Hyperliquid bulls aim for the $25 mark as open interest reaches a new all-time high

- Hyperliquid price trades around $21.20 on Wednesday after rebounding nearly 6% so far this week.

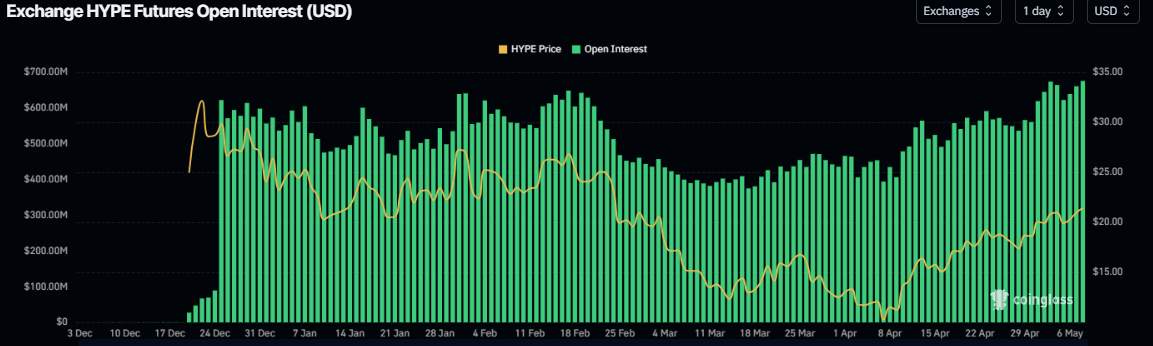

- CoinGlass data shows HYPE open interest reaches a new all-time high of $697 million, suggesting a bullish outlook.

- Ethena launches USDe stablecoin on Hyperliquid, bringing the Dollar-pegged asset to a fast DeFi and derivatives hub.

Hyperliquid (HYPE), the decentralized perpetual trading platform and Layer 1 blockchain, edges higher and trades around $21.20 at the time of writing on Wednesday after rebounding nearly 6% so far this week. CoinGlass data shows HYPE Open Interest (OI) reaches a new all-time high of $697 million, suggesting a bullish outlook. Moreover, Ethena Labs launched USDe stablecoin on Hyperliquid on Monday, bringing the Dollar-pegged asset to a fast Decentralized Finance (DeFi) and derivatives hub.

Hyperliquid Open Interest reaches new all-time high

Coinglass’ data shows that the futures’ OI in HYPE at exchanges rose from $622 million on Monday to $676.03 million on Wednesday, a new all-time high. An increasing OI represents new or additional money entering the market and new buying, which could fuel the current rally in the Hyperliquid’s price.

HYPE Open Interest chart. Source: Coinglass

Ethena Labs announced on Monday that it has launched USDe stablecoin on Hyperliquid’s exchange and HyperEVM blockchain. This will enable users to hold a Dollar-pegged asset in a high-speed DeFi ecosystem known for derivatives trading.

The integration of USDe into Hyperliquid’s ecosystem will benefit its native token HYPE as it increases ecosystem utility and adoption, boosts trading volume, attracts stablecoin liquidity, and signals growth through DeFi integrations and partnerships.

USDe is now live on both @HyperliquidX exchange & HyperEVM 🫳🏻

— Ethena Labs (@ethena_labs) May 5, 2025

HyperCore users will earn daily rewards auto airdropped on top of their USDe spot exchange balances

USDe fills the opportunity for a scalable rewarding dollar asset within the Hyperliquid exchange & ecosystem

HYENA… pic.twitter.com/rbffoZh9ZJ

Hyperliquid’s technical outlook suggests 17% gains ahead

Hyperliquid’s price found a cushion around its daily support level at $19.24 on Tuesday and recovered slightly. This level roughly coincides with the 50% Fibonacci retracement (drawn from the February 14 high of $28.53 to the April 7 low of $9.28) at $18.90. At the time of writing on Wednesday, HYPE trades slightly above at around $21.23.

If HYPE continues its upward momentum, it could extend the rally by 17% from its current level to its psychological importance level of $25.

The Relative Strength Index (RSI) on the daily chart reads 66, above its neutral level of 50, indicating strong bullish momentum. The Moving Average Convergence Divergence (MACD) indicator also showed a bullish crossover, indicating a continuation of the upward trend.

HYPE/USDT daily chart

However, if HYPE fails to find support around the daily level of $19.24 and closes below it, it could extend the decline to retest its April 28 low of $16.90

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Blood and Tears Files of Crypto Veterans: Collapses, Hacks, and Insider Schemes—No One Can Escape

The article describes the loss experiences of several cryptocurrency investors, including exchange exits, failed insider information, hacker attacks, contract liquidations, and scams by acquaintances. It shares their lessons learned and investment strategies. Summary generated by Mars AI This summary was produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

Mars Morning News | Federal Reserve officials to advance stablecoin regulatory framework; US SEC Chairman to deliver a speech at the New York Stock Exchange tonight

Federal Reserve officials plan to advance the formulation of stablecoin regulatory rules. The SEC Chair will deliver a speech on the future vision of capital markets. Grayscale will launch the first Chainlink spot ETF. A Coinbase executive has been sued by shareholders for alleged insider trading. The cryptocurrency market fear index has dropped to 23. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

OECD's latest forecast: The global interest rate cut cycle will end in 2026!

According to the latest forecast from the OECD, major central banks such as the Federal Reserve and the European Central Bank may have few "bullets" left under the dual pressures of high debt and inflation.

MSTR, the leading Bitcoin concept stock, plunges up to 12% intraday after first signaling possible "coin selling"

MicroStrategy has announced the establishment of a $1.44 billion cash reserve to "weather the winter," and for the first time has acknowledged the possibility of selling bitcoin under certain conditions.