DEXE Dominates Daily Gains as All Eyes Turn to Key Breakout Zone

DEXE leads the crypto market in daily gains, with traders betting on continued upside as momentum builds and resistance levels are tested.

DEXE, the native token of DeXe Protocol, an open-source platform for creating and managing decentralized autonomous organizations (DAOs), is today’s top-performing crypto asset, surging nearly 10% in the past 24 hours.

This performance comes as the broader crypto market shows signs of recovery, lifting overall sentiment. If the current momentum holds, it could strengthen the bullish bias toward DEXE and pave the way for further short-term gains.

Traders Bet Big on DEXE

Readings from the DEXE/USD one-day chart show that the altcoin has consistently moved higher since August 3. Trading at $8.31 at press time, its value has since climbed by 15%, with key momentum indicators hinting at strengthening buy-side pressure.

For example, DEXE’s double-digit rally has pushed its price above the Leading Span A (green) and Span B (yellow) of its Ichimoku Cloud.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

DEXE Ichimoku Cloud. Source:

TradingView

DEXE Ichimoku Cloud. Source:

TradingView

As of this writing, the Leading Spans A and B have flipped into dynamic support levels at $7.64 and $7.21, respectively, which may serve as crucial floors for DEXE’s price in the coming sessions.

When an asset trades above its Ichimoku Cloud, it signals a strong bullish trend and upward momentum. It indicates positive market sentiment, and the asset may continue rising if it holds above that support zone.

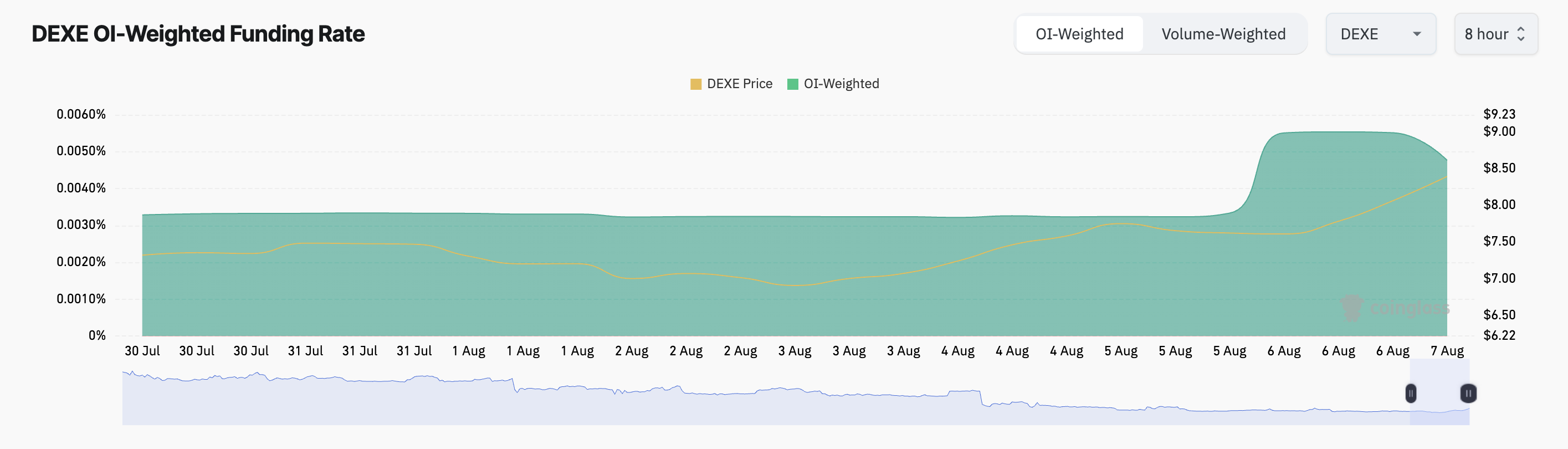

Furthermore, in the derivatives market, DEXE’s funding rate has remained positive since July 20, highlighting growing confidence among futures traders. At press time, this is at 0.0048%.

DEXE Funding Rate. Source:

Coinglass

DEXE Funding Rate. Source:

Coinglass

The funding rate is a recurring fee exchanged between long and short traders in perpetual futures contracts. It is designed to keep the contract price in line with the spot market.

When it is positive, long traders dominate the market and are paying those who hold short positions, indicating bullish market sentiment.

DEXE’s consistently positive funding rate indicates that traders remain firmly bullish on the token, maintaining their conviction even amid broader market volatility.

Will $9.04 Crack or Will $6.73 Come First?

DEXE currently hangs below the resistance at $9.04. If demand soars and bullish bias increases, a breach of this level is possible in the near term. If this happens, the token’s price could rally toward $9.45.

DEXE Price Analysis. Source:

TradingView

DEXE Price Analysis. Source:

TradingView

Converesly, if the bears regain dominance, they could trigger a DEXE price dip to $6.73.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x UAI: Trade futures to share 200,000 UAI!

New spot margin trading pair — KITE/USDT, MMT/USDT!

STABLEUSDT now launched for pre-market futures trading

The transaction fees for Bitget stock futures will be adjusted to 0.0065%