BlackRock’s IBIT Experiences Record $430M Bitcoin Outflow

- Main event includes large outflow, industry impact.

- Bitcoin ETF’s end to inflow streak.

- Bitcoin price down 2.3% amid outflows.

Event Impact

This event highlights Bitcoin’s volatile market impact and demonstrates ETF flow significance. Industry leaders remain silent as Bitcoin prices react variably.

Outflow Details

The outflow from BlackRock’s iShares Bitcoin Trust (IBIT) marked the end of a 31-day inflow streak, setting a new daily record. On May 30, IBIT faced a $430.8 million outflow, exceeding a previous record from February 2025.

CEO Larry Fink and BlackRock’s leadership have not officially commented on the outflow. However, industry experts Nate Geraci and Eric Balchunas have voiced concern about the unprecedented outflow scale and its rapidity within the ETF’s lifecycle .

Bitcoin’s price, showing resilience, dipped only 2.3% amid outflow announcements while still maintaining a 9% rise month-over-month. Total Bitcoin ETF outflows reached $616.1 million, with IBIT accounting for a significant portion.

Speculation around ETF outflows suggests a strategic song shift among long-term investors rather than panic selling. SEC’s ongoing developments on cryptocurrency regulations imply potential market stability for ETFs.

Industry analysts note that similar ETF flow reversals have influenced Bitcoin’s short-term price fluctuation. Long-term holders and institutions often mitigate such risks, affecting overall market dynamics .

Ongoing ETF actions suggest notable implications for asset management and investor strategy, possibly reflecting broader trends in digital asset portfolios. Historical patterns indicate a balancing factor in long-term Bitcoin price stability.

Nate Geraci, President, The ETF Store, commented, “What a run. Not sure I have words to describe how ridiculous this is.”

| Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions. |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

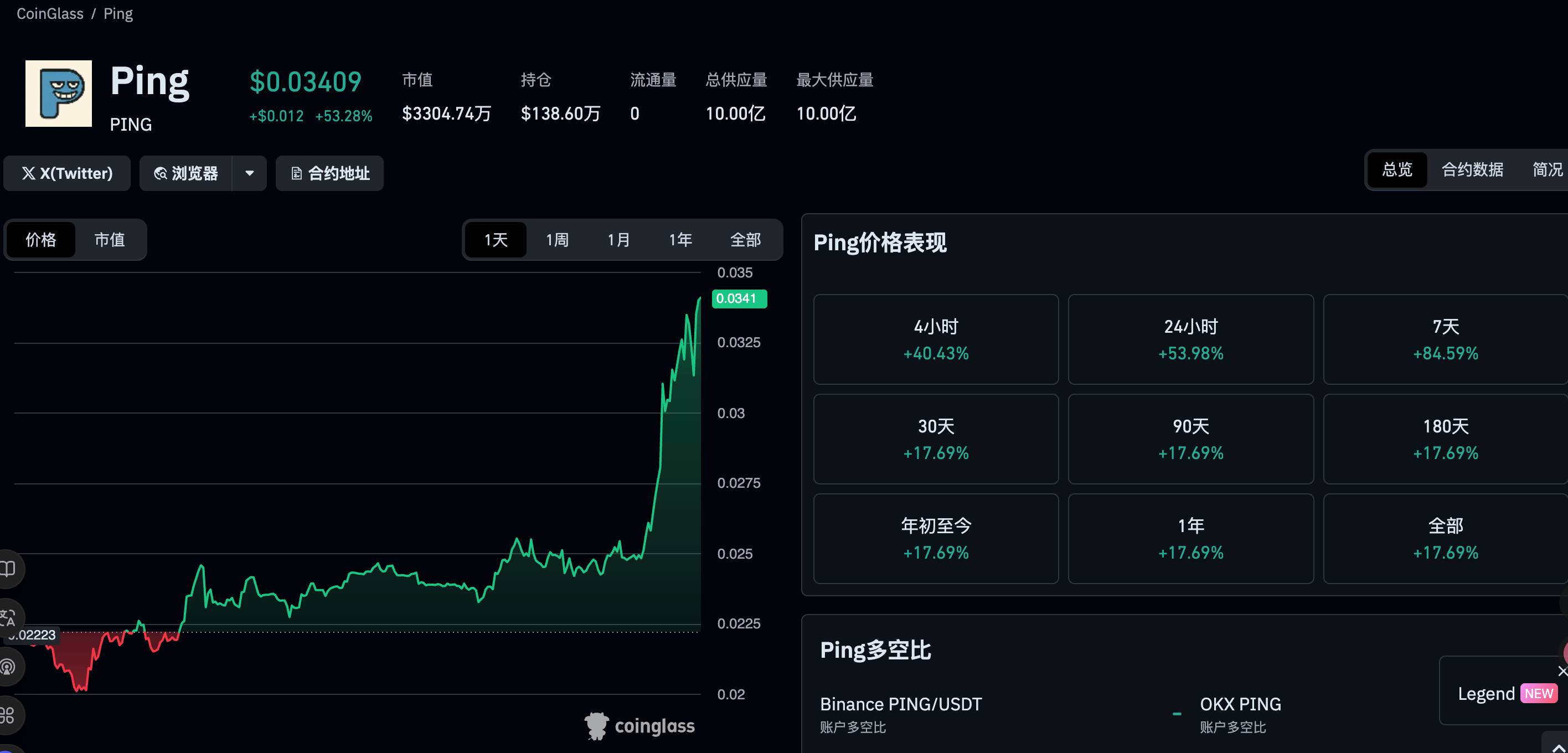

$PING rebounds 50%, a quick look at the $PING-based launchpad project c402.market

