US Appeals Court allows battle over Tornado Cash sanctions to come to an end

Quick Take The Treasury Department’s Office of Foreign Assets Control sanctioned Tornado Cash in August 2022. In the joint motion last week, the government said that removing the sanctions “moots” the appeal.

A U.S. appeals court has granted a joint motion to vacate a case between the Treasury Department and Coin Center over the agency's sanctioning of crypto mixer Tornado Cash.

In a court filing from last week, the clerk for the U.S. Court of Appeals for the Eleventh Circuit said that the motion would be granted, ending the lawsuit between the two.

"This is the official end to our court battle over the statutory authority behind the TC sanctions," said Peter Van Valkenburgh, executive director at Coin Center, on Monday in a post on X. "The government was not interested in moving forward and defending their dangerously overbroad interpretation of sanctions laws."

The Treasury Department's Office of Foreign Assets Control sanctioned Tornado Cash in August 2022, effectively barring people in the U.S. and firms looking to operate in the U.S. from engaging in financial interactions with it. A U.S. federal appeals court later said that the department had overstepped its authority in doing so.

The Treasury Department then removed sanctions against the crypto mixer in March.

In the joint motion last week, the government said that removing the sanctions "moots" the appeal.

"The government’s view is that OFAC’s rescission of the designation moots this appeal. Plaintiffs’ view is that this appeal will become moot after the Texas judgment becomes final and unappealable," they said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Robinhood is building a financial institution tailored for the new generation

Robinhood's crypto revenue grew by 300% in the third quarter, with total revenue reaching $1.27 billions.

Soros predicts an AI bubble: We live in a self-fulfilling market

When the market starts to "speak": an earnings report experiment and a trillion-dollar AI prophecy.

Investing in top VCs but principal halved in four years—what’s happening to crypto funds?

Some crypto funds have outperformed bitcoin during bull markets through leverage or early positioning, offering risk hedging and diversification opportunities; however, their long-term performance has been inconsistent.

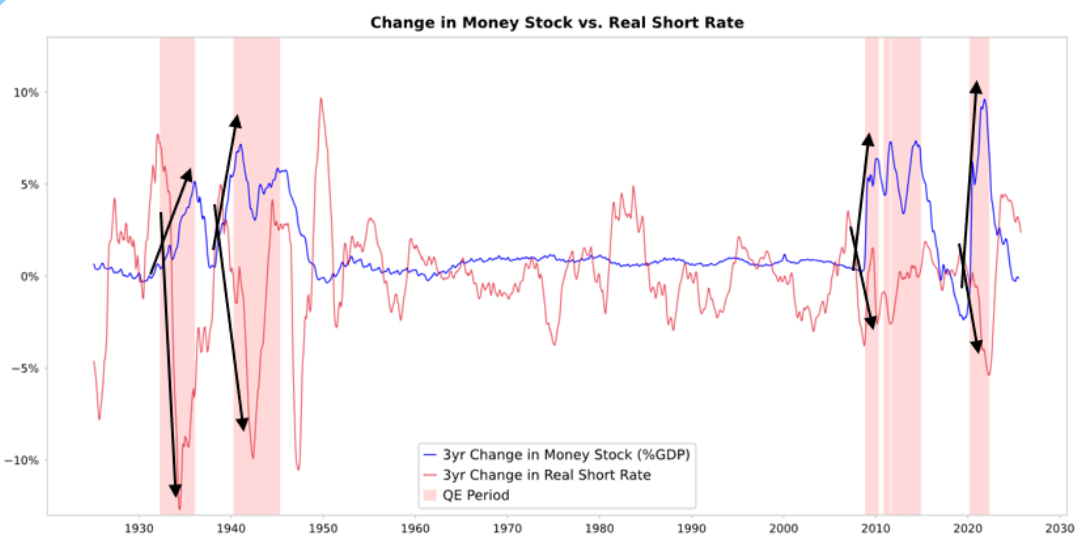

Ray Dalio's latest article: This time is different, the Federal Reserve is fueling a bubble

Due to the highly stimulative nature of current government fiscal policies, quantitative easing will effectively monetize government debt rather than simply reinjecting liquidity into the private system.