Cardano Price Eyes $1 Breakout As Top Wallets Keep Accumulating

Cardano is surging again. With ADA up over 26% in a week and large holders accumulating, the stage is set for a breakout toward $1; if key hurdles are cleared.

Cardano price is gaining serious momentum, climbing over 26% this week alone.

With large wallets quietly increasing their holdings and no signs of heavy selling, the recent rally seems more than just a bounce.

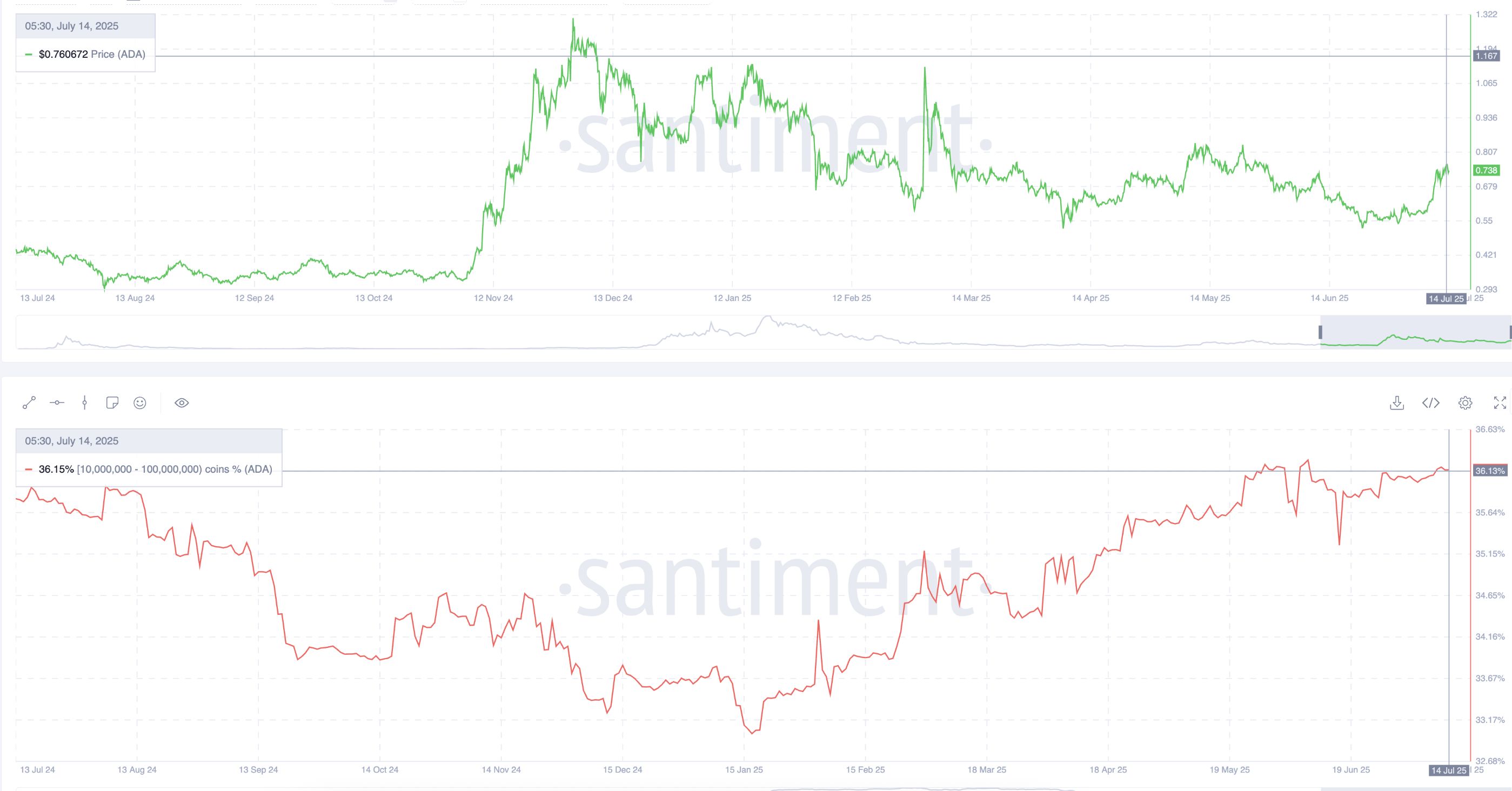

Whale Wallets Keep Accumulating Steadily

The 1 million –10 million ADA wallet group, often categorized as whales, has steadily increased its holdings from ~33% in January to 36.15% in mid-July. Despite ADA’s sharp rally in March, this cohort hasn’t trimmed exposure. This signals that top holders expect further upside.

Cardano price and whale wallets:

Santiment

Cardano price and whale wallets:

Santiment

Whale wallets are large ADA holders who typically hold between 1 million and 10 million coins. Their behavior often influences market direction.

