Ether Bullish Divergence? ETH's 10% Weekly Price Loss Clashes With $300M Whale Buy

The ether (ETH) market is at a critical juncture as a whale snapped up ether (ETH) worth millions, positioning itself bullishly against the cryptocurrency's first weekly loss in over a month.

Programmable blockchain Ethereum's native token, ether, has dropped nearly 10% this week, hitting lows under $3,400 at one point, CoinDesk data show. The decline follows a robust five-week winning streak, signaling profit-taking or de-leveraging alongside losses on Wall Street.

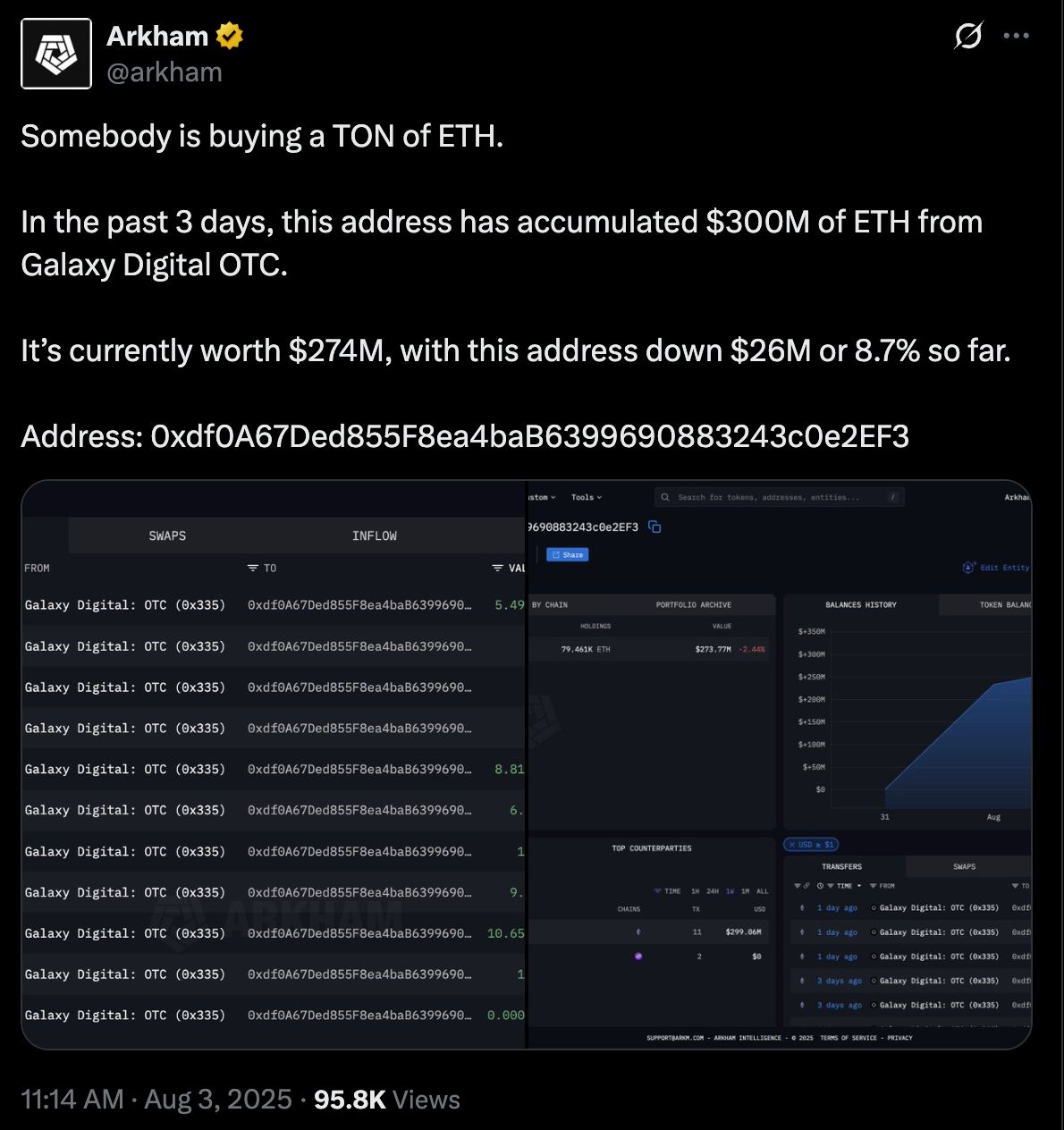

The bearishness, however, contrasts with a powerful signal of long-term conviction from a whale. According to on-chain data tracked by Arkham Intelligence, a single entity snapped up a massive $300 million worth of ether as prices fell, executing a major "buy the dip" operation.

It's the case of bullish divergence. While the weekly price action suggests a loss of immediate upward momentum and potential profit-taking, the significant whale purchase indicates a belief that the recent downturn is merely a temporary setback.

The message is clear: As the price drop flushes out weaker hands, the process if being met with determined buying from a high-conviction entity.

A fresh bout of macro jitters, sparked by the buoyant U.S. dollar and Friday's disappointing U.S. jobs data, has put the crypto market on the back foot.

Bitcoin, the largest digital asset by market value, has held relatively resilient, down just 4.5% for the week. BTC's outperformance relative ETH confirms the change in market sentiment sentiment against ETH that was first signaled by the options market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

QNT Price Breaks Falling Wedge: Can the Bullish Structure Push Toward $150?

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?