Ether (ETH) has surged to $4,000 for the first time in eight months, marking a significant milestone for ETH bulls and indicating a shift in market dynamics as Bitcoin’s dominance declines.

-

Ether reached $4,012 on Bitstamp, gaining 1.7% in a day.

-

ETH’s market cap is increasing as it captures a larger share from Bitcoin.

-

Analysts predict Bitcoin may experience a short-lived rebound, but its dominance is under threat.

Ether hits $4,000 for the first time in eight months, signaling a shift in market dynamics as Bitcoin’s dominance fades. Discover the latest insights!

| ETH Price | $4,012 | Up 1.7% in 24 hours |

What is the significance of Ether reaching $4,000?

Ether’s surge to $4,000 is a pivotal moment, indicating strong bullish sentiment among investors. This price point represents a key psychological level and a potential catalyst for further gains in the crypto market.

How does this impact Bitcoin’s market dominance?

As Ether gains traction, Bitcoin’s market dominance is declining, falling below 60.7%. Analysts suggest this trend may continue, with Bitcoin potentially facing a long-term downtrend in dominance.

Frequently Asked Questions

What factors contributed to Ether’s price increase?

Ether’s price increase is attributed to strong investor sentiment, significant whale purchases, and a growing preference for ETH over Bitcoin.

Will Bitcoin’s dominance recover?

While some analysts believe Bitcoin could rebound, the overall trend suggests a decline in dominance is likely, as altcoins gain popularity.

Key Takeaways

- Ether’s milestone: Surged to $4,000, marking a significant bullish trend.

- Market dynamics: Bitcoin’s dominance is declining as ETH gains market share.

- Future outlook: Analysts predict potential further gains for Ether amidst ongoing investor interest.

Conclusion

Ether’s rise to $4,000 highlights a significant shift in the crypto landscape, with increasing investor interest in ETH and a potential decline in Bitcoin’s market dominance. As the market evolves, staying informed on these trends is crucial for investors.

-

Ether taps $4,000 for the first time in eight months, marking a significant milestone for ETH bulls amid declining Bitcoin dominance.

-

ETH price optimism continues with Ether taking chunks away from Bitcoin’s crypto market cap dominance.

-

BTC could still stage a fresh but short-lived rebound, analysis says.

Ether (ETH) returned to $4,000 for the first time in eight months Friday as Bitcoin (BTC) shed its crypto market cap share.

ETH/USD one-hour chart. Source: Cointelegraph/TradingView

Ether in “reaccumulation zone” as bulls surge to $4,000

Data from Cointelegraph Markets Pro and TradingView showed ETH/USD reaching $4,012 on Bitstamp.

Gaining around 1.7% on the day, the pair made history for 2025 by breaching the key psychological level, now under $900 from new all-time highs.

