Bitcoin hits fresh record over $119K ahead of key Crypto Week

Key Takeaways

- Bitcoin reached a new all-time high of $119,300 ahead of key crypto legislation debates.

- Upcoming bills in Congress may hugely impact crypto regulation and stablecoin issuance.

Bitcoin advanced to a new record high of $119,300 on Sunday as bullish sentiment mounted ahead of a potentially game-changing week for the crypto industry.

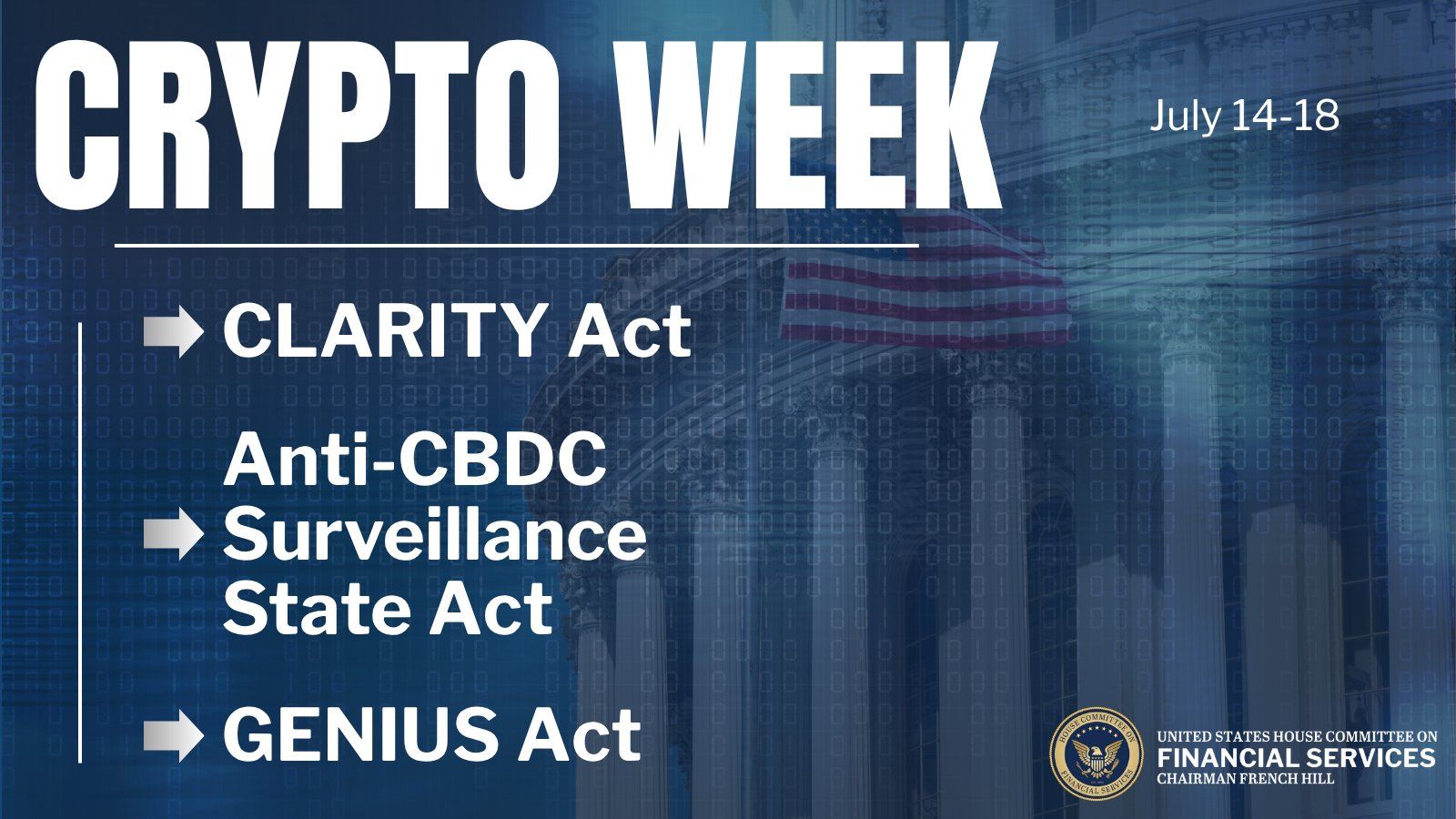

The US House Financial Services Committee has designated the week beginning July 14 as “Crypto Week,” during which lawmakers will debate three key bills aimed at providing clear regulatory frameworks for digital assets, stablecoins, and blockchain technologies.

The legislative package includes the Digital Asset Market CLARITY Act, which would grant the Commodity Futures Trading Commission exclusive oversight of crypto transactions and provide exemptions for established blockchain networks.

Another bill, the GENIUS Act, would allow private companies to issue stablecoins with full cash backing, while the Anti-CBDC Surveillance State Act seeks to prevent the creation of a US Central Bank Digital Currency.

Bitcoin’s price has risen 9.5% in the past week, bringing its year-to-date gains to 27%, according to TradingView data .

The latest rally, which saw Bitcoin break through $112,000 earlier this week, has been supported by expected monetary easing, strong inflows into spot Bitcoin ETFs, and increased corporate adoption.

Analyst sees BTC hitting $130K before year-end correction

Bitcoin’s latest rally has set the stage for a potential final leg in its current multi-year bull cycle, according to John Glover, Chief Investment Officer at digital asset platform Ledn.

In a note shared with Crypto Briefing, Glover said that Bitcoin’s recent move to a new all-time high is a clear signal that the next leg of the bull run is underway. He said the recent dip to $96,000 appeared to have cleared the way for continued upside.

“We have finally broken to new highs, which confirms that the dip to $96k in late June satisfied the wave (ii) pullback (yellow line) within the larger Wave 5 (orange line),” Glover explained.

“While this doesn’t change the ultimate target of circa $136k to complete this bull run, it does likely reduce the time it will take to complete. I was previously looking for this in Q1 of 2026, but now it looks likely to hit $136k by year-end,” the analyst noted.

Glover projected that Bitcoin’s bull market could peak at the end of this year, with a possible move to $130,000 followed by a short-term correction, and then a final rally to $136,000.

“Look for wave (iii) to finish near $130k, followed by a correction to current levels, and then a rally to the $136k target into the end of this year,” he noted. “That will mark the conclusion of the 5-wave move that has transpired over the past 3 years. This completes Wave 3 of the ‘super-cycle,’ which means in the years to come, we will see higher prices yet.”

As for what comes next, Glover believes the bull run may be followed by a healthy correction before Bitcoin resumes its upward trajectory.

He expects Bitcoin to retrace to the $91,000-$109,000 range, offering a potential re-entry point for investors while still maintaining long-term bullish momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

A summary of the "Holistic Reconstruction of Privacy Paradigms" based on dozens of speeches and discussions from the "Ethereum Privacy Stack" event at Devconnect ARG 2025.

Donating 256 ETH, Vitalik Bets on Private Communication: Why Session and SimpleX?

What differentiates these privacy-focused chat tools, and what technological direction is Vitalik betting on this time?

Ethereum Raises Its Gas Limit to 60M for the First Time in 4 Years

DeFi: Chainlink paves the way for full adoption by 2030