Trump signs executive order allowing 401(k) plans to include digital assets

Quick Take Thursday’s executive order marks the latest in multiple that Trump has signed since his inauguration in January. The order also directed federal agencies, such as the SEC, to do their part.

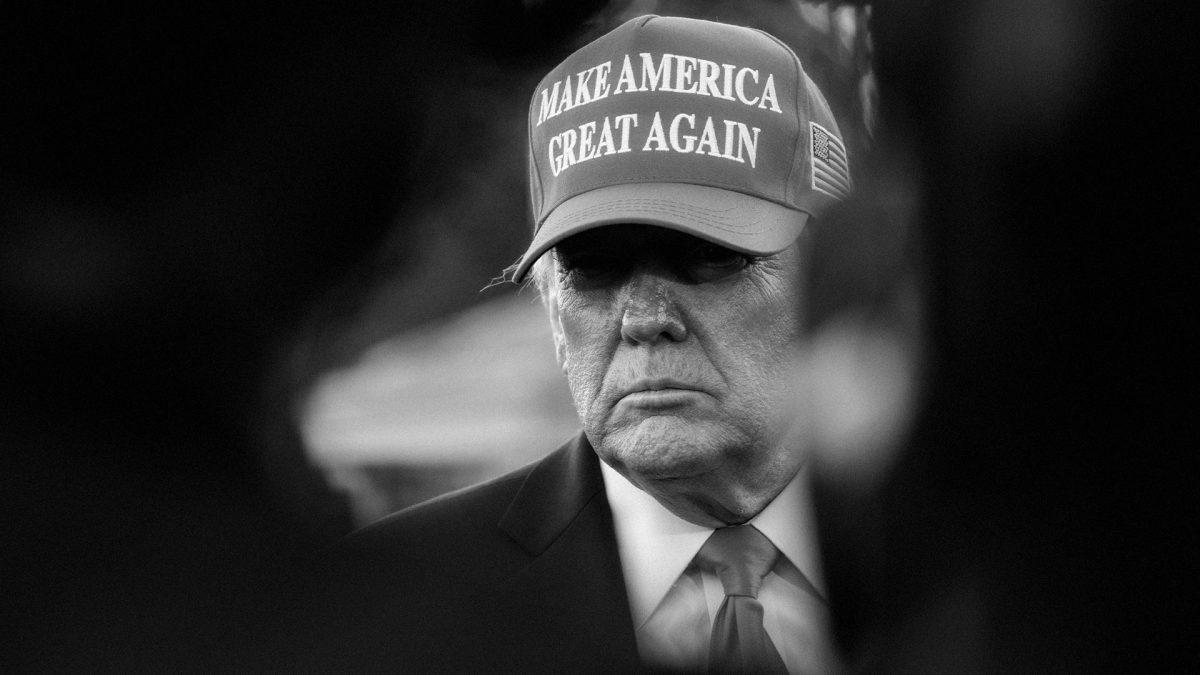

President Donald Trump signed an executive order on Thursday that directs the Labor Department to pave the way for cryptocurrency, private equity, and other alternative assets to be offered in 401(k) retirement plans.

The news , first reported by Bloomberg , would direct the Labor Department, Securities and Exchange Commission, the Treasury Secretary, and others to carry out the order.

"The SEC shall, in consultation with the Secretary, consider ways to facilitate access to investments in alternative assets by participants in participant-directed defined-contribution retirement savings plans," according to the order. "Such facilitation may include, but not be limited to, consideration of revisions to existing SEC regulations and guidance relating to accredited investor and qualified purchaser status, to accomplish the policy objectives of this order."

Thursday's executive order marks the latest in multiple that Trump has signed since his inauguration. In January, Trump signed an executive order promoting U.S. leadership in crypto, which later resulted in a 168-page report outlining recommendations for how crypto should be regulated. Trump has also signed an executive order creating a strategic bitcoin reserve and digital asset stockpile.

Gerry O'Shea, head of global market insights at Hashdex, called the executive order a sign that the Trump administration is continuing to focus on giving investors access to digital assets.

"This moment presents an opportunity for 401(k) plan sponsors to engage in thoughtful dialogue with digital asset investment experts around appropriate exposure levels and product innovation, ensuring this asset class is introduced to retirement strategies in a prudent and constructive way," O'Shea said in a statement.

Under the Biden administration, the Labor Department raised concerns around the idea that crypto can produce outsized returns and cautioned that it could cloud investors' judgment and attract inexperienced investors.

Later, during the Trump administration, the Labor Department reversed guidance discouraging retirement managers from considering crypto as an investment option in 401(k) plans.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services