Ethereum Price Skyrockets: What’s Coming Next?

Ethereum price is making headlines again, climbing aggressively as it approaches the key psychological barrier of $4,000. After weeks of consolidation, ETH has erupted with a powerful breakout, leaving behind major resistance zones and signaling renewed bullish momentum. On the daily chart, ETH price has been printing strong Heikin Ashi candles backed by rising volume and an overheated RSI—indicating that the bulls are in full control, at least for now.

But is this breakout sustainable, or are we witnessing the final leg of an overextended rally? In this article, we’ll analyze Ethereum’s price structure, momentum indicators, Fibonacci targets, and likely next moves to determine whether ETH price can truly break the $4K mark —or if a correction is looming.

Ethereum Price Prediction: Why Is Ethereum Price Surging Right Now?

ETH/USD Daily Chart- TradingView

ETH/USD Daily Chart- TradingView

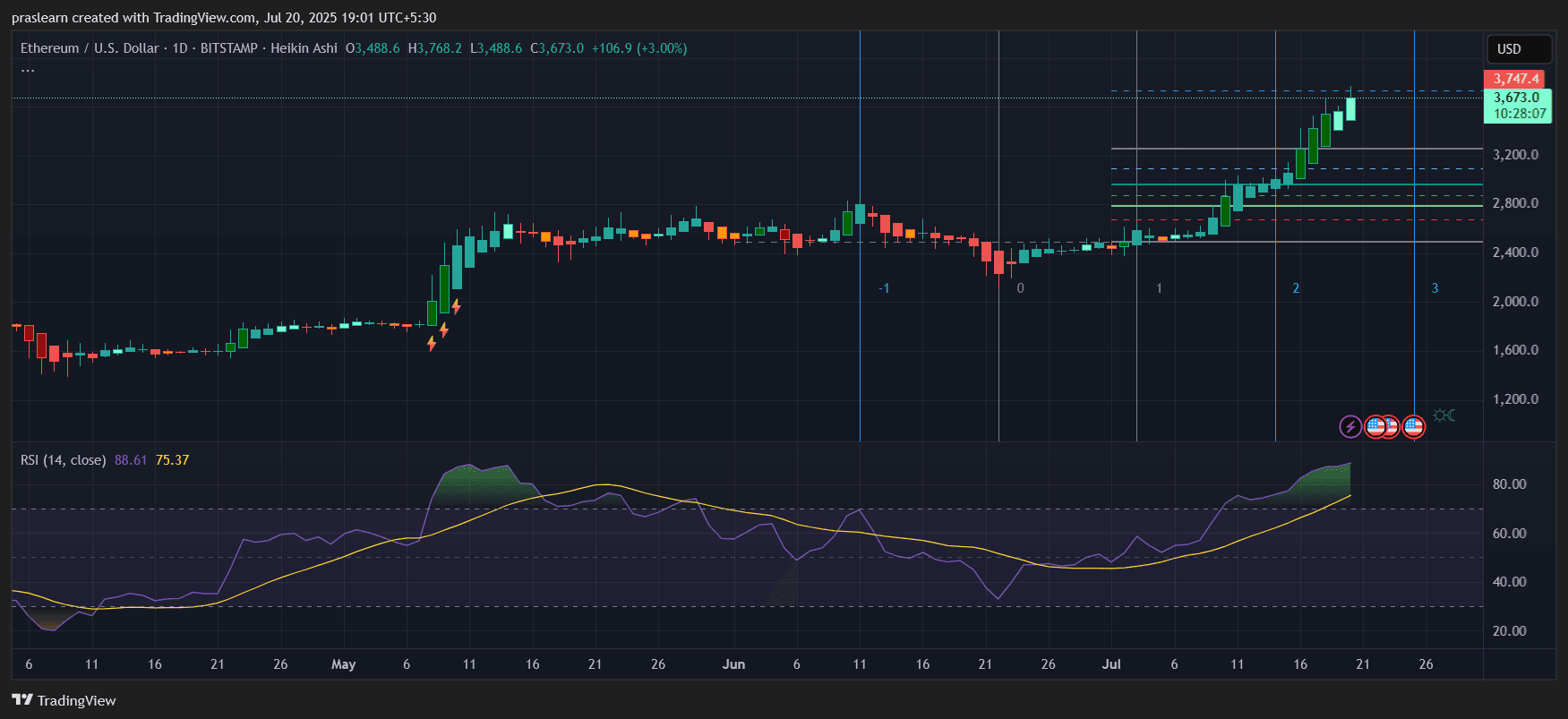

Ethereum (ETH) price is currently on fire , with its price climbing to $3,673—up 3.00% in the last daily candle. The daily chart (Heikin Ashi) shows a strong and consistent bullish trend, with multiple consecutive green candles and minimal wicks to the downside. Momentum has clearly shifted, and Ethereum is challenging key resistance levels near $3,747.4.

