Bitcoin Institutional Investors Trim Exposure Ahead of FOMC as BTC ETFs See Outflows

Institutional investors are pulling back from Bitcoin ETFs amid uncertainty surrounding the Federal Reserve's upcoming policy decision, but spot market inflows remain strong.

On Tuesday, Bitcoin spot ETFs recorded net outflows, snapping a three-day streak of inflows that had brought in over $1 billion.

With uncertainty surrounding the Federal Reserve’s upcoming policy decision, institutional investors appear to be reducing their exposure in anticipation of increased market volatility.

Institutions Pull Back from BTC ETFs as Fed Decision Looms

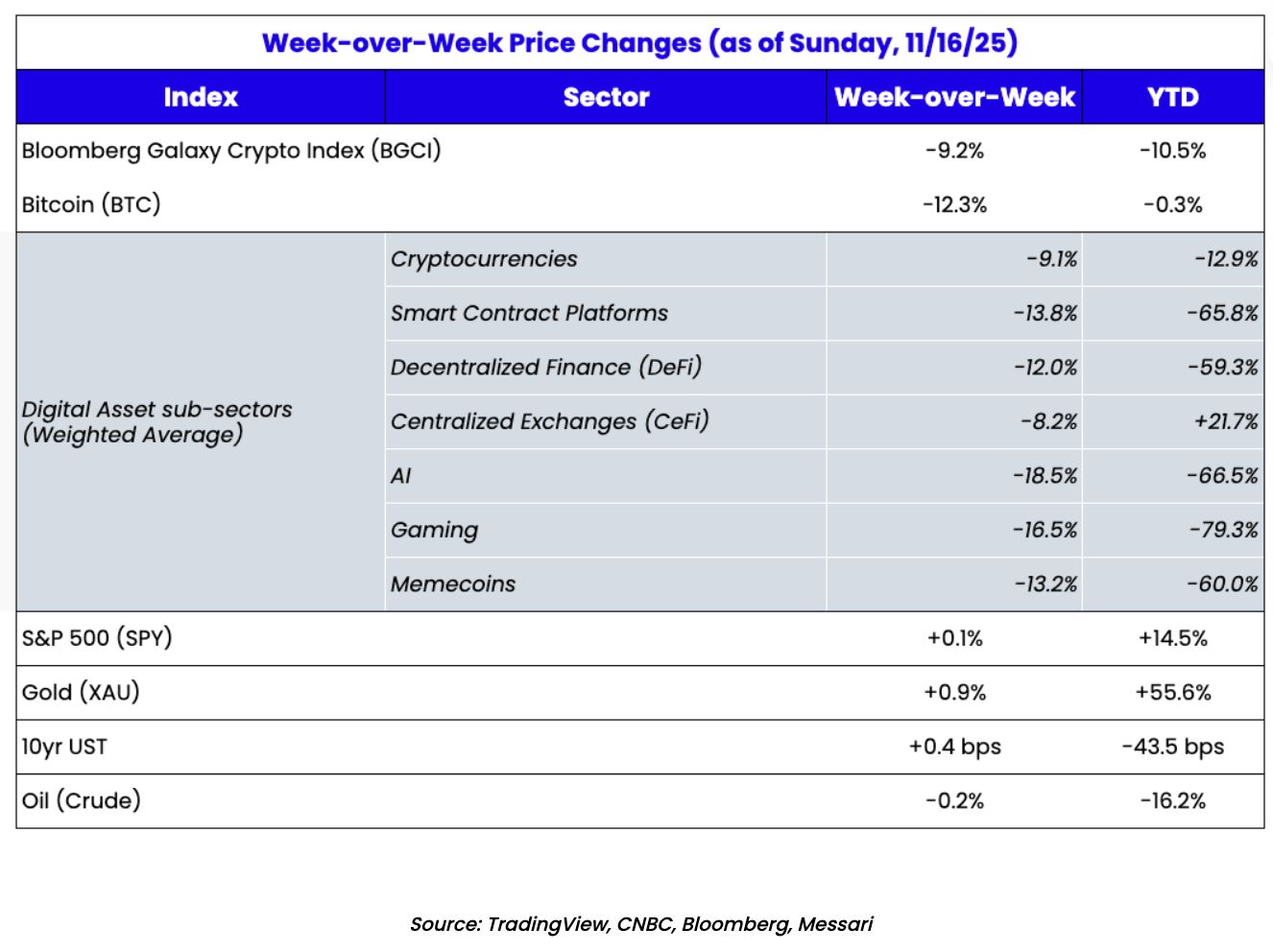

BTC spot ETFs saw net outflows of $85.64 million on Tuesday, marking a shift in sentiment among institutional investors just ahead of today’s US Federal Reserve’s latest policy meeting.

