Ethereum’s price has recently been hovering around $2,623, with on-chain data indicating increasing pressure beneath key resistance levels.

-

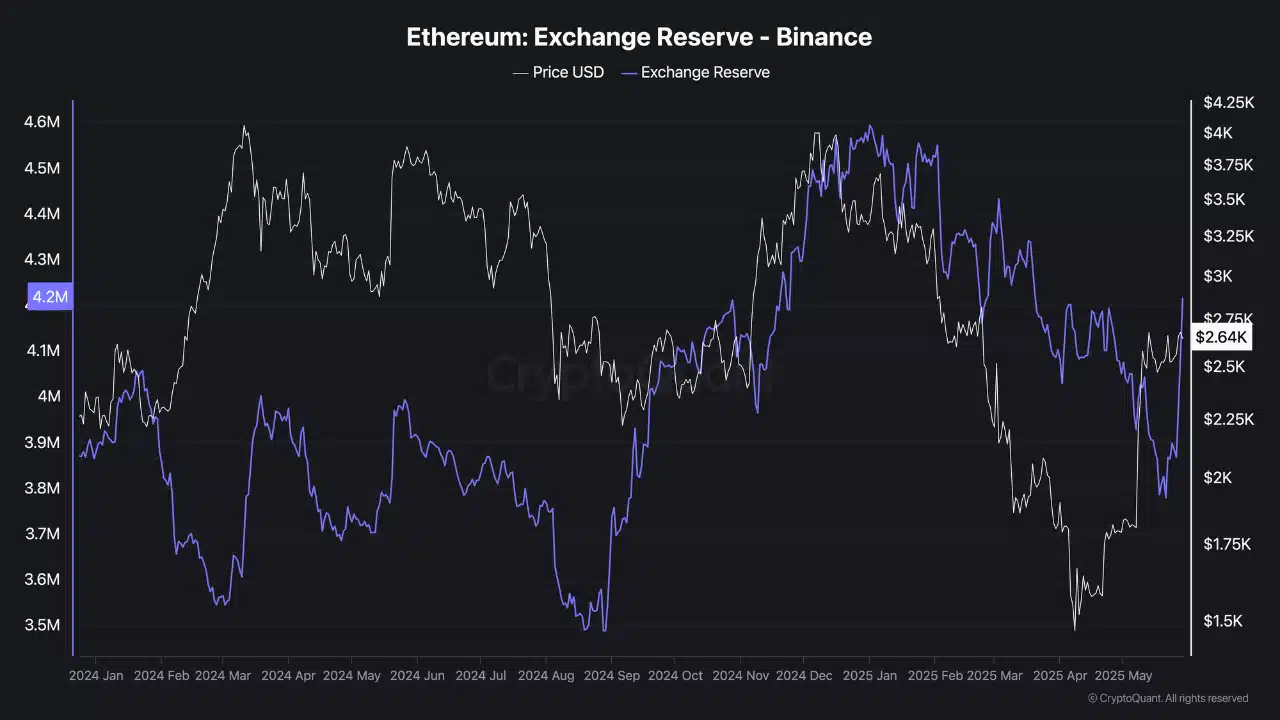

Ethereum’s Exchange Reserves on Binance climbed sharply, hinting at growing sell-side pressure.

-

ETH faces dense liquidation resistance between $2,700 and $2,830, capping upward momentum.

Ethereum [ETH] remained locked in a narrow range between $2,400 and $2,700, but Binance on-chain data revealed a mounting risk beneath the surface. Infact, Binance Exchange Reserves spiked to levels last seen before previous sell-offs, pointing to a rise in tokens being moved to exchanges—typically a sign of mounting sell pressure.

This was compounded by steady outflows, even as the price briefly held above $2,600. As of writing, ETH traded at $2,623.84 after a 3.60% daily drop.

Source: CryptoQuant

Why do negative netflows persist despite sideways price action?

