Dow Jones down 600 points as rate cuts odds surge on hiring slump

U.S. stock indices fell as weak jobs data spooked investors, despite earnings beats from Apple and Amazon.

- Dow Jones fell more than 600 points on weak jobs data.

- Apple stock fell despite strong earnings.

- Fed may have to lower interest rates to boost hiring.

Weak jobs data hit stocks hard, despite improving odds of the Federal Reserve cutting interest rates. On Friday, April 1, the Dow Jones dropped 620 points, or 1.42%, while the S&P 500 lost 1.75%. At the same time, the tech-heavy Nasdaq declined as much as 2.33%. The main driver of the declines was July’s labor market report, which showed just 73,000 new jobs versus the expected 104,000.

Tech stocks were among the biggest losers, and even Apple fell 2.5% despite strong earnings . The tech giant reported its highest revenue growth since December 2021. The report indicated that U.S. consumers continued spending despite inflation concerns stemming from the trade war. Apple also stated it plans to significantly increase its investment in AI.

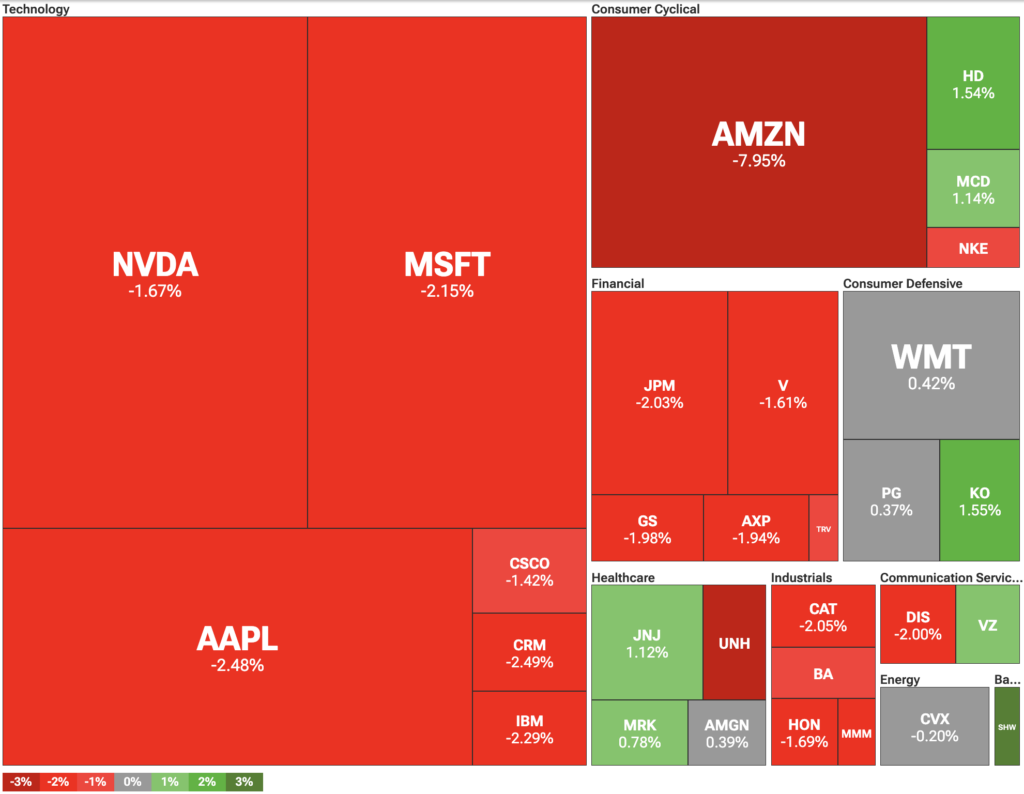

Dow Jones Industrial Average heatmap | Source: TipRanks

Dow Jones Industrial Average heatmap | Source: TipRanks

Amazon’s earnings also exceeded expectations, with earnings per share of $1.68 compared to the $1.33 estimate. However, the company’s third-quarter guidance was relatively modest. This fell short of investor expectations, especially following the company’s multibillion-dollar investment in AI. As a result, its stock was among the biggest losers, falling 8%.

Fed may have to cut rates on weak jobs data

While tech stocks took a beating, there may be a silver lining. Specifically, the weak labor market could force the Federal Reserve to cut interest rates. CME FedWatch futures markets are now pricing in an 83% chance of a rate cut in September, up sharply from 38% just a day earlier—likely due to the disappointing employment data.

The Fed has a dual mandate to maintain low inflation and high employment. So far, the central bank has resisted pressure from President Donald Trump’s White House to lower rates, despite a split among FOMC members.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Base-Solana Bridge Dispute: "Vampire Attack" or Multichain Pragmatism?

The root of the contradiction lies in the fact that Base and Solana occupy completely different positions in the "liquidity hierarchy."

Stable TGE tonight: Is the market still buying into the stablecoin public chain narrative?

According to Polymarket data, there is an 85% probability that its FDV will exceed 2 billion USD on the day after its launch.

The Federal Reserve is likely to implement a hawkish rate cut this week, with internal "infighting" about to begin.

This week's Federal Reserve meeting may feature a controversial "hawkish rate cut." According to the former Vice Chair of the Federal Reserve, the upcoming 2026 economic outlook may be more worth watching than the rate cut itself.

Discover How ZKsync Fast-Tracks Blockchain Security

In Brief ZKsync Lite will be retired by 2026, having achieved its goals. ZKsync team plans a structured transition, ensuring asset security. Future focus shifts to ZK Stack and Prividium for broader application.