ENA Rally Fades as Negative Funding Rates Point to Further Losses

ENA's recent rally is at risk, as negative market signals, including a declining BoP and negative funding rates, suggest a possible drop to $0.48.

Ethena’s ENA token has shed 3% in the past 24 hours, mirroring the broader crypto market’s decline as bearish sentiment gains momentum.

The drop comes just a few days after the token posted strong gains, with traders now gearing for a potential reversal that could erase all of its recent rally.

ENA Slumps as Sellers Seize Momentum

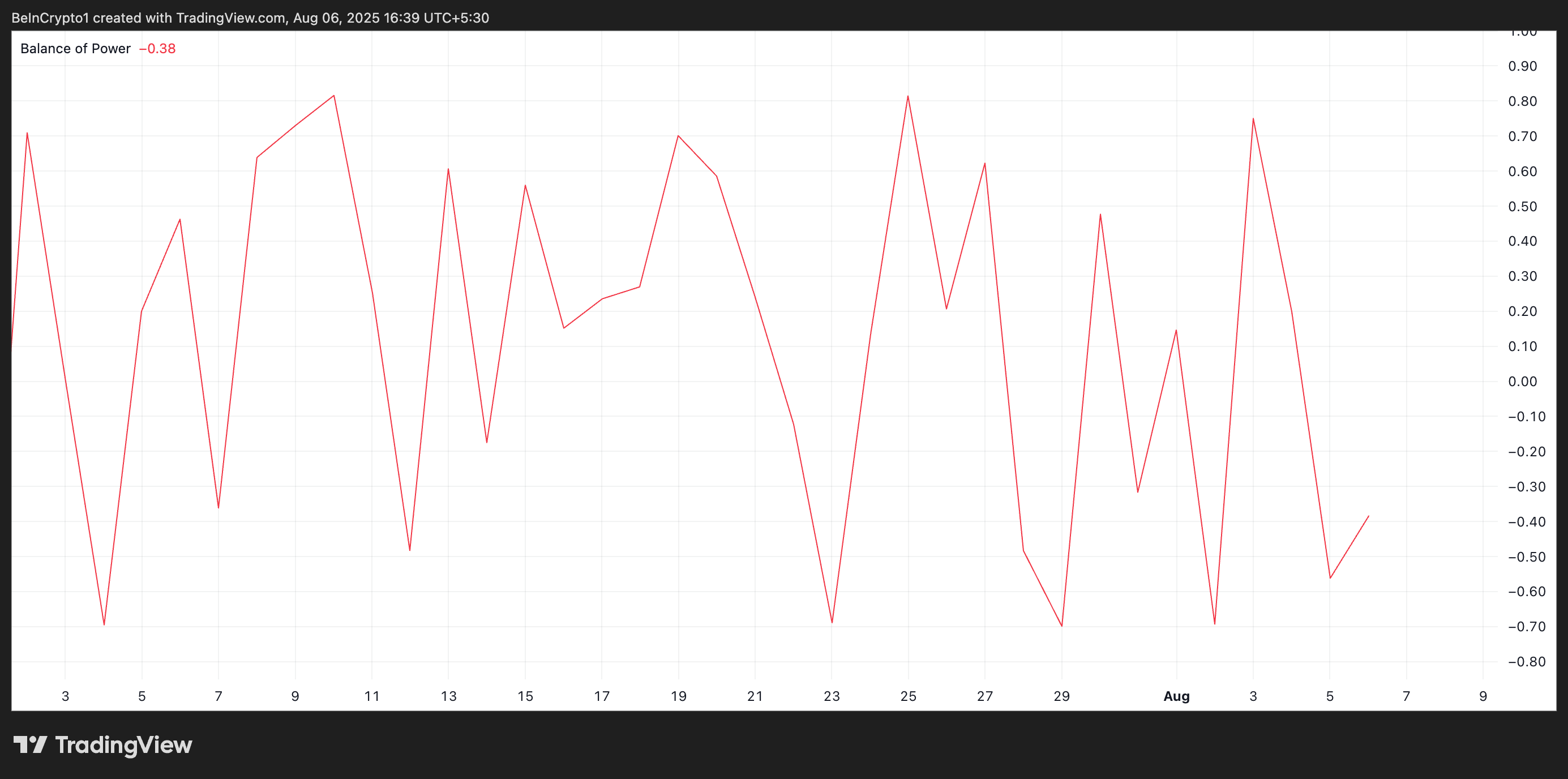

Readings from the ENA/USD one-day chart confirm the bearish tilt in market sentiment. For example, the token’s Balance of Power (BoP) has turned negative, signaling that selling pressure outweighs buying interest. As of this writing, the metric stands at -0.38, indicating negative bias.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

ENA BoP. Source:

TradingView

ENA BoP. Source:

TradingView

The BoP measures the strength of buyers versus sellers in the market, showing whether bulls or bears are in control over a given period. A negative BoP reading means selling pressure dominates, with sellers pushing prices lower despite buying attempts.