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

The outflows came after three consecutive days of strong inflows, totaling over $1 billion, into these BTC-backed funds. This suggests a pullback as market participants prepare for potential volatility surrounding today’s FOMC announcement.

It can also be seen as a strategic step to avoid short-term losses in the event of an unfavorable policy signal or unexpected market reaction.

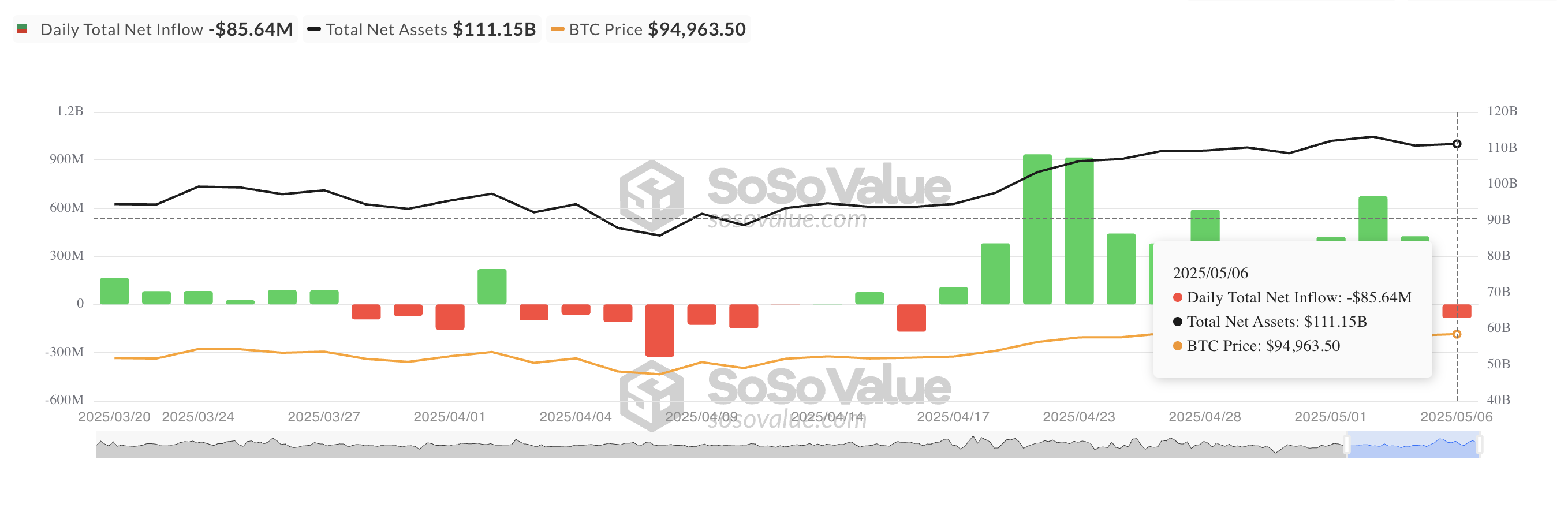

Despite the ETF outflows, on-chain data reveals a spike in spot net inflows today. This indicates that while institutional players may be reducing their ETF exposure, they could be rotating capital into direct spot positions, possibly to capitalize on short-term price swings both before and after the Fed’s announcement.

According to Coinglass, BTC’s spot net inflows sit at $9.72 million. When an asset sees spot inflows, the number of its coin or tokens purchased and moved into spot markets has increased, indicating rising demand.

BTC Spot Inflow/Outflow. Source:

Coinglass

BTC Spot Inflow/Outflow. Source:

Coinglass

This points to surging accumulation among BTC spot market participants, a trend which can drive price appreciation if buying pressure remains.