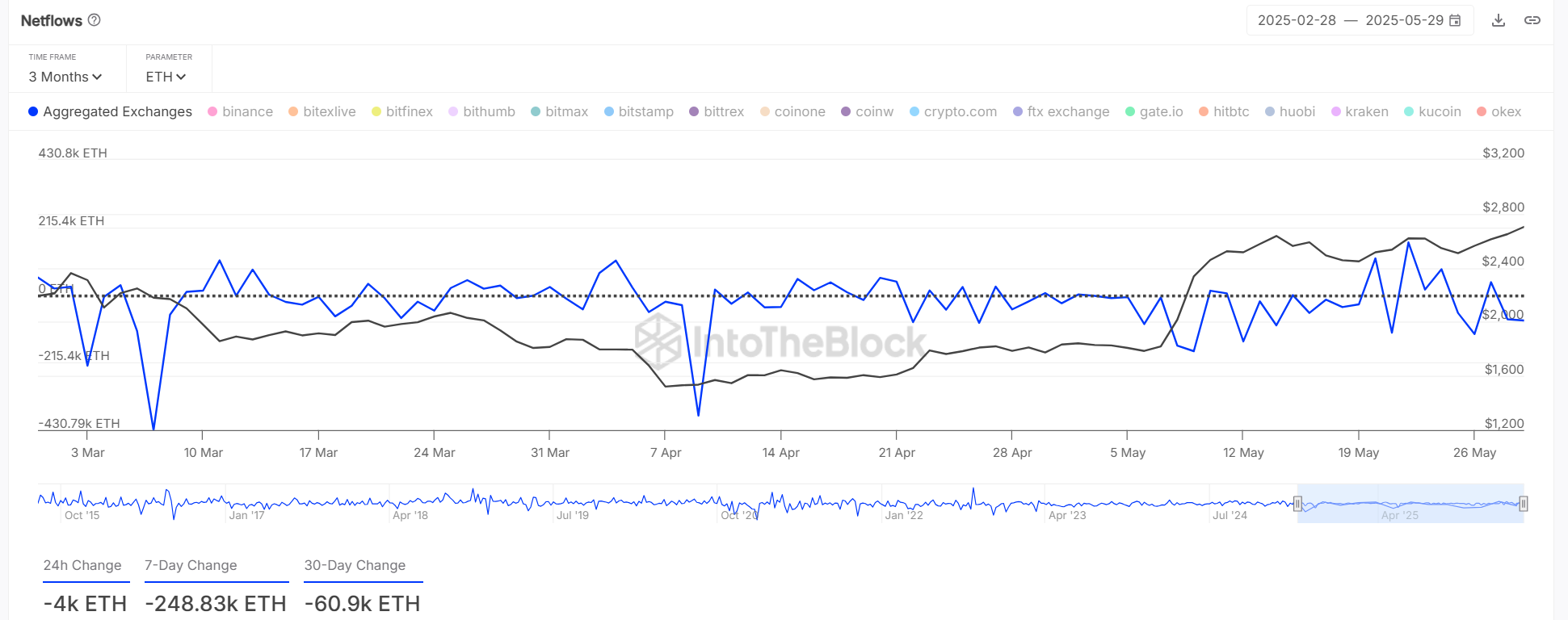

Ethereum’s Netflows remained firmly negative, with -248.83K ETH recorded over the last seven days and -60.9K ETH over 30 days.

While this typically suggests accumulation or investor withdrawal to cold storage, the flat price action implies these withdrawals follow heavy prior sell activity.

The 24-hour Netflow also showed a smaller decline of -4K ETH, reinforcing that capital outflows are steady, not accelerating. Therefore, although the price holds above $2,600, this trend exposes underlying hesitation. Without renewed inflows or buyer confidence, the price may fail to sustain current levels.

Source: IntoTheBlock

Trader caution and liquidation barriers weigh heavily

Over the past 24 hours, Open Interest dropped sharply by 8.99% to $18.14 billion, as traders backed away from both sides of the market.

Lower OI typically signals a lack of conviction, and without aggressive positioning, volatility tends to compress before a breakout or breakdown.