c402.market's mechanism design is more inclined to incentivize token creators, rather than just benefiting minters and traders.

Crypto Capitalism, Crypto in the AI Era

A one-person media company, ushering in the era of everyone as a Founder.

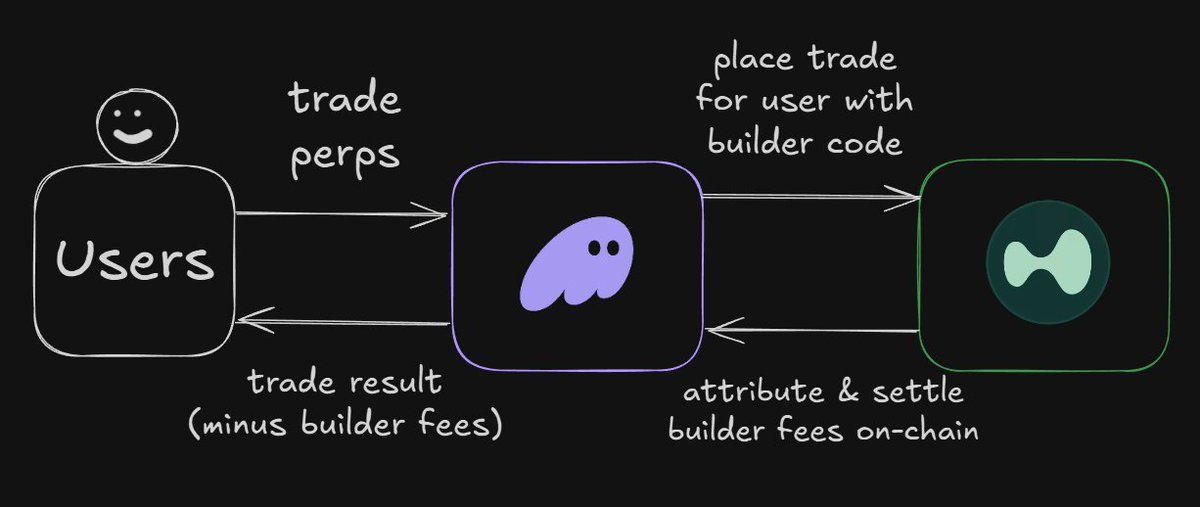

Interpretation of the ERC-8021 Proposal: Will Ethereum Replicate Hyperliquid’s Developer Wealth Creation Myth?

The platform serves as a foundation, enabling thousands of applications to be built and profit.

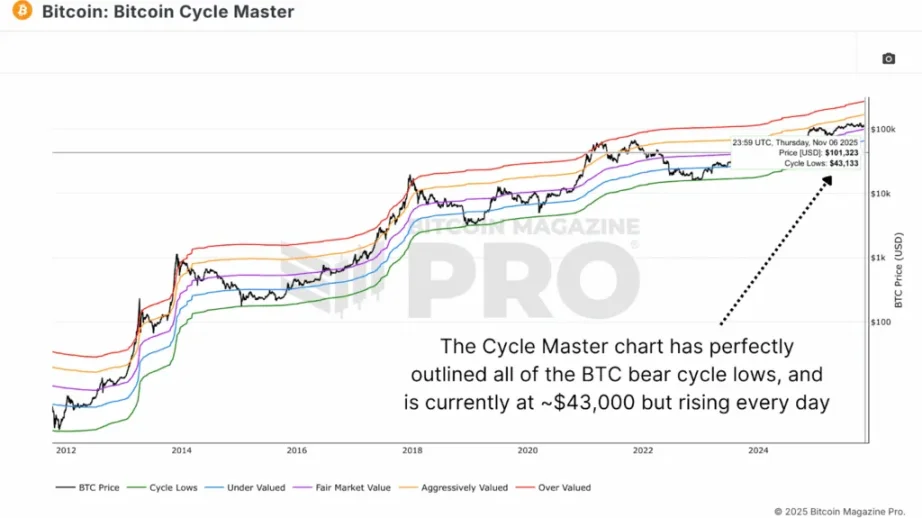

Data shows that the bear market bottom will form in the $55,000–$70,000 range.

If the price falls back to the $55,000-$70,000 range, it would be a normal cyclical movement rather than a signal of systemic collapse.