Rate Cuts

PANews2025/05/02 13:15

Show original

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

The US Dollar Index rose by 0.14% on the 14th.

金色财经•2025/11/14 21:10

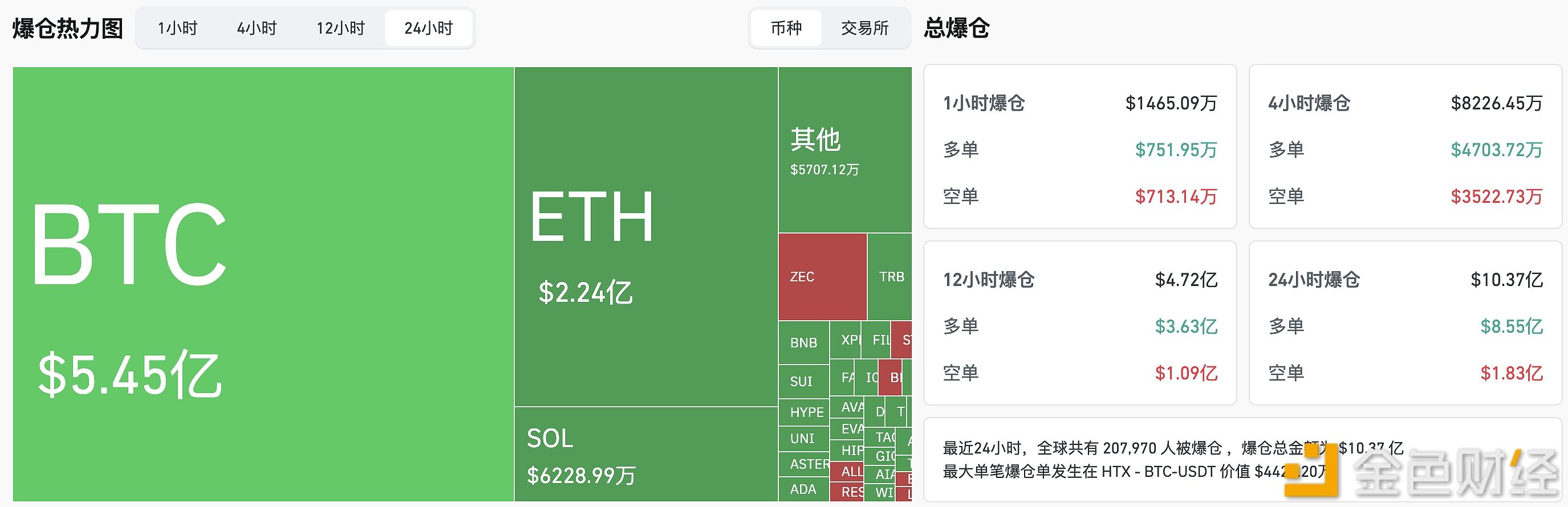

In the past 24 hours, liquidations across the entire network reached $1.037 billion.

金色财经•2025/11/14 19:56

Data: 100 WBTC transferred out from Galaxy Digital, worth approximately $9.51 million

Chaincatcher•2025/11/14 19:09

Data: 1.927 million ENA flowed into a certain exchange's Prime, worth approximately $5.51 million

Chaincatcher•2025/11/14 18:54

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$95,019.52

-3.46%

Ethereum

ETH

$3,166.72

-0.29%

Tether USDt

USDT

$0.9995

+0.02%

XRP

XRP

$2.28

-0.68%

BNB

BNB

$925.68

+1.28%

Solana

SOL

$140.84

-0.84%

USDC

USDC

$0.9999

+0.02%

TRON

TRX

$0.2941

+0.92%

Dogecoin

DOGE

$0.1601

-0.46%

Cardano

ADA

$0.5076

-2.12%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now