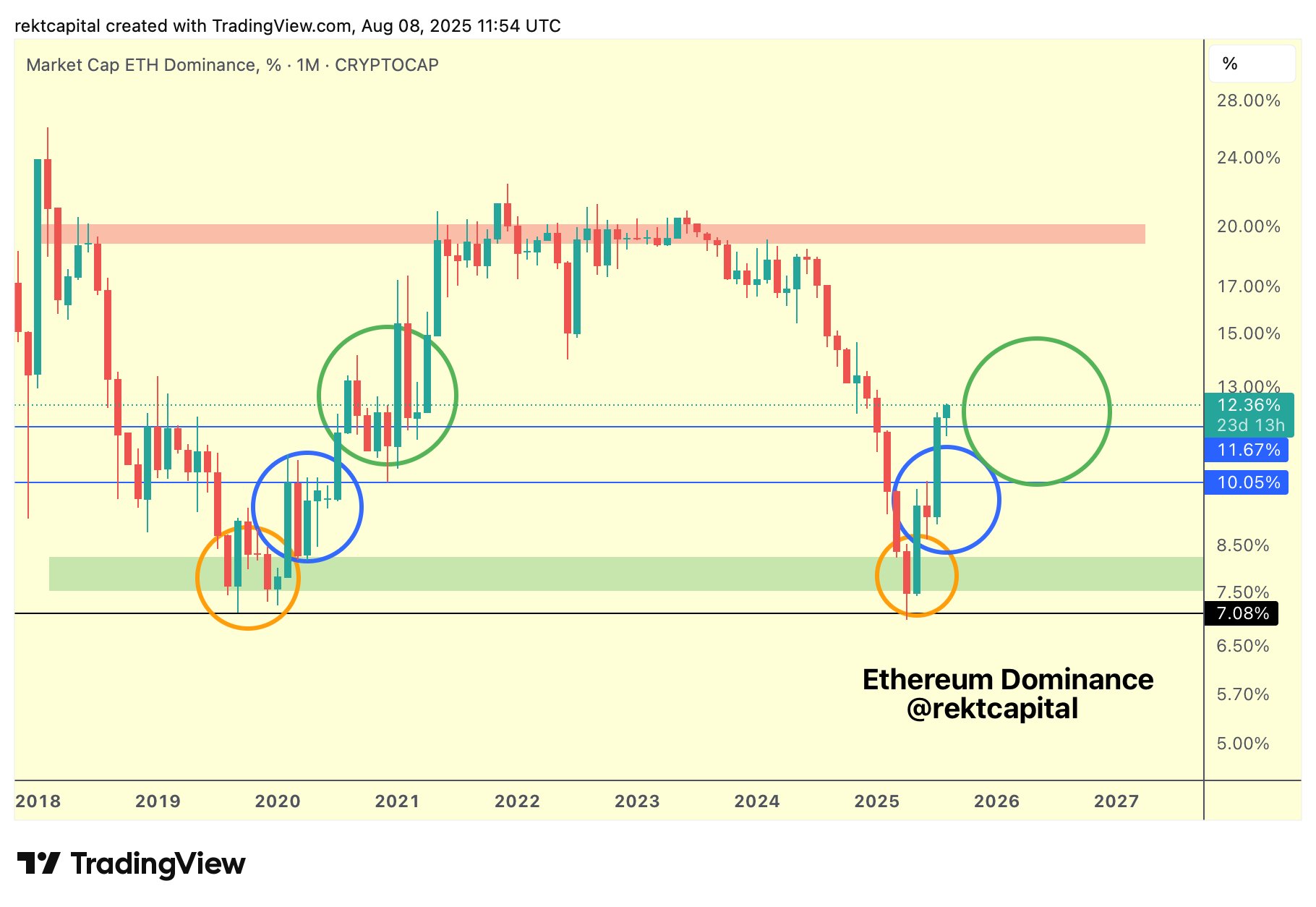

Reacting, popular trader and analyst Rekt Capital was among those eyeing Ether’s increasing slice of the total crypto market cap.

“Ethereum Dominance is already ~50-60% of the way in its Macro Uptrend,” he calculated in an X post.

An accompanying chart compared current price action to the previous ETH bull run through 2021.

Ether crypto market cap dominance one-month chart. Source: Rekt Capital/X

Others noted the ongoing investor preference for Ether over BTC, with popular trader Cas Abbe summarizing recent large-scale purchases.

Analytics resource Lookonchain meanwhile tracked whale transactions, seemingly aiming to capitalize on Ether’s relative strength.

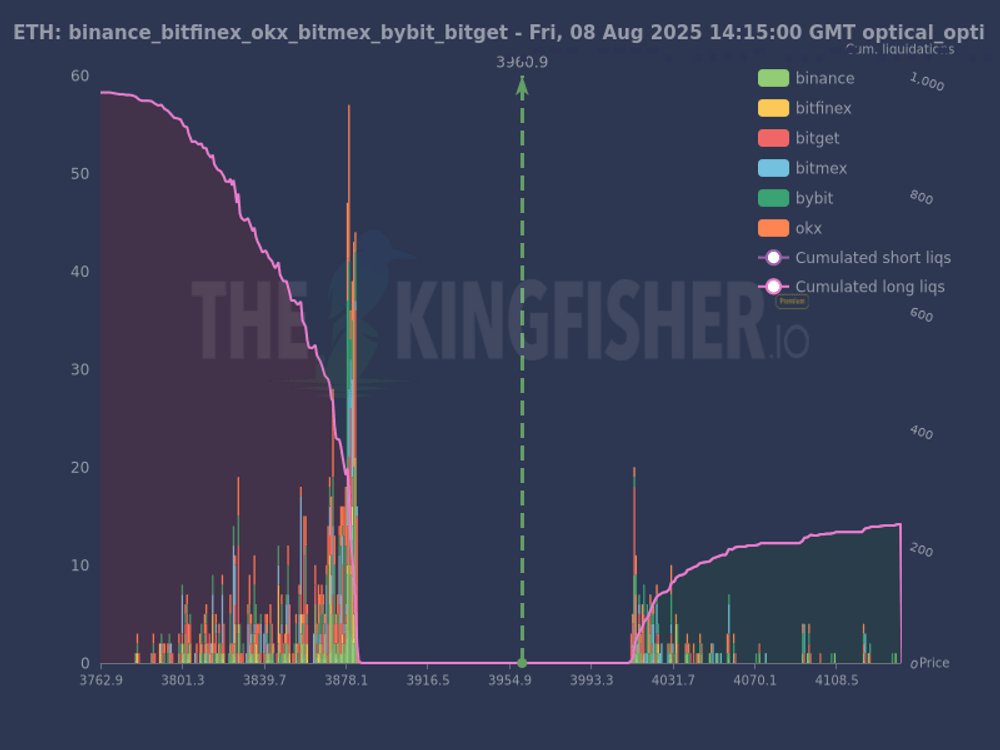

Exchange order book data, featuring a “massive wall of long liquidations” beneath $3,960 meanwhile got X account TheKingfisher primed for further ETH price upside.

“This is what smart money hunts,” part of accompanying X commentary read.

“Most traders see a dump, we see a re-accumulation zone waiting to get fueled.”

ETH exchange order-book liquidity chart. Source: TheKingfisher/X

Bitcoin dominance faces “inevitable” decline

The moves feed into an existing struggle for supremacy from altcoins, which has seen Bitcoin’s market cap dominance slide rapidly.

Bitcoin’s share fell below 60.7% on the day, again dicing with a critical support level.

In further X analysis, Rekt Capital said that while dominance could still rebound to traditional peak levels around 70%, its eventual breakdown was “inevitable.”

“And once that long-term technical uptrend is lost, BTC Dominance will transition into a long-term technical downtrend,” he forecast.

“And the long-term downside target would be a crash down into the low ~40%, maybe high 30% region.”

Bitcoin crypto market cap dominance one-day chart. Source: Cointelegraph/TradingView