BTC Tentative, Dollar Index Hits 5-Week High as U.S. GDP Grew 3% in Second Quarter

Bitcoin

The dollar index (DXY), which gauges the greenback's value against major currencies, rose to 99.34, the highest since June 23, according to data source TradingView.

The dollar found a bid from the better-than-expected U.S. gross domestic product (GDP) data, which showed the economy expanded at a 3% annualized pace in the second quarter.

A sharp drop in imports drove the GDP higher. Meanwhile, consumer spending climbed 1.4% following first quarter's 0.5% in a sign of recovering domestic demand. Meanwhile, the gross domestic purchases price index rose 1.9%, down from 3.4% in Q1.

The upbeat GDP data likely reinforced expectations that the Fed will keep interest rates steady later Wednesday.

The DXY has stabilized in recent weeks, ending a sharp downtrend from January highs above 110.00. Some observers are worried that the stability could shake out dollar shorts, adding to the upside momentum in the global reserve currency and downward pressure in the crypto market.

"We see potential near-term risks emerging from overcrowded positioning in USD shorts. The consensus narrative for much of 2025 has revolved around a weaker Dollar, catalyzed by the ongoing Tariff War, but with the Dollar already down 10% year-to-date, we question how much further it can fall," Singapore-based QCP Capital's Market Insights team said.

"CFTC data shows traders extremely short USDJPY, a position that is not only consensus but also expensive to fund over time. In our view, the market is increasingly vulnerable to a short squeeze in the Dollar, which could force risk-off unwinds across equities, EM, and crypto alike," the team added.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Volatility Weekly Review

BTC Volatility Weekly Review (November 10 - 17): Key indicators (from 4:00 PM Hong Kong time on November 10 to November 17...)

Q3 earnings season: Diverging strategies among 11 Wall Street financial giants—some are selling off, while others are doubling down

Technology stocks led by Nvidia have become a key reference signal for global capital allocation strategies.

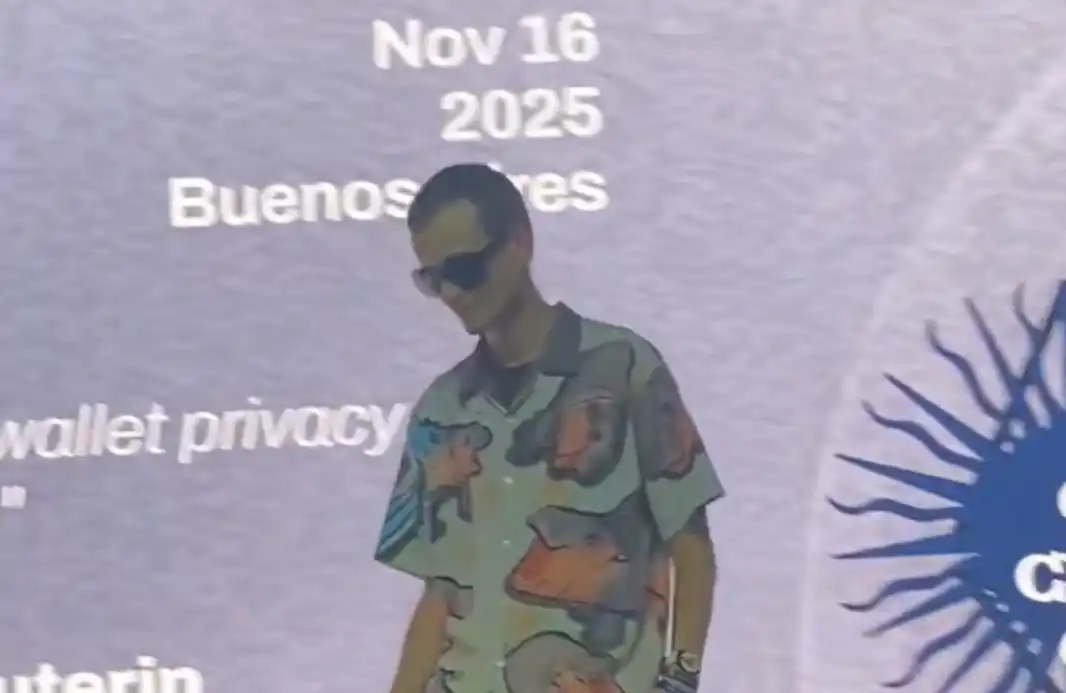

Highlights from the Ethereum Argentina Developers Conference: Technology, Community, and Future Roadmap

While reflecting on the past decade of infrastructure development, Ethereum clearly outlined its key priorities for the next ten years at the developer conference: scalability, security, privacy, and institutional adoption.

Compliance Privacy: What is Kohaku, Ethereum’s Latest Major Privacy Upgrade?

Vitalik once said, "If there is no privacy transformation, Ethereum will fail."