For ENA, this confirms that bears have seized momentum, increasing the likelihood of further downside.

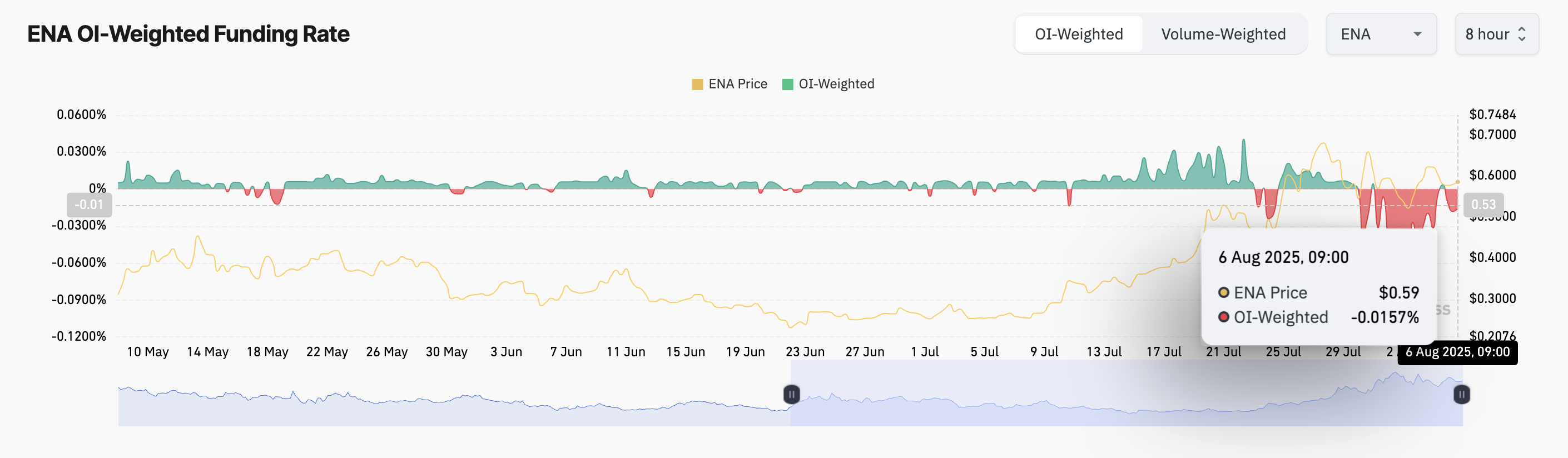

Furthermore, ENA’s negative funding rates across derivatives markets suggest that short positions dominate, strengthening the bearish outlook. At press time, this is at -0.0157.

ENA Funding Rate. Source:

Coinglass

ENA Funding Rate. Source:

Coinglass

The funding rate is a periodic payment exchanged between traders in perpetual futures contracts to keep contract prices aligned with the spot market. When the funding rate is negative, short sellers are paying long traders, indicating that most market participants are betting on a price decline.

For ENA, the negative funding rate highlights that bearish sentiment is dominant in derivatives markets, adding weight to expectations of further losses.

$0.41 or $0.64 Could Be Next

At press time, ENA trades at $0.5637, hanging above the support floor formed at $0.4832. If demand fades further, the bulls may struggle to defend this price level, giving way to a deeper decline toward $0.4140.

ENA Price Analysis. Source:

TradingView

ENA Price Analysis. Source:

TradingView

On the other hand, if buying activity resumes, it could trigger a spike to $0.6451.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Danny Ryan: Wall Street needs decentralization more than you think, and Ethereum is the only answer

A former Ethereum Foundation researcher provided an in-depth analysis at the Devconnect ARG 2025 conference, exploring how eliminating counterparty risk and building Layer 2 solutions could support 120 trillion USD in global assets.

Ethereum’s New Interop Layer Aims to Reunify L2s and Reshape Cross-Chain Activity

OCC Clarifies Banks Can Hold Crypto for Network Fees