PI Price Clings to A Key Support Level: Bounce or Break?

Pi Coin is holding firm above the $0.4452 support, but rising funding rates and weakening bearish power suggest a key move may be close. This PI Price update tracks on-chain sentiment, momentum, and what comes next

Pi Coin has been hovering dangerously close to a key support level after a sluggish trading week. At press time, PI Price stands at $0.4725, struggling to hold above the $0.4452 level.

While on-chain metrics aren’t showing strong conviction either way, some cracks in the bearish momentum are starting to appear.

Open Interest and Funding Rate Signal a Pause

PI Price is showing signs of hesitation. Aggregated Open Interest on Coinalyze (in the 4-hour timeframe) is hovering around $10.09 million and is also showing no major directional conviction over the past few days. This means traders are not aggressively building new long or short positions, suggesting indecision.

PI open interest:

PI open interest:

Meanwhile, the Aggregated Funding Rate climbed to +0.0274, and the Predicted Funding Rate spiked even higher to +0.0516. In simple terms, this means Pi Coin longs are slightly dominant and willing to pay a premium to hold their positions, usually a bullish sign.

PI funding rates turn slightly bullish:

PI funding rates turn slightly bullish:

Open Interest refers to the total number of unsettled contracts in the market. A rising Open Interest generally confirms that more traders are entering the market, supporting the current trend. Funding Rate is the periodic fee paid between long and short traders. Positive values mean longs are dominant; negative ones suggest shorts are in control.

Overall, the flat Open Interest with rising Funding Rates shows a mild long bias, but in the case of Pi Coin, it is without strong conviction.

Bear Power is Losing Steam

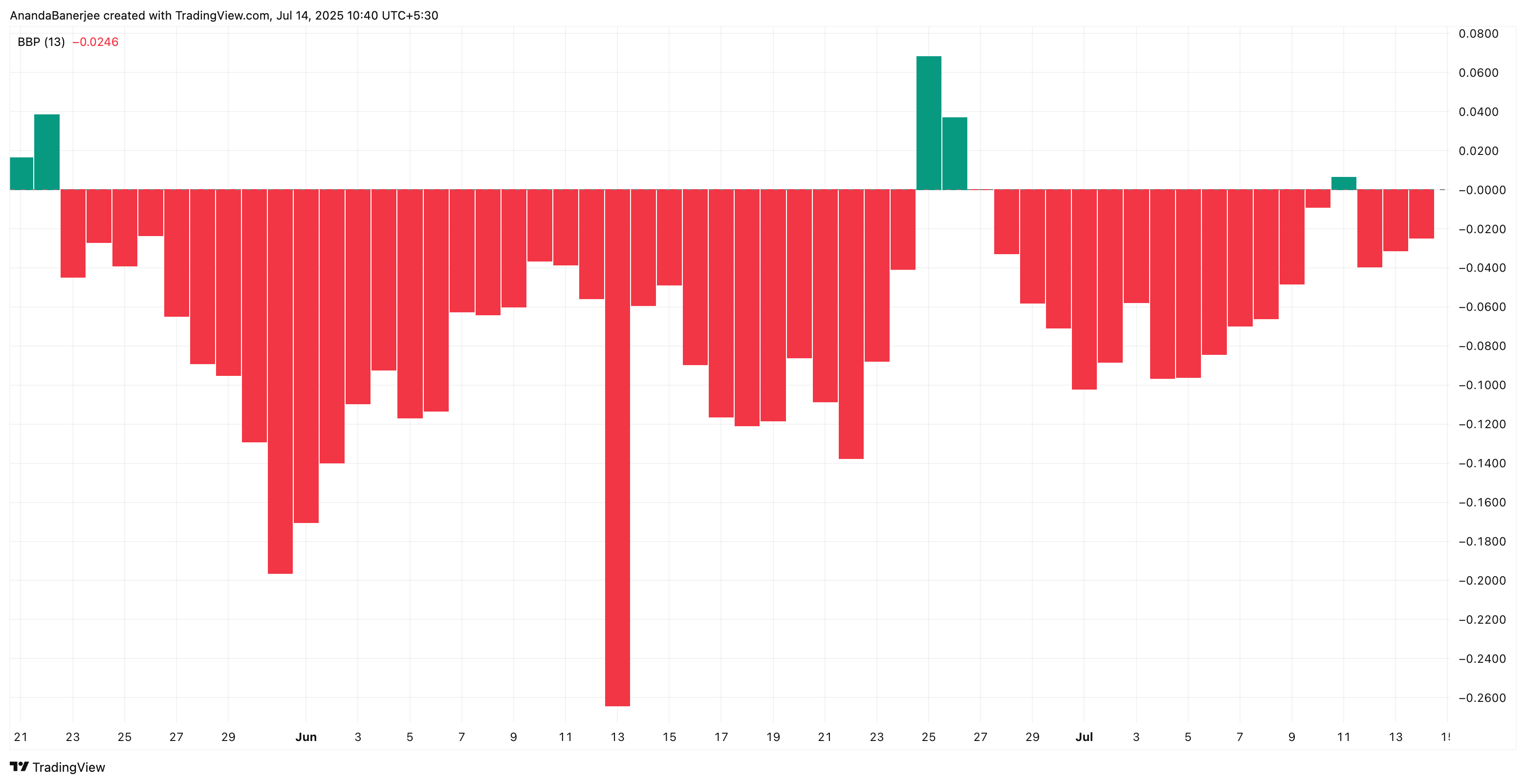

With Funding Rates rising and Open Interest staying flat, the market leans slightly long but without conviction. This hesitation is mirrored in the Bull Bear Power indicator, part of the Elder Ray Index, which tracks the strength of buyers/sellers in the market.