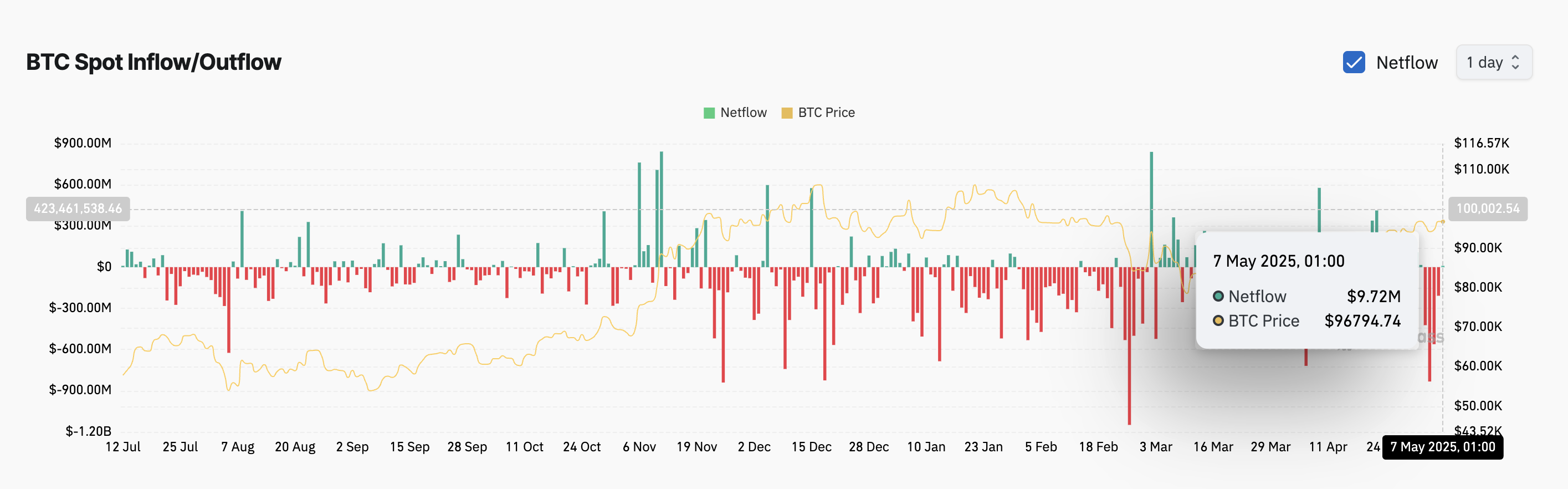

Bitcoin Rises on Buyer Strength

BTC trades at $96,679 at press time, noting a 2% surge over the past day. The coin’s positive Balance of Power (BoP) reflects the steady rise in spot buying activity ahead of the FOMC meeting. As of this writing, this is at 0.10.

This indicator measures the strength of buyers versus sellers by comparing the closing price to the trading range over a specific period. When its value is positive, buyers dominate the market, suggesting bullish momentum and upward pressure on an asset’s price.

If BTC demand rockets and market conditions remain favorable post-FOMC meeting, it could climb toward $102,080.

BTC Price Analysis. Source:

TradingView

BTC Price Analysis. Source:

TradingView

However, if market volatility triggers a move to the downside, BTC could shed recent gains, breach support at $96,187, and fall to $92,048.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Atlantic: How Will Cryptocurrency Trigger the Next Financial Crisis?

Bitcoin fell below $90,000, and the cryptocurrency market lost $1.2 trillions in six weeks. Stablecoins, criticized for disguising risks as safety, have been identified as potential triggers for a financial crisis, and the GENIUS Act could increase these risks. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Bitcoin Surrenders Early as Market Awaits Nvidia’s Earnings Report Tomorrow

Global risk assets have experienced a significant decline recently, with both the US stock market and the cryptocurrency market plunging simultaneously. This is mainly due to investor fears of an AI bubble and uncertainty surrounding the Federal Reserve's monetary policy. Concerns over the AI sector intensified ahead of Nvidia's earnings report, while uncertainty in macroeconomic data further increased market volatility. The correlation between Bitcoin and tech stocks has strengthened, leading to split market sentiment, with some investors choosing to wait and see or buy the dip. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still being iteratively improved.

Recent Market Analysis: Bitcoin Falls Below Key Support Level, Market on High Alert, Preparing for a No Rate Cut Scenario

Due to the uncertainty surrounding the Federal Reserve’s decision in December, it may be wiser to act cautiously and control positions rather than attempting to predict a short-term bottom.

If HYPE and PUMP were stocks, they would both be undervalued.

If these were stocks, their trading prices would be at least 10 times higher, if not more.