Vitalik Buterin: Many institutions value Ethereum for its stability, reliability, and zero downtime

2025/07/05 14:23

2025/07/05 14:23According to Jinse Finance, cryptocurrency founders, developers, and several institutional giants have gathered in Cannes, France for the Ethereum Community Conference (EthCC), where institutional adoption of Ethereum is accelerating. BlackRock, Deutsche Bank, and certain exchanges are all building directly on its infrastructure. In an interview with CNBC in Cannes, Ethereum co-founder Vitalik Buterin stated that people often assume institutional investors only care about scale and speed—but in reality, the opposite is true. Many institutions say they value Ethereum because it is stable, reliable, and never goes offline. They hope that future generations will look back and see a network that truly provides open, free, and permissionless access for the public. Tomasz Stańczak, the new Co-Executive Director of the Ethereum Foundation, added that the core reason institutions choose Ethereum is the same: for ten years, Ethereum has never stopped. When institutions send orders to the market, they want absolute assurance that their orders are treated fairly, with no preferential treatment, and that trades are executed at the time of delivery. As stablecoins and tokenized assets become mainstream, these guarantees are becoming increasingly valuable.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

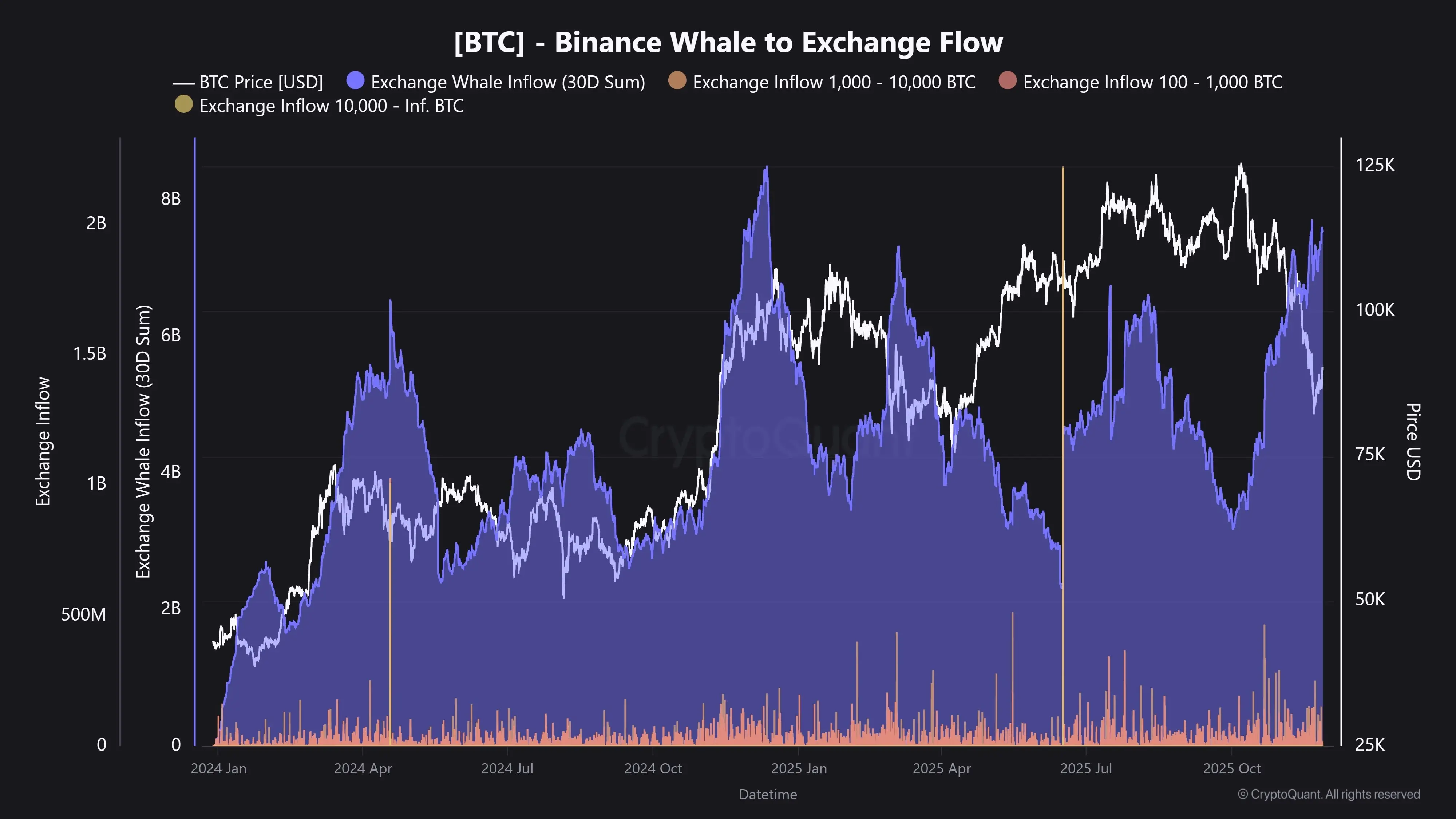

CryptoQuant: Whales have deposited approximately $7.5 billion worth of BTC to a certain exchange in the past month

Today, BTC options with a notional value of $13 billion expire, with the max pain point at $98,000.