Date: Wed, June 04, 2025 | 09:25 AM GMT

The cryptocurrency market has mounted a solid comeback in recent weeks from its bearish Q1, as Ethereum (ETH) has managed to deliver an impressive 45% jump since the start of Q2. That momentum is lifting the overall altcoin space — including DeFi favorite Aave (AAVE).

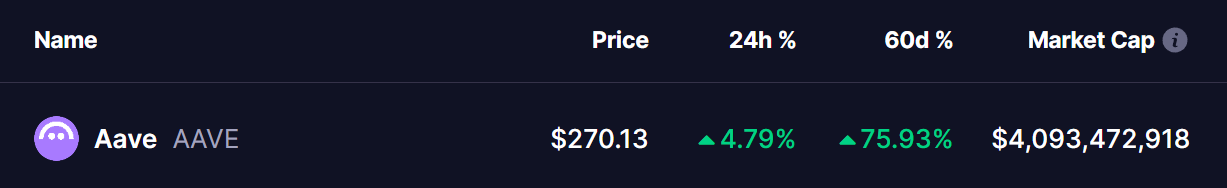

The AAVE token has rallied over 75% in the past 60 days, and judging by the current chart structure, that rally might be far from over. Technical analysis is hinting at a major breakout brewing on the horizon.

Source: Coinmarketcap

Source: Coinmarketcap

Approaches Key Resistance

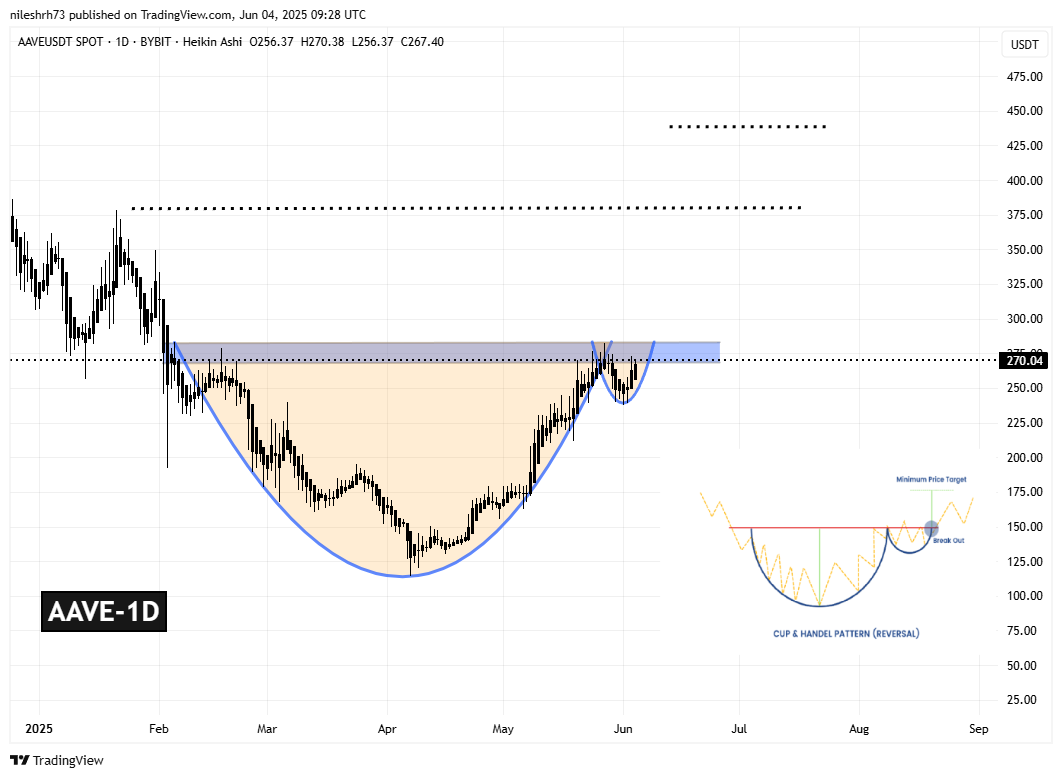

On the daily timeframe, AAVE is forming a textbook Cup and Handle pattern — a classic bullish reversal setup that typically signals strong upside potential. The “cup” structure played out between February and late May, starting with a steep decline from around $283, followed by a rounding bottom near $114.

Aave (AAVE) Daily Chart/Coinsprobe (Source: Tradingview)

Aave (AAVE) Daily Chart/Coinsprobe (Source: Tradingview)

Since then, AAVE has been steadily climbing, making its way back to the neckline resistance around $270–$283. A minor pullback formed the “handle” in late May as AAVE dipped to the $235–$240 zone before bouncing back again — a healthy consolidation within the pattern.

Now, AAVE is once again knocking on the door of its neckline resistance. At the time of writing, it’s trading at $270, setting up for what could be a powerful breakout if bulls can push through.

What’s Next for AAVE?

A confirmed breakout above the $283 mark — especially if the price retests and holds that level as new support — would validate the Cup and Handle pattern. This could open the floodgates for bullish momentum.

The next target would be the $379 region, a key horizontal resistance from previous price action. Beyond that, the full measured move from the pattern projects a potential rally toward $438 — representing a 61% upside from current levels.

Final Thoughts

With the broader market sentiment improving and AAVE showing strong recovery, traders will be closely watching the $270–$283 range. If AAVE clears that hurdle with convincing volume, it could signal the start of a fresh leg higher in this DeFi giant’s price journey. However, it’s also possible that AAVE may spend a bit more time consolidating within the “handle” portion of the pattern before making a decisive breakout attempt — a move that would still be consistent with the typical structure of a Cup and Handle formation.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.