Pi Coin Bull Bear Power:

Pi Coin Bull Bear Power:

At the time of writing, Bear Power has continued to weaken, signaling that bearish momentum is fading.

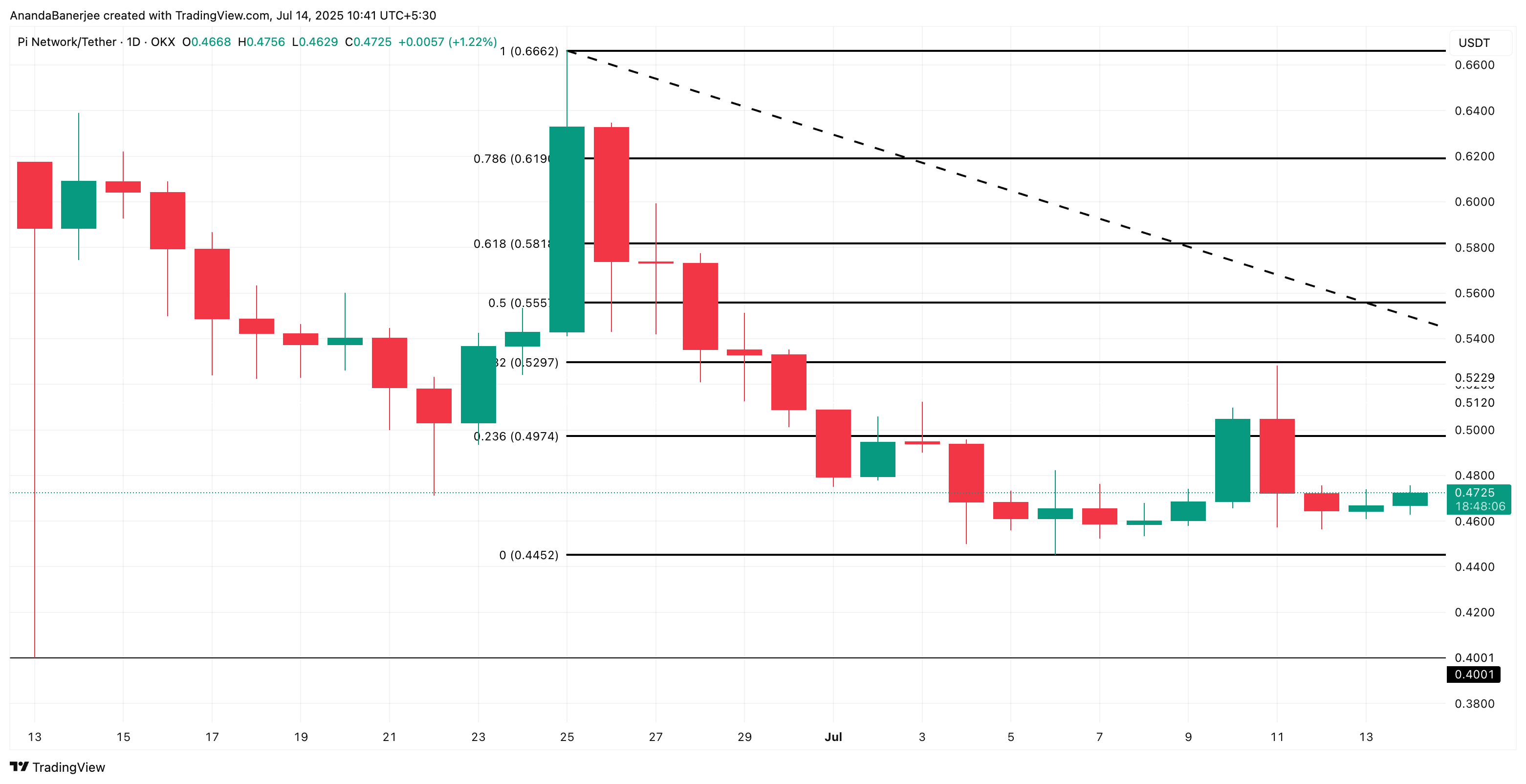

PI Price Analysis: Key Support Still Holding

Pi Coin (PI) is currently trading at $0.4725, hovering just above the key support level at $0.4452. This level was derived using the Fibonacci retracement tool, drawn from the late June high to the July 6 low.

PI price analysis:

PI price analysis:

Fibonacci retracement is a technical tool traders use to identify potential support and resistance levels by measuring how far the price has pulled back from a recent move.

So far, this support has held despite PI’s broader downtrend. A breakdown below $0.4452 could expose Pi Coin to a sharper correction toward $0.4001, the next major support.

On the flip side, if momentum builds, the next upside resistance is at $0.4974, a level where the PI price has been rejected a few times. A daily close above $0.4974 could flip the structure short-term bullish, invalidating the bearish hypothesis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Google executive makes millions of dollars overnight through insider trading

Insider addresses manipulated Google's algorithm by referencing prediction market odds.

Stablecoins in 2025: You Are in Dream of the Red Chamber, I Am in Journey to the West

But in the end, we may all arrive at the same destination through different paths.

XRP’s Extreme Fear Level Mirrors Past 22 % Rally

Critical Bitcoin Bear Market Signal: 100-1,000 BTC Wallet Buying Slows Dramatically