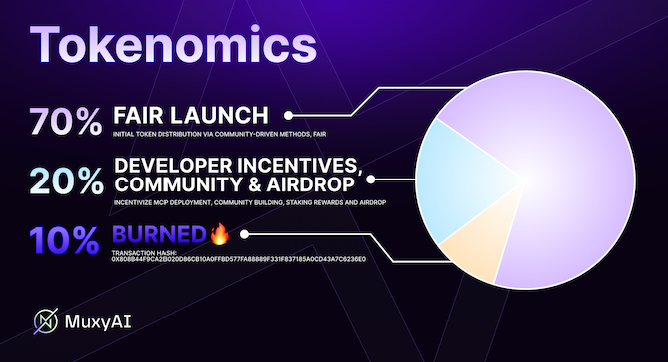

MAI Tokenomics

$MAI Tokenomics

Token Allocation and Distribution Strategy

-

Total Supply: 1,000,000,000

Lock-up and Vesting Mechanisms

-

Incentive Pool Tokens (20%): Released gradually into the ecosystem according to a predetermined Emission Schedule. This schedule will be designed for long-term incentive effectiveness, possibly linked to protocol usage, time, specific development milestones, or employing a decaying release rate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

JPMorgan’s Competitive Advantage: Healthcare and Financial Sectors Flourish as Markets Evolve

- JPMorgan views current U.S. equity pullback as a buying opportunity, signaling potential stabilization after valuation-driven corrections. - Raised Eli Lilly's price target to $1,150 citing regulatory tailwinds for obesity drugs despite sector challenges like Merck's Cidara acquisition. - Dominated leveraged loan markets with $20B EA financing, leveraging $50B regulatory exposure limits to outpace rivals in high-risk deals. - Faces legal scrutiny over Epstein ties and $73M Javice liability, contrasting w

Crypto Takes a Hit, ARK Invests: Major Wagers on Key Industry Leaders

- ARK Invest heavily buys crypto-linked stocks like Coinbase , Circle , and Bullish amid market declines, signaling sector resilience bets. - Purchases occur as Bitcoin drops below $90,000 and regulatory uncertainties persist, with ARK's "buy the dip" strategy targeting foundational crypto players. - Analysts highlight Circle's stablecoin leadership and Bullish's growth potential, despite post-earnings stock declines and broader crypto volatility. - Institutional moves like Canary Capital's XRP ETF and Kra

Bitcoin News Update: Institutions Increase Bitcoin Holdings Threefold During Market Fluctuations, Strengthening Abu Dhabi’s Aspirations as a Crypto Hub

- A 10-year Bitcoin model by Sminston With shows 300% returns even with poor timing, highlighting its long-term resilience despite 2025 volatility. - Global liquidity ($113 trillion) and undervalued BTC (-1.52σ below fair value) suggest favorable conditions for Bitcoin's $170,000 projected fair price. - Institutional confidence grows as Abu Dhabi's Mubadala triples Bitcoin holdings and invests $2B in Binance, reinforcing its crypto hub ambitions. - New projects like Bitcoin Munari (BTCM) and regulatory shi

Bitcoin Updates: Institutions Remain Wary Amid Regulatory Turbulence—Will Bitcoin Reach $80K?

- Bitcoin fell below $90,000 in late 2025 amid regulatory scrutiny, macroeconomic uncertainty, and institutional outflows, losing 26% from its October peak. - Record $523M ETF outflows and $19B leveraged liquidations highlight market fragility, while Harvard's $443M IBIT allocation signals cautious institutional interest. - Fed ethics scandals and delayed rate cuts (now 46% chance in December) exacerbate uncertainty, alongside Japan/Brazil's regulatory headwinds raising compliance costs. - Analysts debate