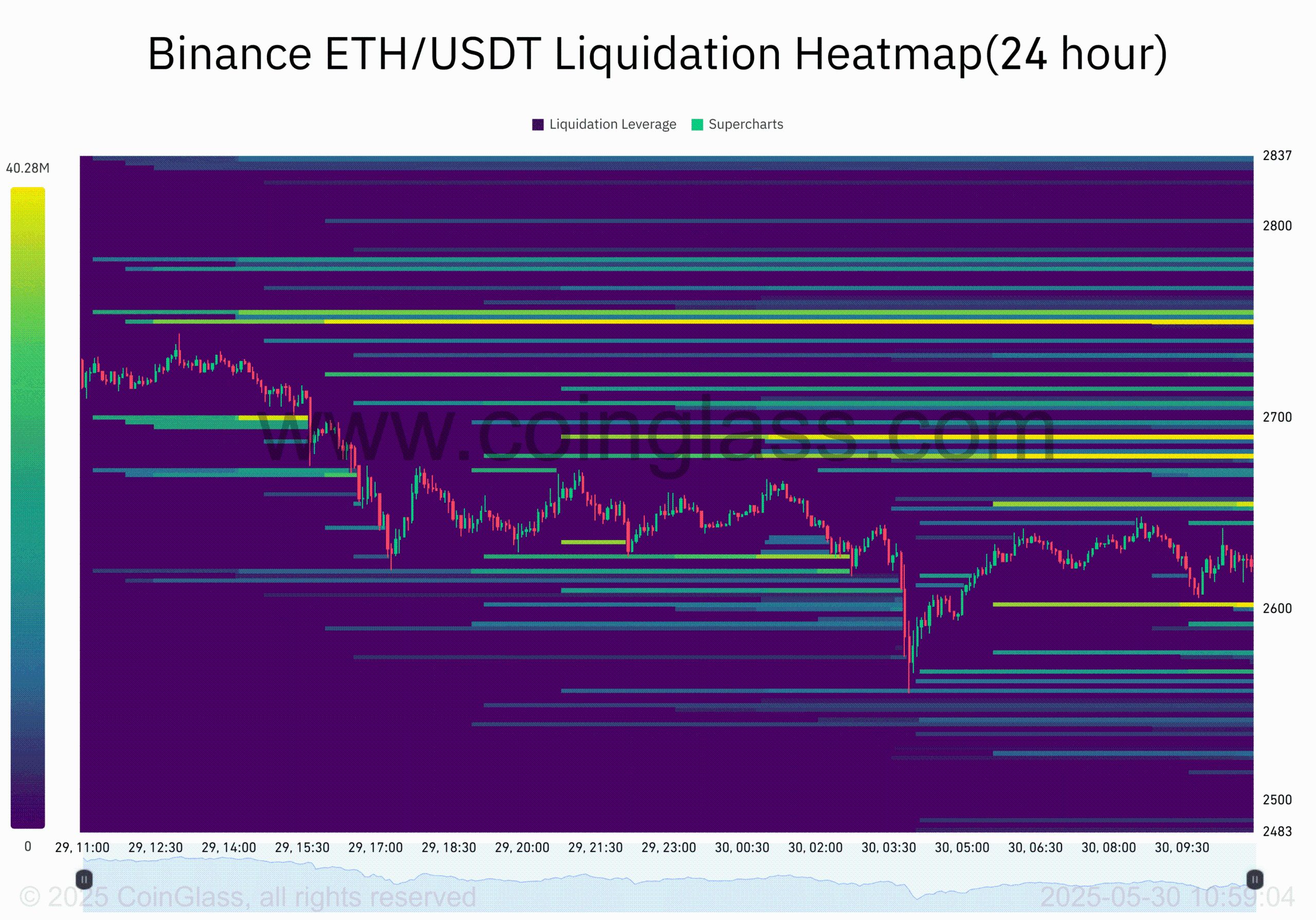

However, what’s more concerning is Binance’s ETH/USDT Liquidation Heatmap, which shows dense liquidation walls stacked between $2,700 and $2,830.

These clusters have repeatedly triggered selling pressure, creating resistance zones that absorb bullish momentum. Each failed attempt to breach this region has led to sharp reversals, as seen on the 24-hour chart.

Source: CoinGlass

Unless ETH surges with substantial volume to clear these barriers, bulls may remain trapped below them. These liquidation zones act as a ceiling until market conviction shifts strongly in favor of buyers.

Ethereum’s sideways movement conceals deeper market weakness. Declining OI, negative Netflows, and strong liquidation zones suggest that sell pressure is capping gains.

If bulls cannot reclaim $2,700 convincingly, the $2,480 support could come under pressure next. For now, caution remains warranted as ETH navigates a tight range with limited momentum.

Conclusion

In summary, while Ethereum currently holds critical price levels, ongoing negative netflows and trader hesitance indicate a reluctant market. Unless significant bullish sentiment returns, ETH could face challenges maintaining its current position.