Ethereum Market Cap Surpasses $430 Billion Milestone

- Ethereum market cap hits $430 billion, highlighting institutional interest.

- Ethereum prices surged over 21% in the past week.

- BlackRock leads with a record-breaking $499.2M Ethereum purchase.

Nut Graph: The rapid increase in Ethereum’s market cap underscores the growing trust and interest in cryptocurrency by major financial players. This shift is supported by significant trade volumes and institutional engagements, suggesting Ethereum’s growing influence.

Institutional Interest and Ethereum’s Growth

Ethereum has witnessed a remarkable rise, with its market cap reaching over $430 billion. This increase is partly attributed to heightened demand from institutional investors and historic inflows into Ethereum exchange-traded funds (ETFs) .

Key figures like Arthur Hayes from BitMEX and CEO Eugene Gaevoy of Wintermute have highlighted the scarcity of Ethereum in the market. “There is almost no Ethereum available for sale on their OTC platform right now,” said Eugene Gaevoy. BlackRock has notably intensified its acquisitions, purchasing $499.2 million in a single day.

Impact of Institutional Investments

Institutional investment has had an immediate impact, with Ethereum’s value surging over 21% within seven days. This highlights increased interest and potential appreciation amidst significant market activity.

The financial landscape is seeing shifts, as the influx of ETF products boosted investor interest. The Ethereum Trust recordings and activity mark strategic moves toward institutional cryptocurrency adoption.

Public Interest and Regulatory Trends

A recent surge in Google searches for Ethereum signals heightened public interest, often presaging market movements. The co-opting of Ethereum by institutional treasuries further emphasizes this trend.

Regulatory acceptance appears steady, contributing to unprecedented institutional activity. Historical precedents during similar surges in 2021 revealed correlative spikes in DeFi tokens and tech adoption, enhancing Ethereum’s stature in the cryptocurrency world.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Paxos proposes to back Hyperliquid’s new USDH stablecoin

Share link:In this post: Paxos has submitted a proposal to support Hyperliquid’s launch of the USDH stablecoin on its platform. The company plans to use 95% of the interest generated by its reserves backing USDH to repurchase HYPE and redistribute it back to ecosystem initiatives. Paxos Labs has also acquired Molecular Labs in a bid to accelerate stablecoin adoption in the Hyperliquid ecosystem.

Crypto sentiment moves into fear terriroty as traders weigh next moves

Share link:In this post: Crypto sentiment has moved into the fear region as investors are now holding off from taking more risks. Santiment has highlighted the focus on larger-cap tokens, noting that traders are presently not open to risks. Analysts and traders question the near-term direction of some of these major assets.

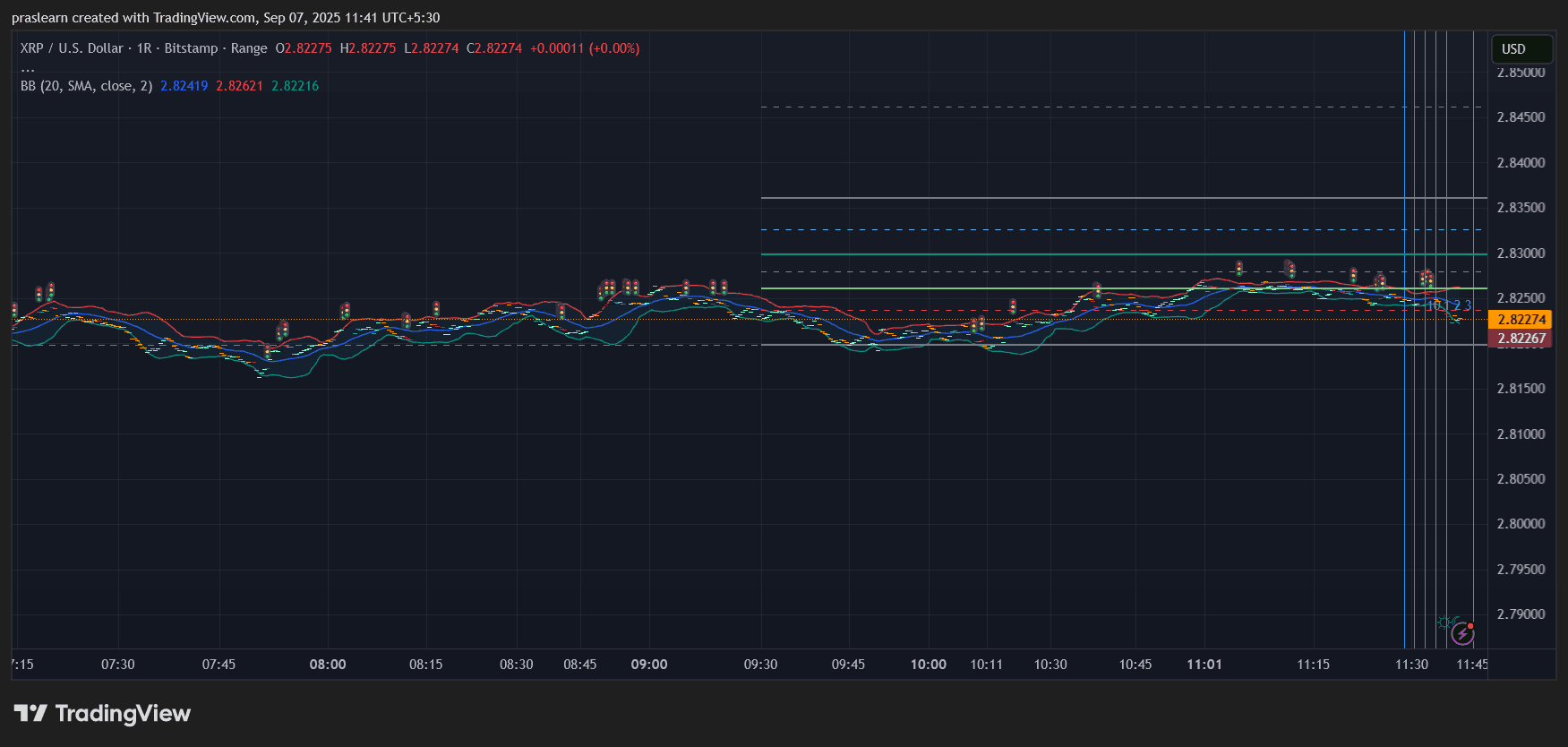

Is XRP about to break through $3?

XRP is currently fluctuating within a narrow range around $2.80, but with the Federal Reserve almost certain to cut interest rates this month, volatility is about to return.

Top 3 Altcoins Worth Buying in September 2025

The crypto market is in a stagnant state, but bitcoin's stability and the altcoin season index indicate opportunities. Here are the top three altcoins worth buying right now.