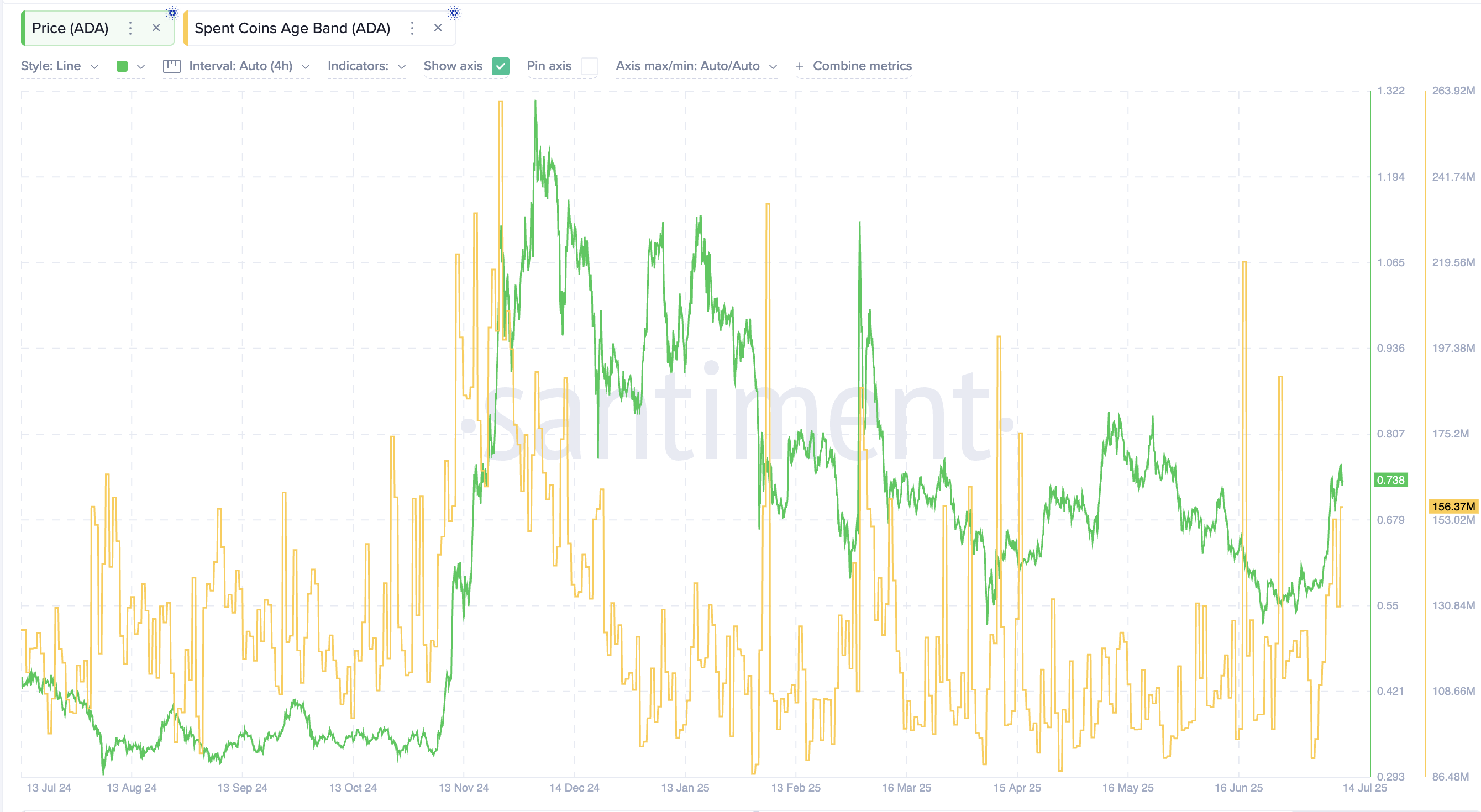

No Major Exits Yet as Spend Coins Age Remains Low

The Spent Coins Age metric spiked briefly in mid-June but has dropped back to lower levels. That means older ADA coins aren’t being sold. And most long-term holders appear to be sitting tight; a classic bullish signal during uptrends.

Also, the major spike in Spent Coins Age metric, around mid-June and also early-April, didn’t align with major price spikes. This shows that the selling trends associated with older wallets are not exactly profit-inspired. This might be a good sign in an uptrending market, meaning there aren’t many rally-restricting elements in play.

Cardano price and Spent Coins Age metric:

Santiment

Cardano price and Spent Coins Age metric:

Santiment

Spent Coins Age measures how long coins sit before being moved. A lower value suggests reduced selling pressure from older wallets.

