Dow Jones up on bank earnings as Trump denies plans to fire Powell

U.S. stocks traded higher as markets digested CPI data and President Trump walked back comments on the Fed Chair.

U.S. stock indices rose on Wednesday, July 16, with the Federal Reserve once again in focus. The Dow Jones Industrial Average gained 120 points, or 0.27%, boosted by strong earnings from major U.S. banks. Meanwhile, the S&P 500 and the Nasdaq posted more modest gains of 0.13% and 0.08%, respectively.

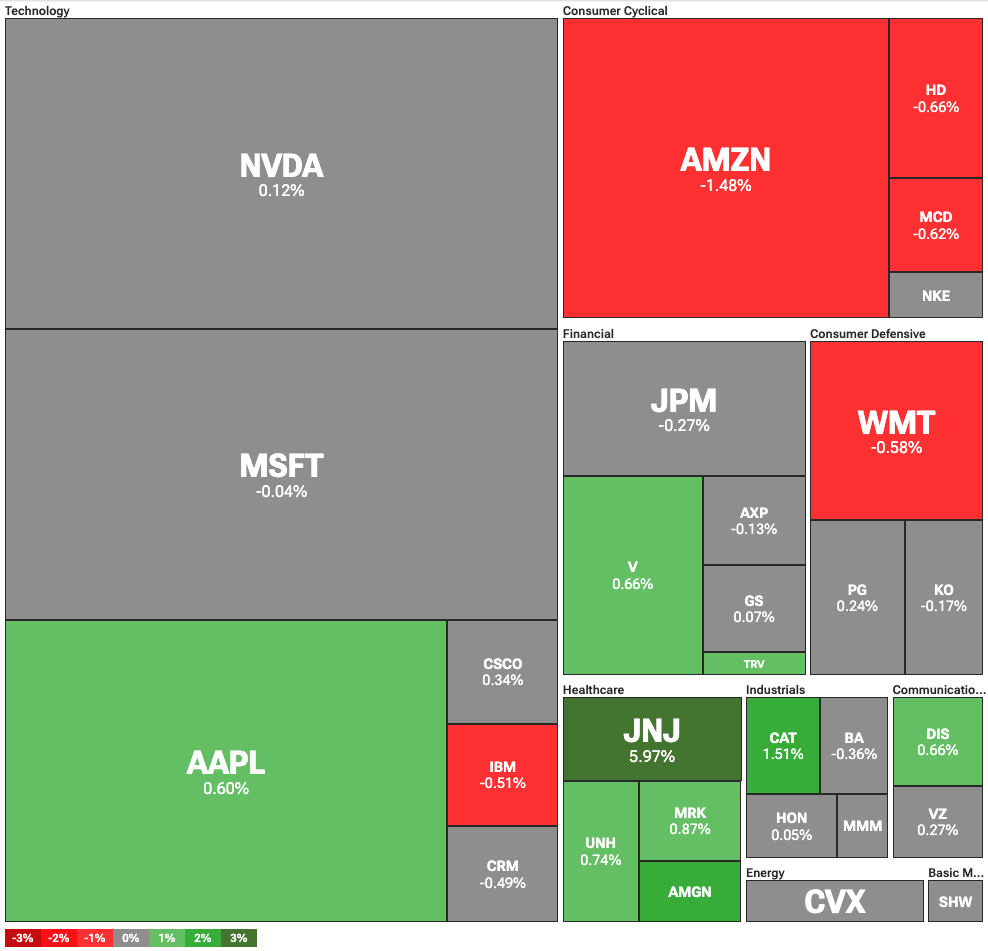

Dow Jones Industrial Average heatmap | Source: TipRanks

Dow Jones Industrial Average heatmap | Source: TipRanks

raders turned their attention to renewed tensions between the White House and the Federal Reserve. On July 16, President Trump denied earlier reports that he planned fire Fed Chair Jerome Powell. He stated that he is “not planning” to remove Powell, though he reiterated that the Chair was doing a “terrible job.”

Trump has continued to pressure the Fed to lower interest rates in an effort to stimulate the economy and lift the stock market. Most recently, the White House criticized the central bank over a $2.5 billion renovation project for two buildings in Washington.

The Fed remains hesitant to adjust interest rates due to persistent inflation concerns. The latest CPI data added to those fears, showing that consumers are beginning to feel the impact of Trump’s tariffs. In this environment, rate cuts appear unlikely, unless there is a significant shift in the Fed’s leadership.

Big banks profit despite fears over inflation

Strong earnings from major banking giants helped lift the stock market. Goldman Sachs, Bank of America, and Morgan Stanley all posted better-than-expected results. The banks also reported growing market share, fueled by positive loan growth.

This suggests that the current environment continues to favor large financial institutions with significant exposure to capital markets. Notably, Goldman Sachs is up 22% year to date, while JPMorgan has gained 19% over the same period.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.

Balancer Rallies to Recover and Redistribute Stolen Funds After Major Cyber Attack

In Brief Balancer plans to redistribute $8 million to users after a massive cyber theft. The recovery involved crucial roles by white-hat researchers rewarded with 10% incentives. Unclaimed funds will undergo governance voting after 180 days.

Bitcoin Faces Renewed Selling Pressure as Whale Deposits Spike and Market Fear Deepens