Tesla misses out on massive Bitcoin gains after selling at $20K

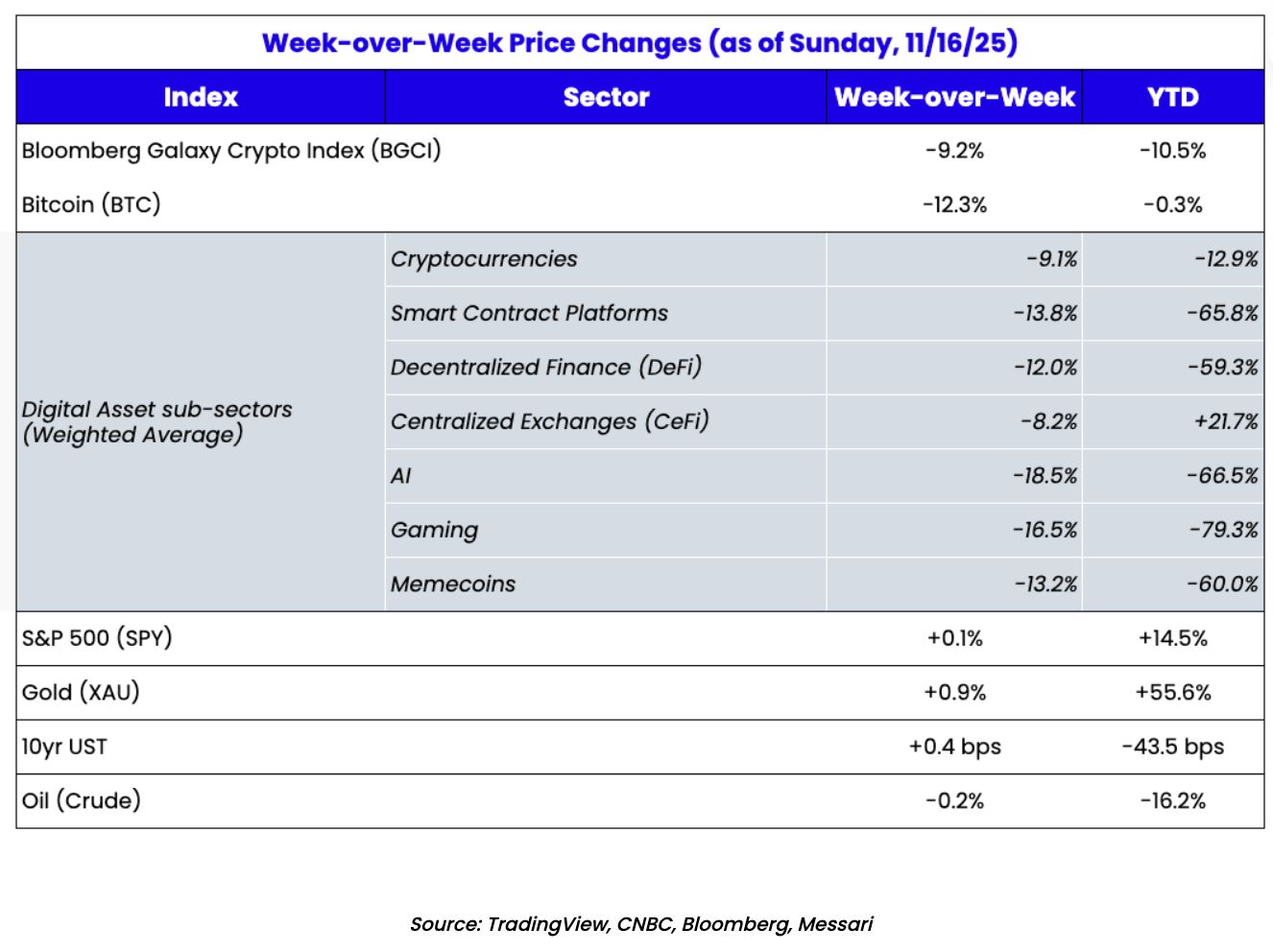

Key Takeaways

- Tesla missed out on billions in potential profits by selling 75% of its Bitcoin holdings too early.

- The company's early Bitcoin sale coincided with challenges in its core auto business and impacted financial results.

Tesla could have made billions if it had held onto Bitcoin (BTC) instead of selling the bulk of it when prices crashed in 2022.