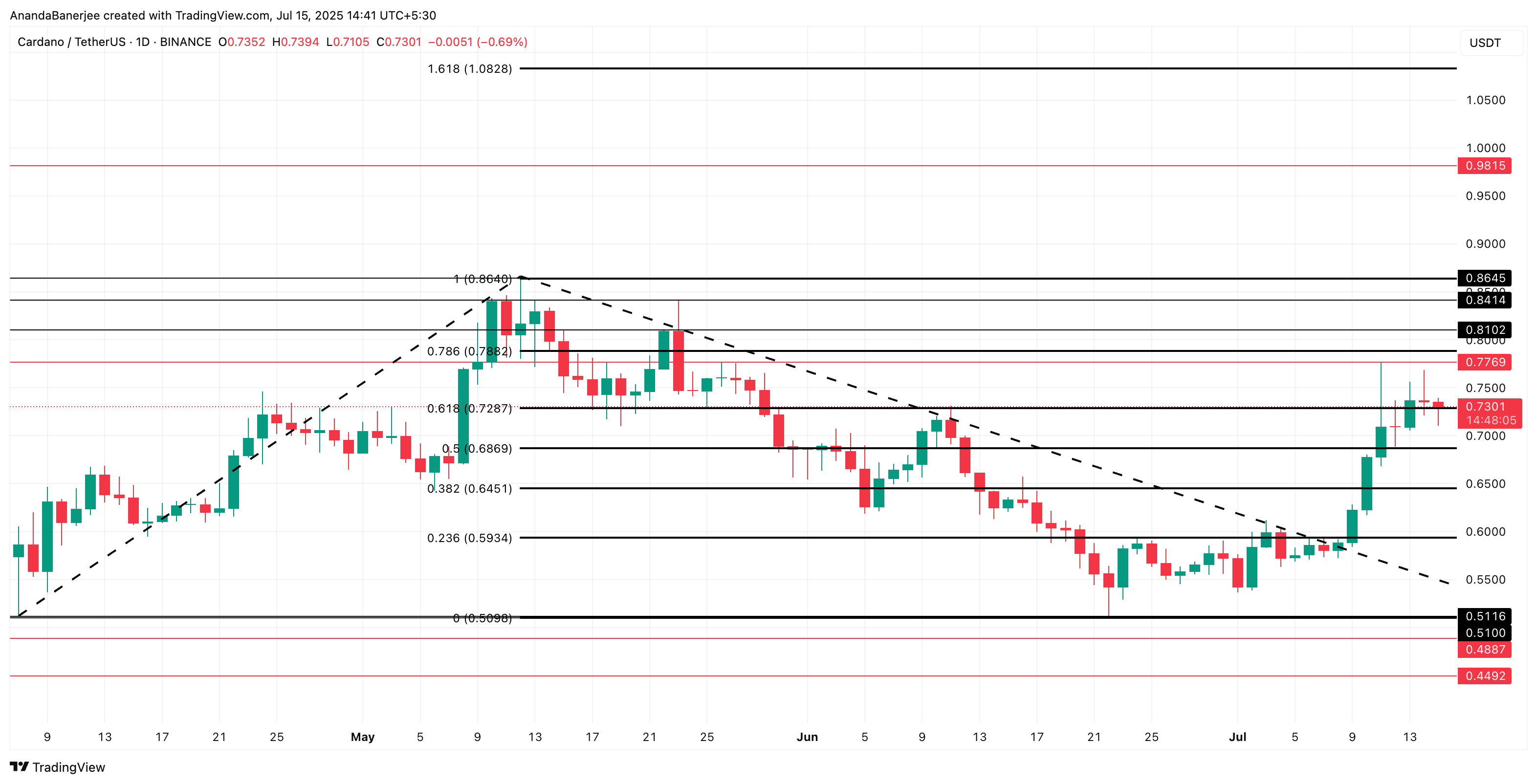

Cardano Price Approaches Critical Resistance

The Cardano price is currently trading at $0.73, marginally above the 0.618 Fibonacci level ($0.7287) and heading toward the dual resistance zone:

- Strong horizontal level at $0.77

- 0.786 Fibonacci at $0.78

Cardano price analysis:

TradingView

Cardano price analysis:

TradingView

If ADA price breaks both, there’s little friction until $0.86, and from there, the 1.618 Fibonacci extension targets $1.08, representing a ~46% potential upside from current levels.

The Fibonacci extension is drawn from the $0.51 swing low to $0.86 high, with retracement confirming support near $0.50, a textbook impulse wave.

With whales accumulating, no signs of mass exits, and a clean price structure, Cardano’s rally toward $1.08 looks increasingly probable. However, a dip under $0.72 followed by the retest of the key support level ($0.68 or .5 Fib level) could invalidate the bullish take.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science

Mars Morning News | ETH returns to $3,000, extreme fear sentiment has passed

The Federal Reserve's Beige Book shows little change in U.S. economic activity, with increasing divergence in the consumer market. JPMorgan predicts a Fed rate cut in December. Nasdaq has applied to increase the position limit for BlackRock's Bitcoin ETF options. ETH has returned to $3,000, signaling a recovery in market sentiment. Hyperliquid has sparked controversy due to a token symbol change. Binance faces a $1 billion terrorism-related lawsuit. Securitize has received EU approval to operate a tokenization trading system. The Tether CEO responded to S&P's credit rating downgrade. Large Bitcoin holders are increasing deposits to exchanges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

The central bank sets a major tone on stablecoins for the first time—where will the market go next?

The People's Bank of China held a meeting to crack down on virtual currency trading and speculation, clearly defining stablecoins as a form of virtual currency with risks of illegal financial activities, and emphasized the continued prohibition of all virtual currency-related businesses.