$42 Million in Shorts on the Line—Can HBAR Pull Off a Surprise Squeeze?

HBAR’s price faces a critical resistance at $0.276, with $42 million in liquidations potentially sparking a rally. Bitcoin’s price movement could drive HBAR’s next big move.

The recent Hedera (HBAR) price action has been marked by a recovery attempt after a notable drawdown. Despite showing some signs of a bounce, the altcoin’s inability to gather bullish momentum raises concerns.

A key issue is the increasing risk to traders holding short positions, as they face significant liquidation pressure.

HBAR Traders Beware

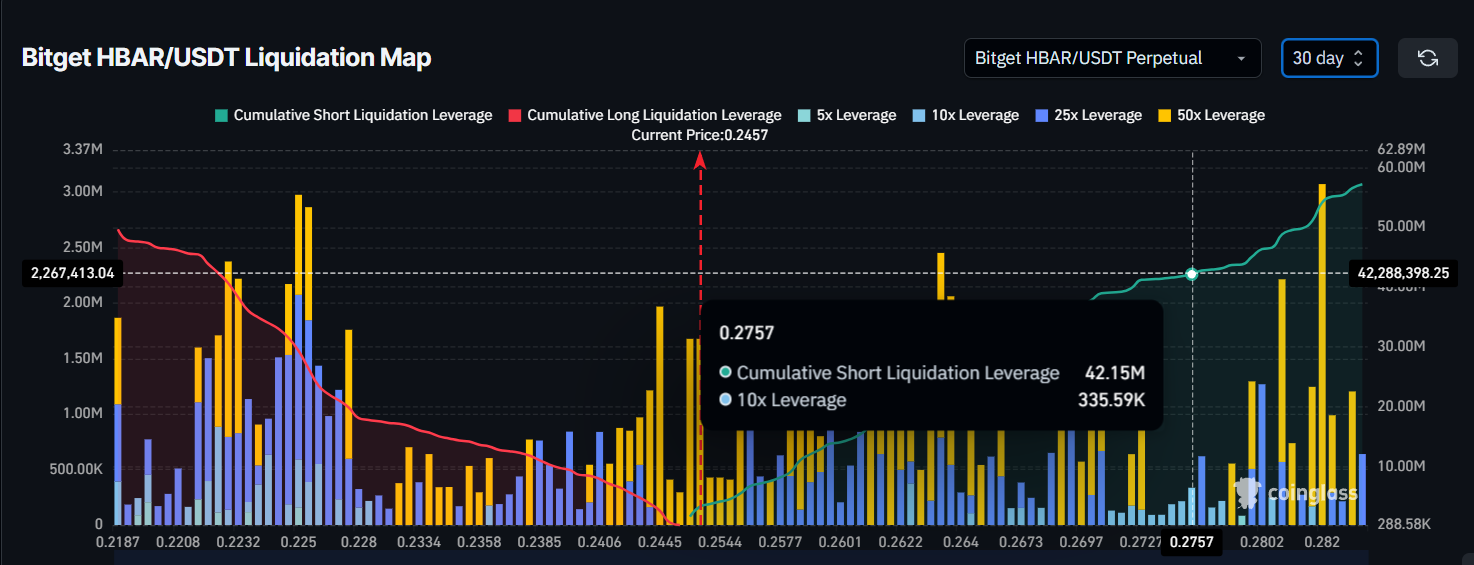

Recent data from the liquidation map reveals that about $42 million worth of short contracts could be liquidated if HBAR manages to recover and reach the $0.276 resistance level. This price point serves as a significant barrier to HBAR’s recovery.

The large volume of shorts at this level shows that many traders are not optimistic about a potential recovery. If the price crosses this barrier, it could spark a squeeze, benefiting those with long positions.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

HBAR Liquidation Map. Source:

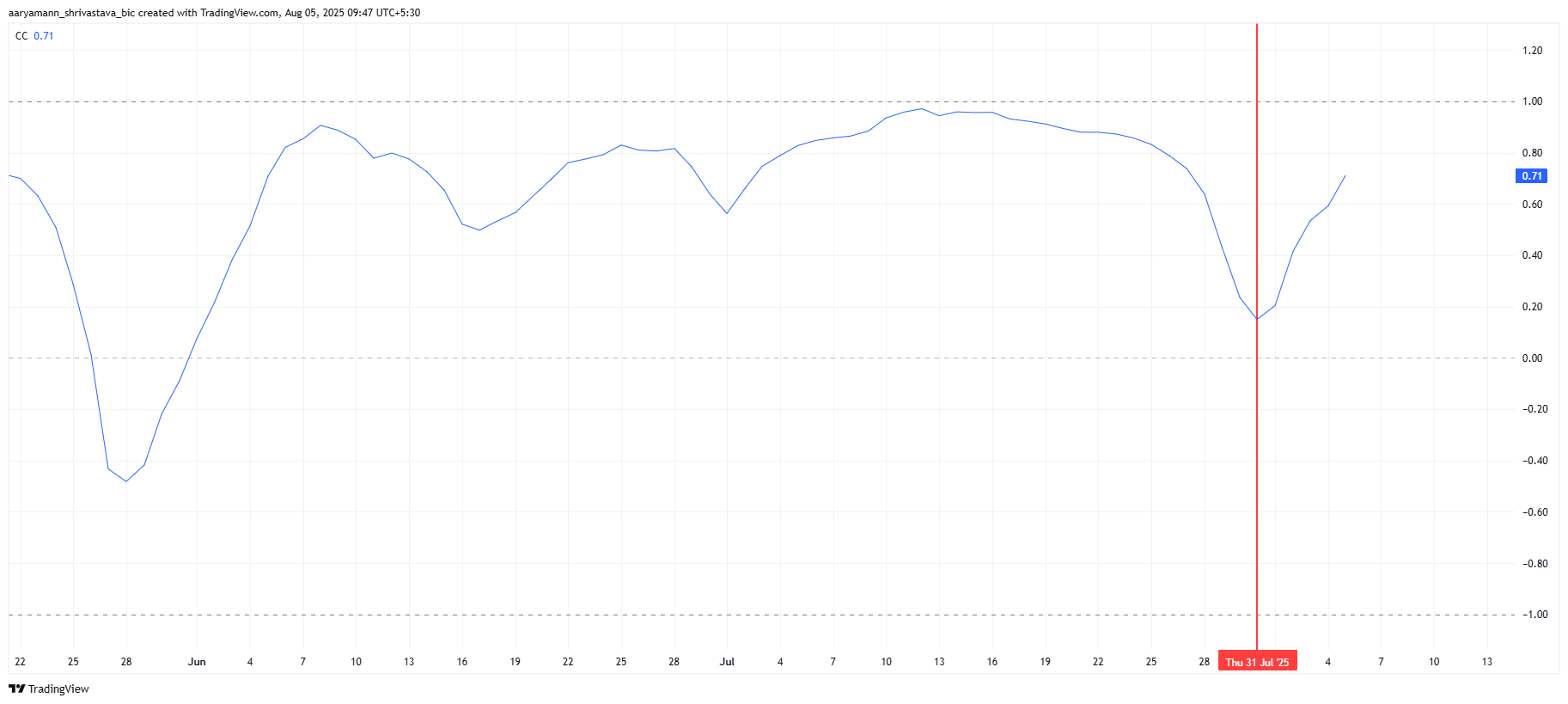

HBAR’s correlation with Bitcoin has surged significantly, from 0.19 to 0.71 in just five days. This sharp increase suggests that HBAR is now more likely to follow Bitcoin’s price movements.

HBAR Liquidation Map. Source:

HBAR’s correlation with Bitcoin has surged significantly, from 0.19 to 0.71 in just five days. This sharp increase suggests that HBAR is now more likely to follow Bitcoin’s price movements.

If Bitcoin successfully breaks the $115,000 resistance and holds it as support, HBAR may see a continued rise as well. This could provide the necessary momentum for HBAR to breach its resistance levels and recover some of its recent losses.