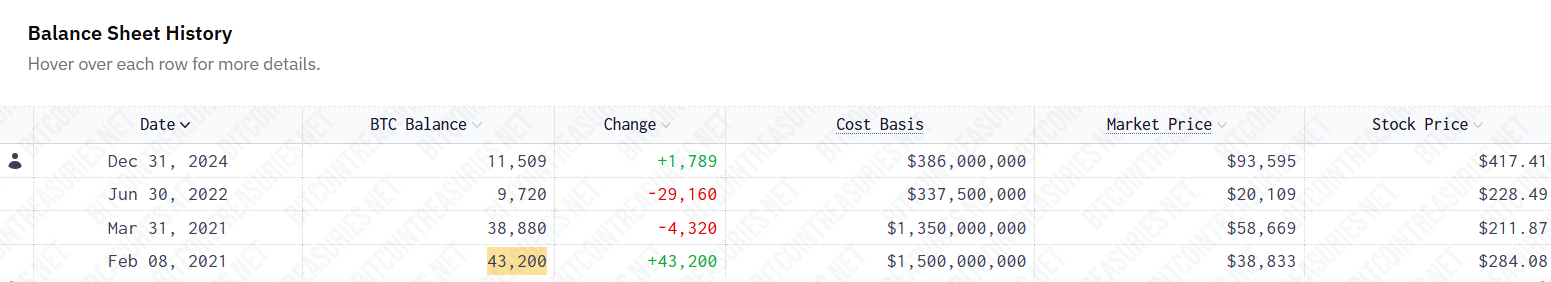

In early 2021, Tesla acquired 43,200 Bitcoin worth $1.5 billion as part of its treasury diversification strategy, data from BitcoinTreasuries.net shows.

Soon after, the company began accepting the asset as payment for its cars, but then suspended the option due to environmental concerns related to Bitcoin mining’s energy usage.

In March of that year, Elon Musk’s electric vehicle company made its first Bitcoin sale, offloading 4,320 BTC when Bitcoin was trading above $58,000. Bitcoin reached a high of $61,500 during the 2021 cycle, so Tesla’s initial sale was not entirely unreasonably timed.

By the end of June 2022, Tesla had sold another 29,160 BTC, representing 75% of its remaining holdings. At that time, Bitcoin was trading around $20,000 and later dropped to a yearly low of $16,500.

Source: BitcoinTreasuries.net

Source: BitcoinTreasuries.net

However, the second sale was less favorable. It resulted in massive missed gains.

Bitcoin has exploded since Wall Street stepped in, with major players like BlackRock, Grayscale, and other fund managers pushing to bring Bitcoin to institutional investors through ETFs. Grayscale’s court victory over the SEC paved the way for the landmark debut of spot Bitcoin funds in the US.

Following that, Bitcoin has left the $20,000 level well behind. The digital asset crossed $100,000 last December and extended its rally to $122,000, its latest high.

With Bitcoin trading at around $116,300 at the time of reporting, Tesla’s initial holdings would be valued at about $5 billion. The BTC it offloaded would be worth over $3.5 billion now.

Tesla now holds 11,509 BTC worth around $1.4 billion. The company has not adjusted its Bitcoin portfolio since its last purchase.

Tesla’s auto revenue dropped for the second quarter in a row, and the company missed Wall Street’s projections. The stock plunged 8% on Thursday before bouncing back 3.5% on Friday. It’s still down more than 21% so far this year, per Yahoo Finance .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Atlantic: How Will Cryptocurrency Trigger the Next Financial Crisis?

Bitcoin fell below $90,000, and the cryptocurrency market lost $1.2 trillions in six weeks. Stablecoins, criticized for disguising risks as safety, have been identified as potential triggers for a financial crisis, and the GENIUS Act could increase these risks. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Bitcoin Surrenders Early as Market Awaits Nvidia’s Earnings Report Tomorrow

Global risk assets have experienced a significant decline recently, with both the US stock market and the cryptocurrency market plunging simultaneously. This is mainly due to investor fears of an AI bubble and uncertainty surrounding the Federal Reserve's monetary policy. Concerns over the AI sector intensified ahead of Nvidia's earnings report, while uncertainty in macroeconomic data further increased market volatility. The correlation between Bitcoin and tech stocks has strengthened, leading to split market sentiment, with some investors choosing to wait and see or buy the dip. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still being iteratively improved.

Recent Market Analysis: Bitcoin Falls Below Key Support Level, Market on High Alert, Preparing for a No Rate Cut Scenario

Due to the uncertainty surrounding the Federal Reserve’s decision in December, it may be wiser to act cautiously and control positions rather than attempting to predict a short-term bottom.

If HYPE and PUMP were stocks, they would both be undervalued.

If these were stocks, their trading prices would be at least 10 times higher, if not more.