Injective (INJ) Surge After Staked ETF Filing

- Injective surges following staked ETF filing by Cboe BZX.

- ETF marks a pivotal milestone for INJ and Layer 1 tokens.

- Potential increase in institutional interest in regulated staking.

Injective (INJ) saw a significant price increase after the Cboe BZX Exchange filed for the Canary Capital Staked INJ ETF, garnering substantial institutional interest.

The event heralds wider mainstream acceptance for staked Layer 1 tokens and sparked immediate market volatility, highlighting the potential for broader institutional adoption.

Injective (INJ) has surged after the Cboe BZX Exchange’s filing for a staked INJ ETF, named Canary Capital Staked INJ ETF. This filing is a notable step towards the mainstream integration of Layer 1 tokens.

The fund concept, introduced by Canary Capital Group LLC, will provide regulated access to Injective infrastructure. Eric Chen and Albert Chon from Injective Labs have not made personal statements; the official narrative comes from regulatory filings.

The market saw INJ’s price rise above $16, later pulling back due to profit-taking. Volatility increased, with substantial derivatives liquidations and a dip in open interest. ETF approval could significantly impact Injective’s staking participation.

Historical precedents, such as previous Bitcoin and Ethereum ETF approvals , indicate potential institutional flow shifts. This event might enhance market liquidity and depth for INJ.

“The SEC concluded that certain blockchain staking activities do not constitute securities offerings, removing a critical obstacle and providing long-awaited clarity for both fund issuers and the broader industry.”

The potential approval may lead to substantial technological and financial shifts. Data and analyses suggest enhanced Layer 1 staking narratives. The correlation with other tokens like Solana and Ethereum hints at broader sector implications.

Injective ecosystem growthDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

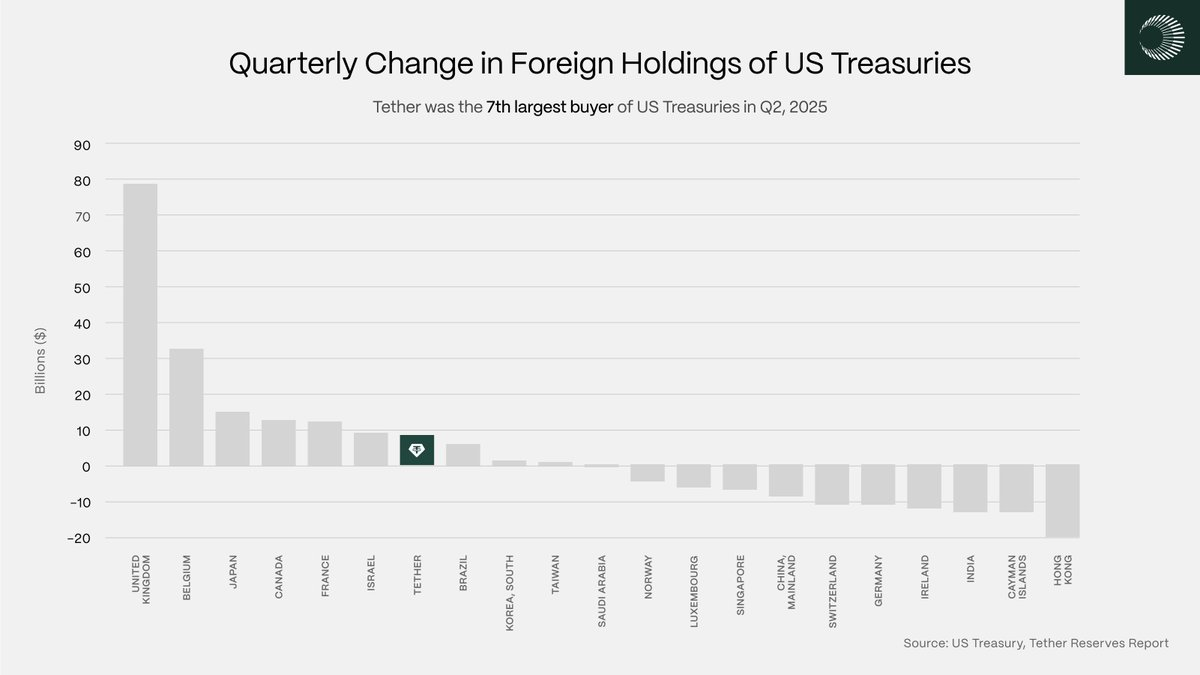

Tether: Quasi-sovereign allocator

Tether’s ascent as a top-10 foreign buyer of Treasurys signals stablecoin issuers are no longer just liquidity users

Powell’s Jackson Hole speech sparks renewed momentum amid rate‑cut hopes

BTC and ETH rally on dovish Fed signals

DOJ Clarifies Liability for Open Source Developers

Ripple Partners with SBI for RLUSD Launch in Japan