HBAR Correlation To Bitcoin. Source:

HBAR Correlation To Bitcoin. Source:

HBAR Price Is Looking For a Bounce

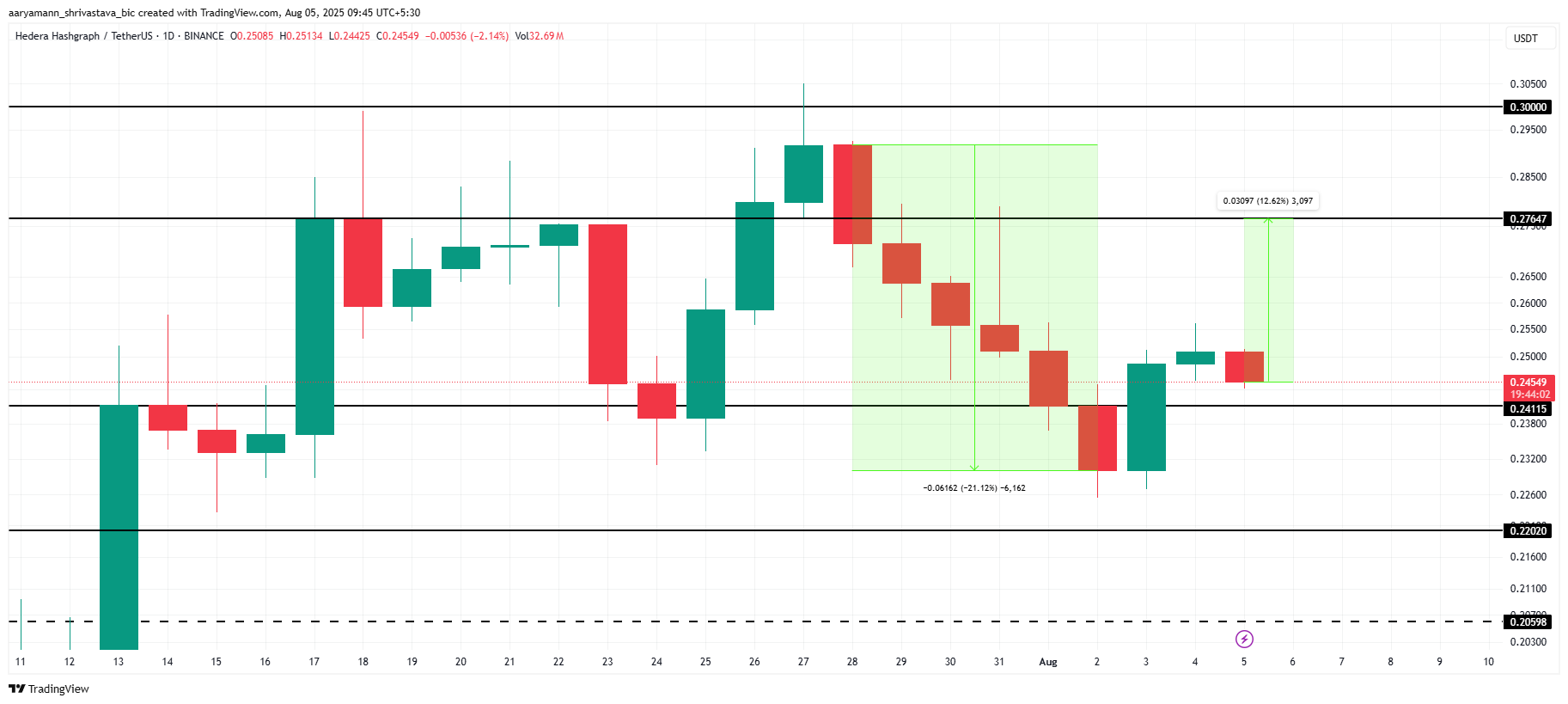

HBAR is currently trading at $0.245, sitting 12.6% below its next major resistance level of $0.276. Breaking this resistance is essential for HBAR to recover the 21% loss it incurred at the end of July.

If HBAR can secure the $0.241 support level, it would be poised to push towards $0.276. This would open the door for further price appreciation and potentially trigger the liquidation of short positions.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

However, if HBAR fails to maintain support at $0.241 and market sentiment remains weak, the price could continue its downward trend. A fall below $0.241 would suggest a further decline, with the next support at $0.220, invalidating the bullish outlook and shifting the focus to potential further losses.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Do Kwon Wants Lighter Sentence After Admitting Guilt

Bitwise Expert Sees Best Risk-Reward Since COVID

Stellar (XLM) Price Prediction: Can Bulls Push Toward $0.30 in December?

21Shares XRP ETF Set to Launch on 1 December as ETF Demand Surges