BlackRock has confirmed it has no immediate plans to apply for XRP or Solana ETFs, focusing instead on Bitcoin and Ethereum, which impacts market sentiment.

-

BlackRock denies immediate plans for XRP and SOL ETFs.

-

Speculation affects altcoin market sentiment significantly.

-

BTC and ETH remain the primary assets for ETF applications.

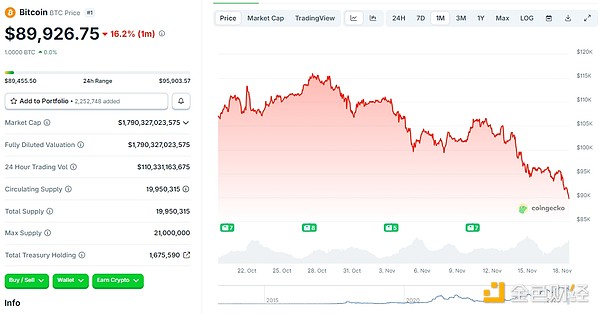

BlackRock has confirmed no immediate plans for XRP or Solana ETFs, focusing on Bitcoin and Ethereum. This decision impacts market sentiment significantly.

BlackRock Confirms No Immediate XRP, SOL ETF Plans

BlackRock has confirmed there are no immediate plans to apply for Solana or XRP ETFs, focusing on Bitcoin and Ethereum, following recent regulatory developments and market speculation.

BlackRock’s ETF Strategy

BlackRock, a leading investment firm, has officially announced that it has no plans to file for exchange-traded funds related to Solana or XRP. This announcement follows widespread market speculation and legal developments connected to Ripple and the SEC. Without immediate plans for XRP or Solana ETFs, BlackRock reaffirms its focus on Bitcoin and Ethereum products. Notably, BlackRock executives have not personally commented, but their statement addresses persistent speculation in the crypto market. A BlackRock spokesperson remarked, “No plans to submit applications for either [XRP or Solana] product at this time.”

Market Impact and Focus

The news impacts Solana and XRP, removing potential catalysts from upcoming ETF announcements. BTC and ETH remain the only U.S.-listed spot crypto ETF assets. As such, no new institutional funding impacts these altcoins at this time. BlackRock’s focus on Bitcoin and Ethereum underscores its strategic direction amid U.S. regulatory clarity. Market observers anticipated potential altcoin ETF filings, but this announcement clarifies the current scope of BlackRock’s institutional interest.

Speculation and Analysis

The ongoing speculation influences market sentiment but does not affect institutional ETF strategies. BlackRock’s statement confirms that near-term institutional product launches for these cryptocurrencies remain unplanned. Historically, the launch of Bitcoin and Ethereum spot ETFs led to significant market inflows. Expert analysts, such as Eric Balchunas, predict future altcoin ETF approvals, but current conditions prioritize established assets, highlighting ongoing market transformations. Balchunas noted, “Bloomberg analysts say that there is a 95% chance that the SEC will approve the pending XRP ETF applications this year.”

Frequently Asked Questions

What are the implications of BlackRock’s decision on XRP and SOL?

BlackRock’s decision to not pursue XRP and SOL ETFs removes potential market catalysts, impacting investor sentiment and expectations for these altcoins.

How does this affect Bitcoin and Ethereum?

Bitcoin and Ethereum remain the primary focus for BlackRock, ensuring that these assets continue to attract institutional interest and investment.

Key Takeaways

- No immediate XRP or SOL ETFs: BlackRock is prioritizing Bitcoin and Ethereum.

- Market sentiment affected: The announcement impacts altcoin expectations significantly.

- Future ETF approvals: Analysts predict potential future approvals for altcoin ETFs but focus remains on established assets.

Conclusion

In summary, BlackRock’s confirmation of no immediate plans for XRP and Solana ETFs emphasizes its strategic focus on Bitcoin and Ethereum. This decision shapes market sentiment and investment dynamics, highlighting the ongoing evolution in the crypto landscape.

![[Bitpush Daily News Selection] Strategy increased its holdings by purchasing 8,178 bitcoins last week at an average price of $102,171; CBOE will launch continuous futures contracts for bitcoin and ethereum on December 15; Federal Reserve Governor Waller: Supports risk-management rate cuts in December](https://img.bgstatic.com/multiLang/image/social/8ce218bf9e396bdadfada2b4ef95f3111763451361931.png)