XRP Surges 5% Amid Ripple’s Legal Optimism

- Ripple’s legal clarity fuels optimism, driving XRP’s recent price surge.

- XRP jumped over 5%, reaching $3.

- Institutional interest and altcoin rotation play significant roles.

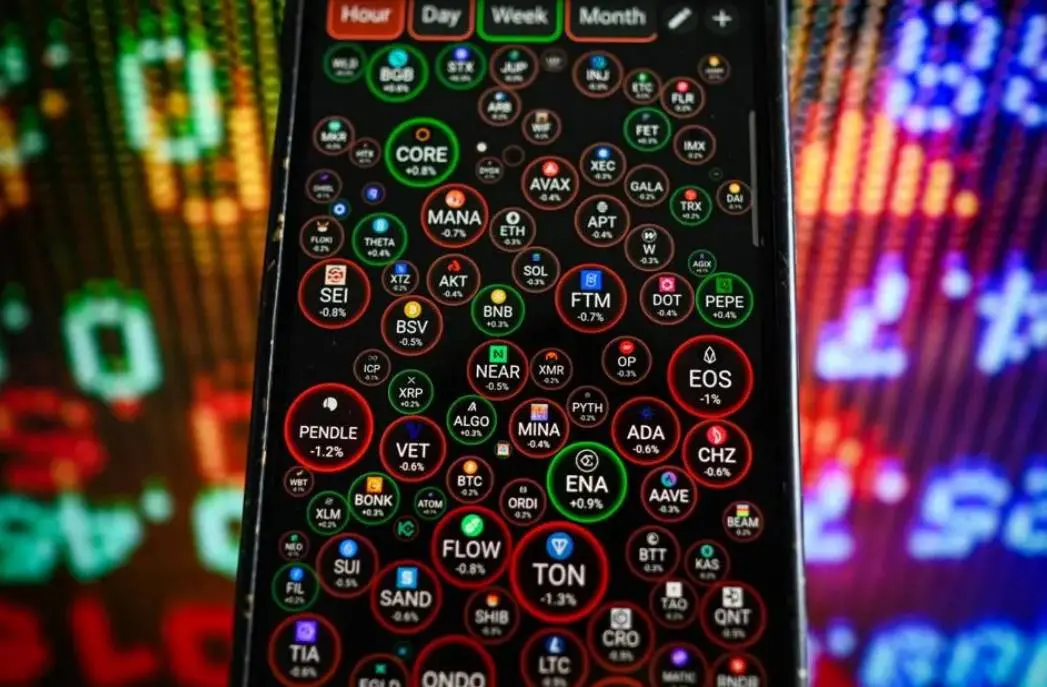

XRP surged over 5% on August 4, 2025, reaching $3, significantly outperforming Bitcoin’s recovery on the cryptocurrency market, driven by renewed optimism and increased institutional interest.

The surge reflects market confidence amid legal clarity, influencing financial strategies and indicating potential bullish trends for major altcoins like Ethereum and Avalanche.

XRP surged over 5% following increased optimism around Ripple’s ongoing legal clarity. The cryptocurrency regained the $3 mark, outpacing Bitcoin’s recovery , as capital rotation into large-cap altcoins gained momentum. Key players include Ripple’s leadership such as CEO Brad Garlinghouse and CTO David Schwartz, who focus on macro and legal factors rather than commenting on recent price movements. Analyst EGRAG CRYPTO predicted significant technical patterns .

“This may be the beginning of the biggest candle body in XRP’s history,” emphasizing the scale of the technical setup, EGRAG CRYPTO stated.

The immediate effect was a boost in XRP’s trading volume and liquidity. Ethereum and Avalanche also saw increases, reflecting broader altcoin interest amid rising institutional investments and decreased regulatory pressures. Increased institutional involvement in XRP has been noted since July, partly driven by ETF discussions. The cryptocurrency’s performance underscores a growing trend of capital inflows into altcoins amidst legal and policy changes.

Notable historical precedents range from past peaking at $3.66 before a correction. Similar cycles characterize the altcoin market’s volatility, with correlated pricing in layer-1 blockchain protocols. Bullish technical sentiment suggests potential price gains if institutional flows continue. Legal clarity and reduced sell pressure bolster analyst and community confidence, positioning XRP for long-term growth.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From "flood irrigation" to a differentiated landscape, will the altcoin season repeat the glory of 2021?

The altcoin season of 2021 erupted under a unique macro environment and market structure, but now, the market environment has changed significantly.

a16z In-Depth Analysis: How Do Decentralized Platforms Make Profits? Pricing and Charging Strategies for Blockchain Startups

a16z points out that a well-designed fee structure is not at odds with decentralization—in fact, it is key to creating a functional decentralized market.

OpenSea unveils final phase of pre-TGE rewards, with $SEA allocation details due in October

Bitcoin Mining Difficulty Reaches New Record High