The major catalyst seems to be the broader market optimism following renewed ETF speculation and a surge in DeFi activity. However, the chart shows this isn’t just hype—it’s a technically strong move with confirmation from indicators.

What Does the RSI Say About Ethereum’s Strength?

The Relative Strength Index (RSI) is currently at 88.61, well above the traditional overbought threshold of 70. This extreme reading is rare and signals tremendous momentum—but also a potential short-term cooling.

Historically, when Ethereum’s RSI reaches these levels, a pullback or consolidation follows within 5–7 days. However, overbought conditions during strong breakouts often lead to bullish continuations if volume supports the trend.

Here’s a historical context:

In May 2021, ETH's RSI reached 88, followed by a 10% rise before a 15% correction.

A similar setup now suggests Ethereum could hit $3,950–$4,000 before facing resistance.

Fibonacci Levels and Breakout Zones

Looking at the Fibonacci retracement levels drawn from the previous swing high and low, Ethereum has broken past multiple retracement zones:

- $2,800 – Previous 0.618 level broken with high volume

- $3,200 – Passed without resistance

- $3,488 – Local breakout level

- $3,747.4 – Next key target zone

If Ethereum price breaks above $3,750 , the next Fibonacci extension target sits at $4,150, which aligns with the psychological round number of $4,000.

Price Projection Calculation:

Let’s use a simple Fibonacci extension method:

If the swing low was $2,400 and swing high is $3,488, the difference is:

$3,488 - $2,400 = $1,088

Fibonacci 1.618 extension = $2,400 + (1.618 × $1,088) = $4,162

This projection points toward a possible $4,150–$4,200 target in the coming weeks.

Is This a Blow-Off Top or the Start of a New Rally?

Currently, Ethereum price is trading in Wave 3 of an Elliott Wave pattern , which typically represents the strongest bullish leg. The chart shows clear impulsive movement without significant retracement, confirming bullish control.

The lack of bearish divergence on the RSI and the strength of the current candles support the case for a continuation rally, at least until $3,950–$4,150.

However, traders should note:

- ETH is overbought

- Pullbacks to $3,200 or $2,950 are possible

- Strong support lies between $2,850–$3,200

Ethereum Price Prediction for July 2025

Given current momentum, strong Heikin Ashi structure , and RSI-backed breakout, Ethereum price is likely to continue its upward journey.

Short-Term Prediction (Next 7–10 days):

- Bullish scenario: ETH hits $3,950–$4,150

- Consolidation scenario: ETH stabilizes between $3,200–$3,600

- Bearish reversal only if: ETH drops below $2,950

Should You Buy ETH Now?

The technicals support a bullish continuation. However, with RSI so high, short-term pullbacks are natural and even healthy. If you're looking to enter, consider waiting for a dip near the $3,200 zone—or ride the wave with a tight stop loss.

Ethereum price looks strong, and the chart setup could be signaling the start of a major bullish phase. If it breaks $3,750 convincingly, $4,150 may just be the next destination.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Economic Truth: AI Drives Growth Alone, Cryptocurrency Becomes a Political Asset

The article analyzes the current economic situation, pointing out that AI is the main driver of GDP growth, while other sectors such as the labor market and household finances are in decline. Market dynamics have become detached from fundamentals, with AI capital expenditure being key to avoiding a recession. The widening wealth gap and energy supply are becoming bottlenecks for AI development. In the future, AI and cryptocurrencies may become the focus of policy adjustments. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still in the process of iterative improvement.

AI unicorn Anthropic accelerates IPO push, taking on OpenAI head-to-head?

Anthropic is accelerating its expansion into the capital markets, initiating collaboration with top law firms, which is seen as an important signal toward going public. The company's valuation is approaching 300 billions USD, and investors are betting it could go public before OpenAI.

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

The Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Reshaping

The change of the next Federal Reserve Chair is a decisive factor in reshaping the future macro environment of the cryptocurrency industry.