Bitcoin’s $1.2 Trillion Unrealized Profit Pool Grows While Holders Resist The Urge to Sell

2025/07/05 14:00

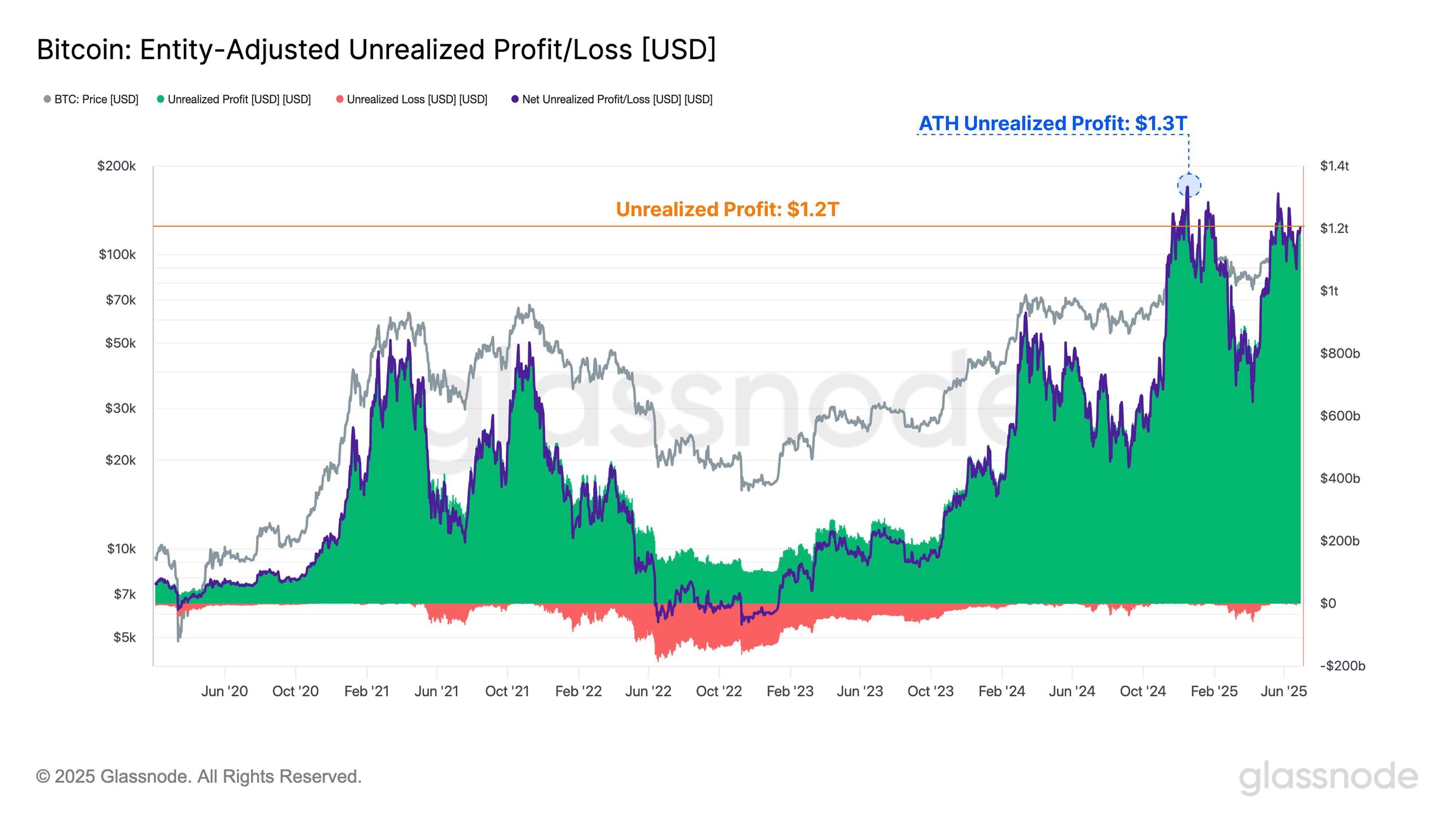

2025/07/05 14:00Bitcoin investors are currently holding an estimated $1.2 trillion in unrealized profits, according to on-chain analytics platform Glassnode.

