Bitcoin rebounds above $103k after Iran missile attack intercepted

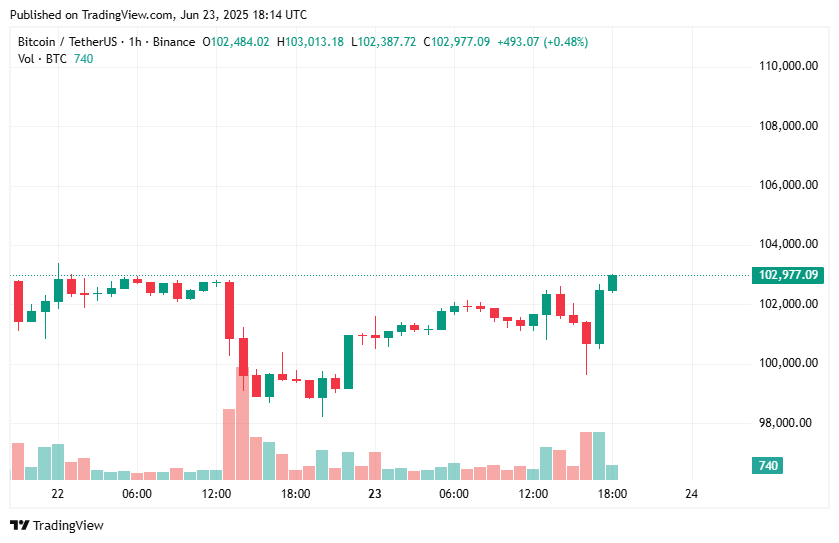

Bitcoin price has swiftly bounced above $103,000 after a sharp decline triggered by reports of Iran firing missiles at a U.S. base in Qatar.

Following confirmation that U.S. interceptor missiles successfully intercepted the Iranian missiles with no casualties, Bitcoin ( BTC ) surged. The benchmark cryptocurrency had briefly touched the $100,000 level after Iran announced it had fired missiles at Al Udeid Air Base in Qatar.

However, a statement from the Qatari Ministry of Defense detailing a successful interception of the ballistic missile attack helped boost sentiment, with Bitcoin and the broader crypto market responding positively.

According to Axios, President Donald Trump’s administration was “aware” of Iran’s coordinated attack on Al Udeid Air Base and in Iraq. Sources said the White House had “good advance warning,” noted .

The New York Times also reported that Iran had given Qatari advance information on the impending attack, with Qatar closing its airspace.

Bitcoin touches $102.5k

At the time of writing, BTC price was hovering around $102,800, up nearly 4% in the past 24 hours. The gains marked a V-shaped recovery following the sharp drop seen during afternoon U.S. trading. Bitcoin touched highs of $103k across major exchanges.

BTC chart on crypto.news

BTC chart on crypto.news

While the crypto market saw a swift rebound, further downside could follow. Reports indicate that Qatar has stated it reserves the right to respond to the attacks. Iraq, Kuwait, Bahrain, and the UAE have also shut down their airspace, and U.S. military bases across the Middle East—including at Ain Al-Asad Airbase in Iraq—are on high alert.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This year's hottest cryptocurrency trade suddenly collapses—should investors cut their losses or buy the dip?

The cryptocurrency boom has cooled rapidly, and the leveraged nature of treasury stocks has amplified losses, causing the market value of the giant whale Strategy to nearly halve. Well-known short sellers have closed out their positions and exited, while some investors are buying the dip.

Showcasing portfolios, following top influencers, one-click copy trading: When investment communities become the new financial infrastructure

The platforms building this layer of infrastructure are creating a permanent market architecture tailored to the way retail investors operate.

Ripple raised another $500 million—are investors buying $XRP at a discount?

The company raised funds at a valuation of $40 billions, but it already holds $80 billions worth of $XRP.

CoinShares: Net outflow of $1.17 billion from digital asset investment products last week.