Inflation data, firing threats and policy updates: What’s moving markets

Cryptocurrency and stock traders alike had a lot to unpack Wednesday

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe .

US equities were in the red midway through Wednesday’s trading session, after inflation data may have started to reflect tariff-related price hikes and President Trump renewed threats to fire Fed Chair Jerome Powell.

Meanwhile, cryptocurrencies were mostly flat as the industry continues to monitor the status of three bills in the House.

There’s a lot to unpack, so let’s get started.

First up: inflation and tariffs. June’s CPI report showed the headline figure increased 0.3% month over month. The 12-month rate is now 2.7% — in line with expectations but higher than May’s 2.4% reading.

A grain of salt here: The Bureau of Labor Statistics announced last month that it was reducing its sample collection areas across the US. The change is due to staffing shortages at the agency. Fewer workers on hand to check prices means more estimating and guessing in the data.

The department based 35% of its missing prices on other regions of the country or different products in June. Prior to staffing shortages, around 10% was typical.

Sectors most exposed to tariffs, like household furnishings and appliances, were up over the month, increasing 1% and 1.9%, respectively. Prices for new and used cars, on the other hand, declined 0.3%.

Odds of interest rates staying the same later this month increased to 97.4% after the print, per data from CME Group.

Speaking of Fed policy brings us to our second topic: Trump is apparently back at it again with threats against Powell.

The president last night showed a draft letter firing the chair to a group of House Republicans, the WSJ and New York Times reported. Trump on Wednesday, however, told reporters “we’re not planning on doing anything.”

“I don’t rule out anything, but I think it’s highly unlikely,” Trump added. “Unless he has to leave for fraud.”

That last comment comes after the White House alleged Powell either made false statements to Congress about the Fed’s $2.5 billion renovation of its offices, or failed to comply with permit requirements. The challenge came via a letter sent last week from Trump budget director Russell Vought.

Trump did admit to meeting with House Representatives on Tuesday night, which brings us to topic number three: What’s going on with crypto policy?

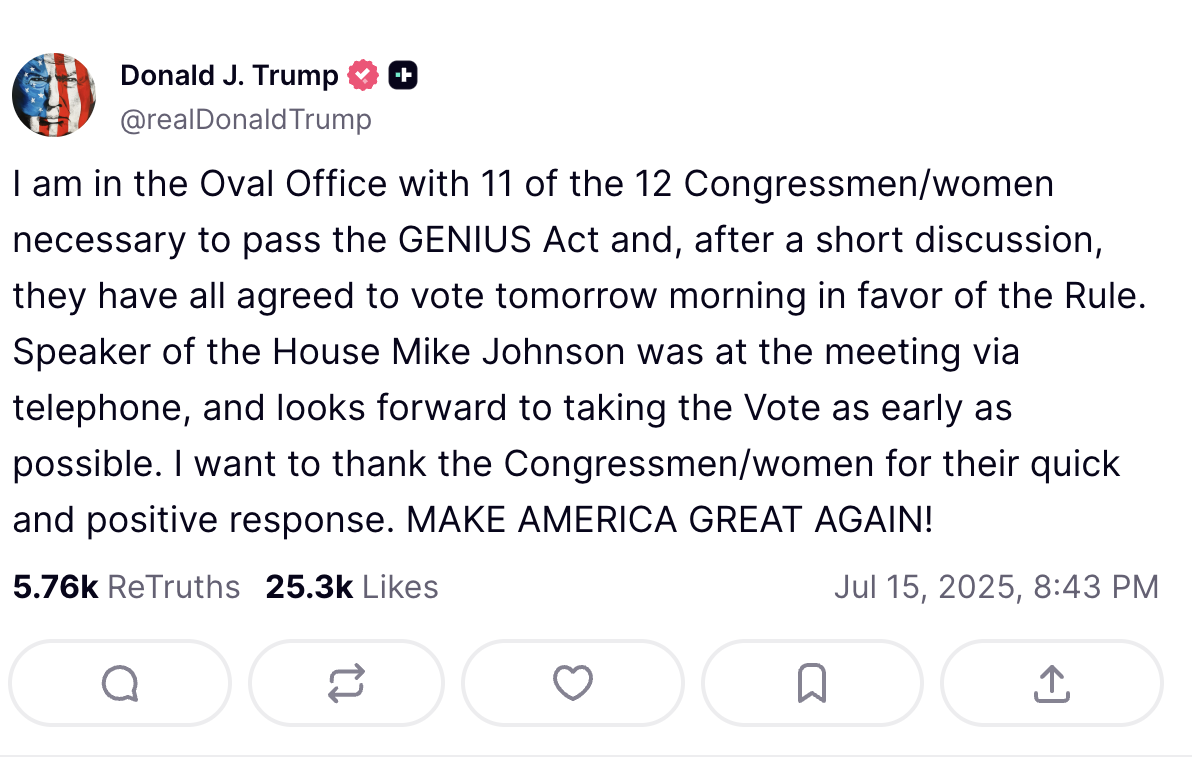

In a Truth Social post yesterday evening, Trump wrote:

The post came after the GENIUS Act failed to pass a procedural vote Tuesday. A group of GOP Freedom Caucus members refused to vote in favor of advancing the bill, citing concerns over the GENIUS Act and the Anti-CBDC Surveillance Act being separate pieces of legislation, a person familiar with the matter told me.

Representatives gathered on Wednesday to reconsider the rule, but the deal President Trump struck with hardliners on Tuesday did not appear to be effective. The drama was still playing out at time of publishing, so keep an eye on Blockworks’ congressional coverage for updates.

The holdup comes as lawmakers and industry members alike insisted the bill was poised to pass. I’ve been told the White House has already scheduled time in the Oval Office for Trump to sign the bill into law on Friday.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown : Decoding crypto and the markets. Daily.

- Empire : Crypto news and analysis to start your day.

- Forward Guidance : The intersection of crypto, macro and policy.

- 0xResearch : Alpha directly in your inbox.

- Lightspeed : All things Solana.

- The Drop : Apps, games, memes and more.

- Supply Shock : Bitcoin, bitcoin, bitcoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

No wonder Buffett finally bet on Google

Google holds the entire chain in its own hands. It does not rely on Nvidia and possesses efficient, low-cost computational sovereignty.

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes