What to expect from Pi Network Price in August?

Pi’s price performance has remained largely lackluster over the past few weeks. It has attempted to climb but has failed to sustain any meaningful upward momentum.

With August approaching, the altcoin faces additional pressure from a significant token unlock that could further weigh on its already fragile market structure.

156 Million PI Tokens Set to Flood Market as Price Nears Breakdown

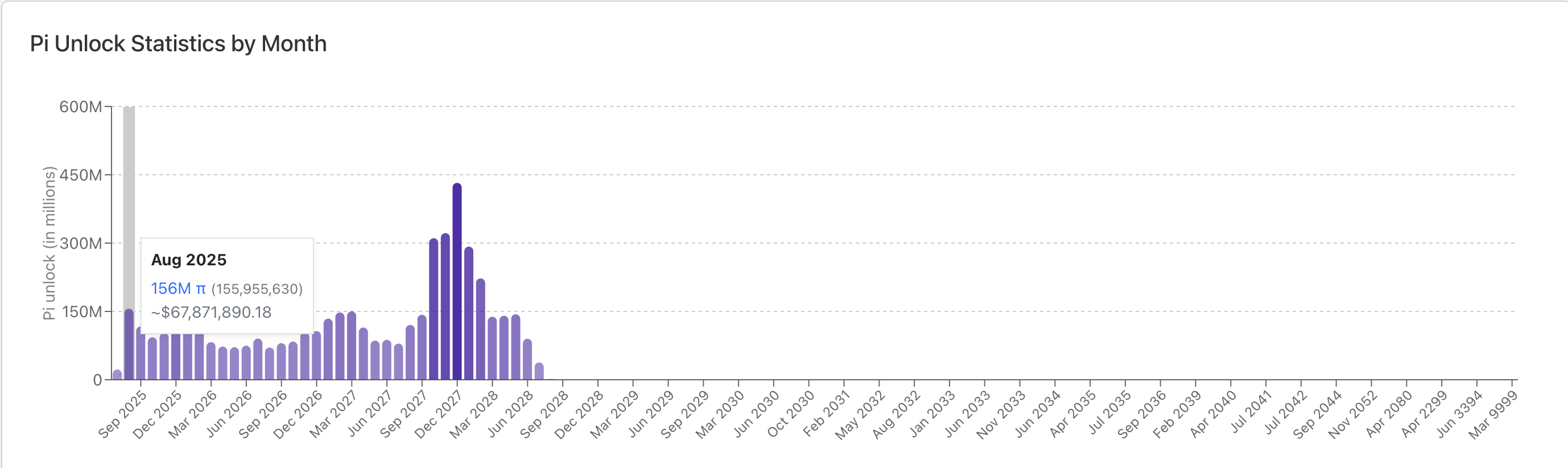

Pi faces a significant token unlock event in August. According to data from PiScan, 156 million tokens—worth approximately $68 million at current prices—are scheduled to be unlocked over the 31-day period.

This unlock event adds serious downside risk to a token already under pressure, with little bullish sentiment to support a rebound.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Currently trading at $0.43, PI has failed to keep pace with the broader crypto market rally that saw many assets notch new all-time highs. The altcoin has been weighed down by aggressive supply-side pressure, with over 250 million tokens released into circulation this month alone.

With minimal buying demand to counterbalance this supply, PI has been unable to gain traction. It remains locked in a tight range and hovers dangerously close to its all-time low of $0.40.

PI Faces Bleak August as Buying Interest Fades

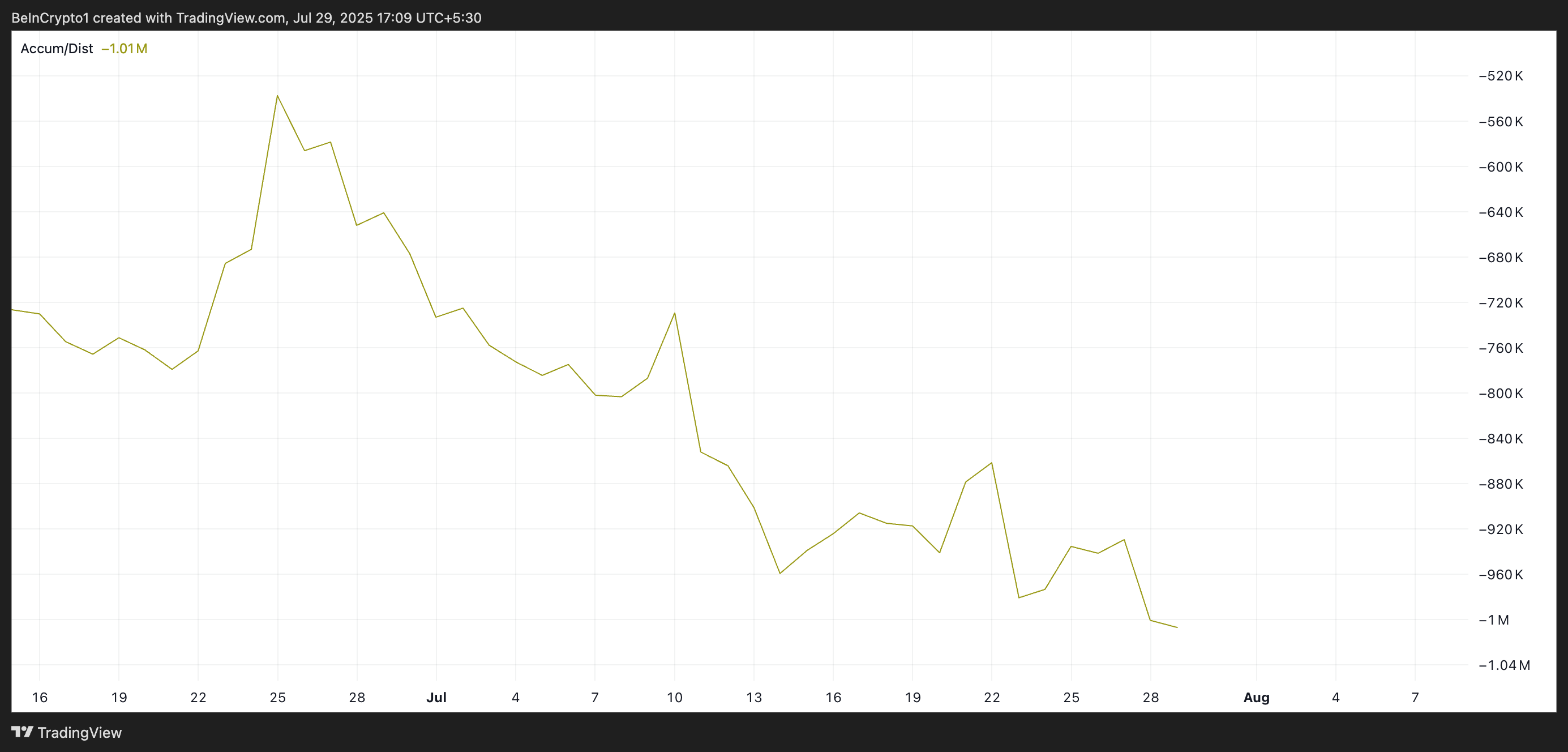

Readings from the daily chart show technical indicators flashing bearish signals, with no clear signs of reversal. For example, PI’s Accumulation/Distribution (A/D) line, a measure of buying versus selling volume, has steadily declined since June 26.

Currently at -1.01 million, its value has plummeted by over 85% since then, highlighting waning interest from market participants.

When an asset’s A/D line plunges like this, selling volume outweighs buying pressure. This trend shows the sustained weakening demand for PI and hints at a growing risk of further price declines in August.

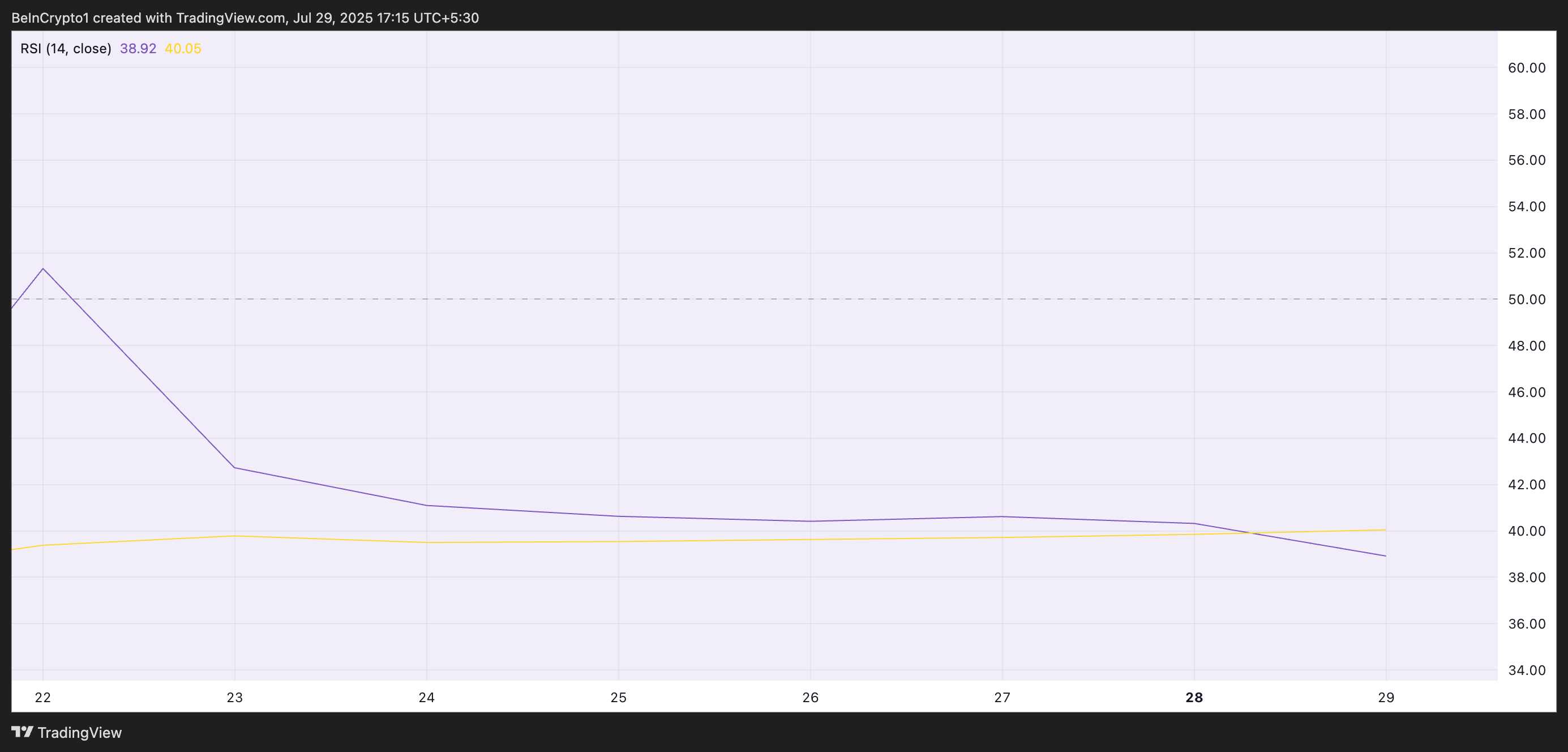

Moreover, following a failed attempt to rally above the 50-neutral line on July 22, PI’s Relative Strength Index (RSI) has trended downward. It currently stands at 38.92, reflecting the strength of the sellers across PI spot markets.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 38.92 and falling, PI’s RSI signals mounting bearish momentum as August approaches. This suggests the token could face further declines unless a reversal emerges soon.

Can PI Survive August’s $68 Million Supply Flood?

Without sufficient new demand to absorb the 156 million PI tokens set to be released next month, the altcoin faces a potential drop to its all-time low of $0.40. A deeper decline below this level remains likely if bearish momentum continues to build.

However, if the current trend reverses and buyers return to the market, they could help stabilize PI’s price in August and attempt to push it back above the $0.46 resistance level.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Staking Weekly Report December 1, 2025

🌟🌟Core Data on ETH Staking🌟🌟 1️⃣ Ebunker ETH staking yield: 3.27% 2️⃣ stETH...

The Blood and Tears Files of Crypto Veterans: Collapses, Hacks, and Insider Schemes—No One Can Escape

The article describes the loss experiences of several cryptocurrency investors, including exchange exits, failed insider information, hacker attacks, contract liquidations, and scams by acquaintances. It shares their lessons learned and investment strategies. Summary generated by Mars AI This summary was produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

Mars Morning News | Federal Reserve officials to advance stablecoin regulatory framework; US SEC Chairman to deliver a speech at the New York Stock Exchange tonight

Federal Reserve officials plan to advance the formulation of stablecoin regulatory rules. The SEC Chair will deliver a speech on the future vision of capital markets. Grayscale will launch the first Chainlink spot ETF. A Coinbase executive has been sued by shareholders for alleged insider trading. The cryptocurrency market fear index has dropped to 23. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

OECD's latest forecast: The global interest rate cut cycle will end in 2026!

According to the latest forecast from the OECD, major central banks such as the Federal Reserve and the European Central Bank may have few "bullets" left under the dual pressures of high debt and inflation.