-

Recent market dynamics have seen AAVE whales capitalize on price pullbacks, signaling a renewed interest in this leading altcoin.

-

A surge in whale activity has coincided with a negative net flow in exchanges, reinforcing the bullish sentiment among investors.

-

According to analysts, the increased accumulation reflects a strategic move by whales to enhance their positions amid current market volatility.

Whale accumulation of AAVE signals bullish sentiment amidst market volatility, with recent data showing significant buying pressure from large holders.

Whale Accumulation: A Key Indicator of Market Sentiment

In the wake of a price pullback to $239, AAVE whales have aggressively purchased significant amounts of the token, reinforcing bullish market sentiment. This strategic accumulation is underscored by the observation that one whale, who offloaded 184.4 WBTC worth approximately $20.4 million, has notably re-entered the market. This transaction was executed via Wintermute OTC, demonstrating the liquidity available for institutional investors. Following this sale, the whale invested $15 million into AAVE, acquiring 57,715 tokens at an average price of $259.9.

Analytical Insights into Whale Behavior and Accumulation Patterns

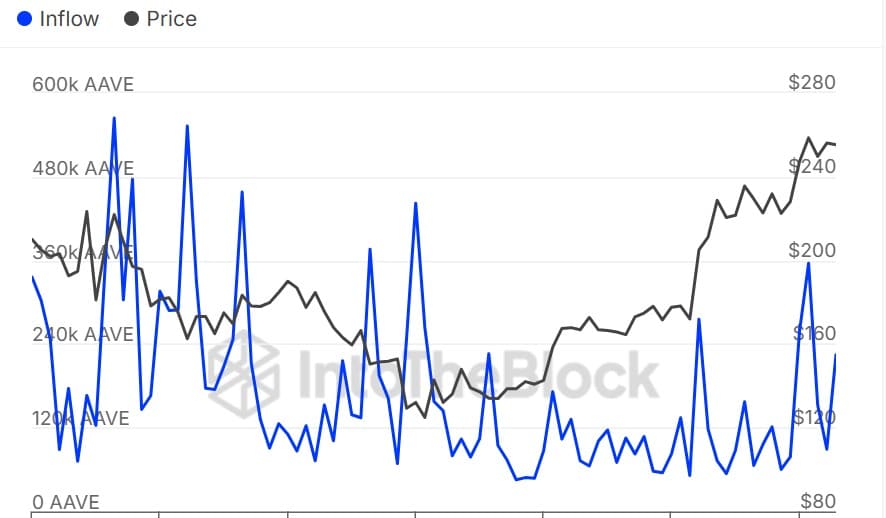

Data from on-chain analytics platform IntoTheBlock reveals a significant spike in large holders’ capital inflows, rising from 89k to 224.87k within 24 hours. This pattern of increasing inflows is indicative of a broader trend among whales looking to accumulate AAVE at favorable prices. The positive net flow observed among large holders, rising from 1.4k to 26.86k, supports the notion that selling pressure is being outscaled by buying activities. In the same period, this group has offloaded 198k AAVE tokens, yet the overall sentiment remains optimistically bullish.

Source: IntoTheBlock

Broader Market Trends and Investor Activity

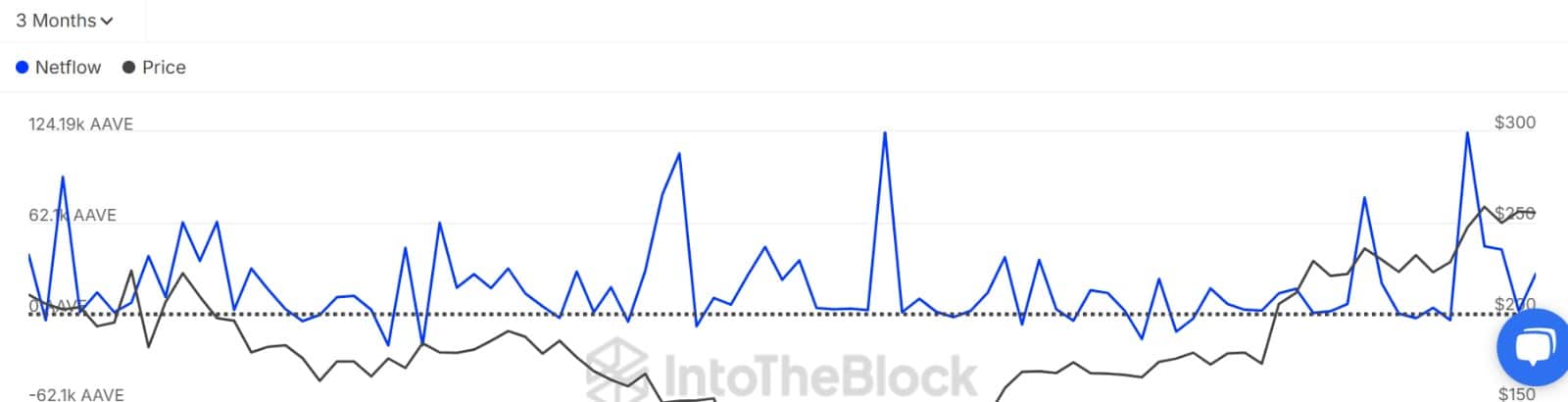

Further analysis indicates that this whale-driven accumulation extends beyond isolated incidents. The overall market has experienced three consecutive days of negative Netflow, suggesting that withdrawals are outpacing deposits. This phenomenon consistently signals bullish sentiment among investors, particularly as these trends hold over a sustained period. Positive net flows across exchanges often indicate an anticipation of price appreciation, as market participants withdraw assets in expectation of future gains.

Source: IntoTheBlock

Price Response and Short-Term Forecast

The strategic accumulation by whales has yielded positive returns, contributing to a 1.73% increase in AAVE’s price, reaching a daily high of $262. Investors are closely monitoring this momentum as the altcoin aims to test resistance levels at $270 and subsequently $284, amidst the backdrop of improving market sentiment. The potential for further gains appears plausible, although caution is warranted, as fluctuations could lead to a drop to support levels around $231 during profit-taking sessions.

Conclusion

The patterns of whale accumulation and broader market sentiment surrounding AAVE highlight a dynamic and evolving investment landscape. As whales continue to enhance their positions, the potential for price recovery remains strong. Investors should remain vigilant of market trends while considering the implications of whale activities on overall market dynamics.