Dow Jones up 500 points on Iran-Israel ceasefire, Powell to wait with rate cuts

U.S. stocks are up as lowering tensions in the Middle East create more positive, risk-on sentiment.

Major U.S. stock indices rose after the announced ceasefire between Israel and Iran. On Tuesday, June 24, Dow Jones was up 470 points or 1.1%, reclaiming its levels before the 12-day war started. At the same time, the S&P 500 was up 1.05%, and the tech-focused Nasdaq was up 1.43%.

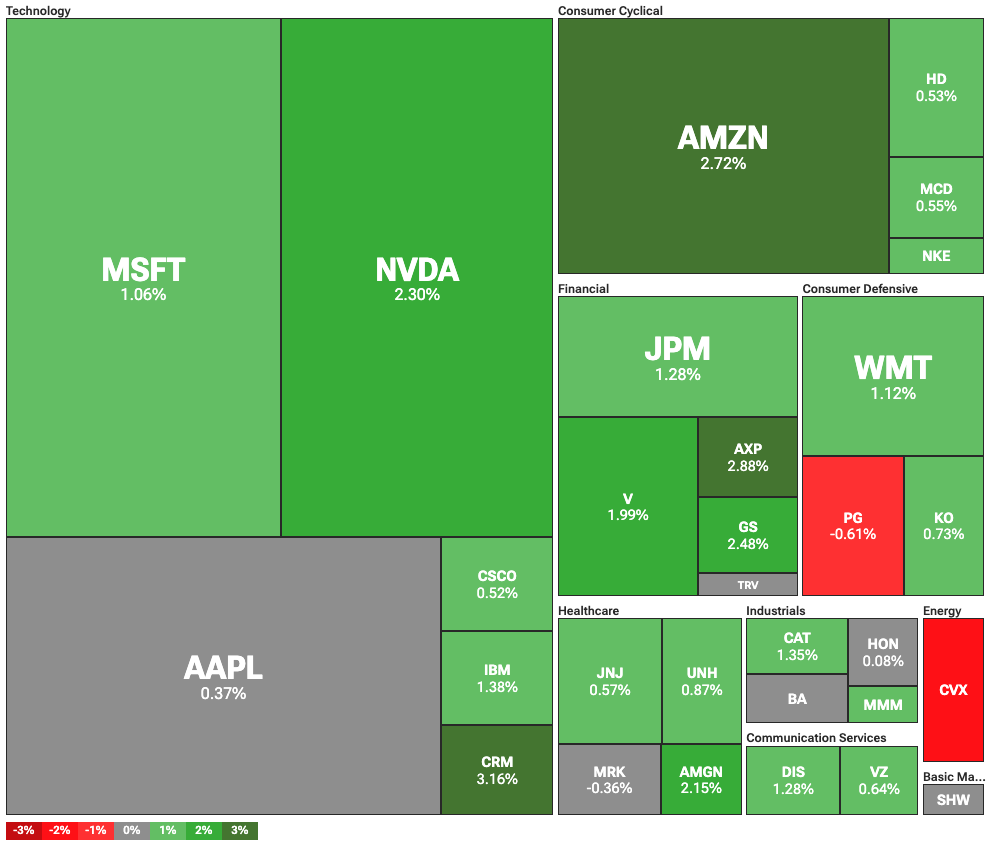

Dow Jones Industrial Average heatmap | Source: TipRanks

Dow Jones Industrial Average heatmap | Source: TipRanks

Driving the markets were hopes that the conflict between Iran and Israel would cease for now. U.S. President Donald Trump announced a ceasefire between the two countries. Moreover, he pressured Israel to stop its attacks against Iran, which promised hope for an end to the war.

The escalation of a broader conflict threatened the global oil economy. This was particularly true after the U.S. got directly involved with its own strikes on Iran’s nuclear facilities. After these strikes, Iran even threatened to push the price of oil to its historic levels by closing the Strait of Hormuz.

The price of crude oil dropped back down to $64 per barrel, down 5.33% in just one day. Crude oil traded near $75 at the height of the crisis, the highest price since January this year. Lower oil prices are good news for the global macro outlook as they could lead to cooling inflation.

Fed can afford to wait with rate cuts: Powell

With de-escalating tensions in the Middle East, focus is once again on the Federal Reserve and interest rates. In his testimony before Congress, Fed Chair Jerome Powell said that the Fed will wait for more information before making changes to the interest rates.

In particular, Powell is concerned by the potential effects of Trump’s tariffs, which could both push inflation up and lower growth. What is more, effects on inflation could be either short-lived or persistent, which would require a different response.

In any case, Powell stated that rate cuts could come sooner if inflation stays low or if the unemployment rate picks up.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From "whoever pays gets it" to "only the right people get it": The next generation of Launchpads needs a reshuffle

The next-generation Launchpad may help address the issue of community activation in the cryptocurrency sector, a problem that airdrops have consistently failed to solve.

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.