This significant figure highlights the paper gains accumulated by long-term holders as Bitcoin continues to trade close to its record highs.

Bitcoin Investor Base Shifts From Traders to Long-Term Institutional Allocators

Glassnode data reveals that the average unrealized profit per investor stands at around 125%, which is lower than the 180% seen in March 2024, when the BTC price reached a peak of $73,000.

Bitcoin Unrealized Profit. Source;

Glassnode

Bitcoin Unrealized Profit. Source;

Glassnode

However, despite these massive unrealized gains, investor behavior suggests no major rush to sell the top crypto. BeInCrypto previously reported that daily realized profits have remained relatively subdued, averaging just $872 million.

This starkly contrasts previous price surges, when realized gains surged to between $2.8 billion and $3.2 billion at BTC price points of $73,000 and $107,000, respectively.

Moreover, current market sentiment suggests that investors are waiting for a more decisive price movement before adjusting their upward or downward positions. The trend points to firm conviction among long-term holders, with accumulation continuing to outweigh selling pressure.

“This underscores that HODLing remains the dominant market behavior amongst investors, with accumulation and maturation flows significantly outweighing distribution pressures,” Glassnode stated.

Meanwhile, Bitcoin analyst Rezo noted that the current trend reflects a fundamental shift in the significantly evolved profile of Bitcoin holders. According to him, the typical BTC holder has shifted from short-term speculative traders to long-term institutional investors and allocators.

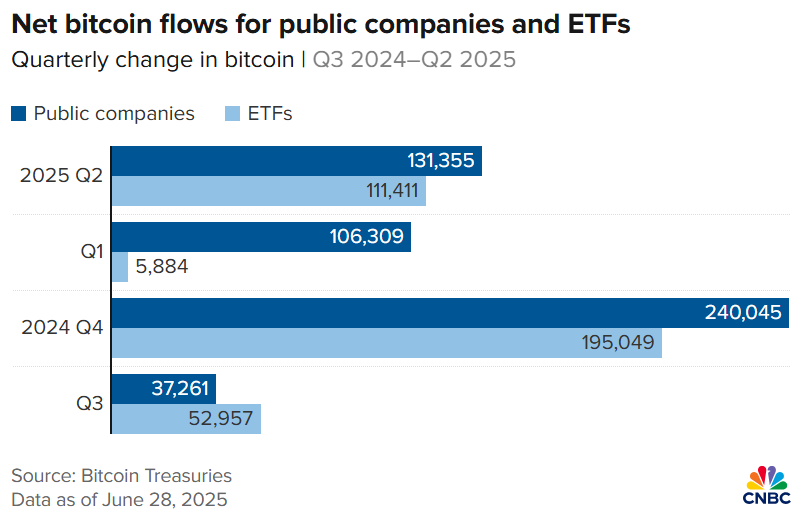

Rezo pointed to the increasing influence of institutional players such as ETFs and public companies like Strategy (formerly MicroStrategy).

“The holder base has changed – from traders seeking exit to allocators seeking exposure. MicroStrategy, sitting on tens of billions in unrealized gains, keeps adding. ETFs = constant bid, not swing traders,” he said.

Notably, public companies like Strategy increased their Bitcoin holdings by 18% in Q2, while ETF exposure to Bitcoin climbed by 8% in the same period.

Bitcoin Flows For ETFs and Public Companies. Source:

CNBC

Bitcoin Flows For ETFs and Public Companies. Source:

CNBC

Considering this, Rezo concluded that most short-term sellers likely exited between $70,000 and $100,000. He added that what remains are investors who treat Bitcoin less as a speculative trade and more as a strategic long-term allocation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.

Balancer Rallies to Recover and Redistribute Stolen Funds After Major Cyber Attack

In Brief Balancer plans to redistribute $8 million to users after a massive cyber theft. The recovery involved crucial roles by white-hat researchers rewarded with 10% incentives. Unclaimed funds will undergo governance voting after 180 days.

Bitcoin Faces Renewed Selling Pressure as Whale Deposits Spike and Market Fear Deepens