XRP Volatility Might be Fading – Downside Break or Rally Ahead?

XRP is trading in a narrow range between $3.22 and $3.30 after its early August rally, with falling volatility and weakening bullish signals pointing to a possible downside break. A move below $3.22 could send prices to $2.99, while a push above $3.33 may revive bullish momentum toward $3.66.

XRP’s market momentum has slowed since Friday, with trading activity cooling and price action moving sideways.

The token, which had seen modest movement earlier in the week, now shows signs of reduced volatility and weakening demand, raising concerns about a potential bearish shift.

XRP Trading Flatlines, But Sellers Could Soon Take Control

Readings from the XRP/USD one-chart show that the altcoin has trended within a narrow range over the past three trading sessions. Since Friday, XRP has faced resistance at $3.30 and found support at $3.22.

This follows a four-day rally between August 3 and 7, during which the token surged by 20%. The current sideways trend indicates reduced market volatility, reflecting a relative balance between buying and selling pressure.

In such phases, the market is often in a “wait-and-see” mode, with traders anticipating a catalyst to determine the next price move.

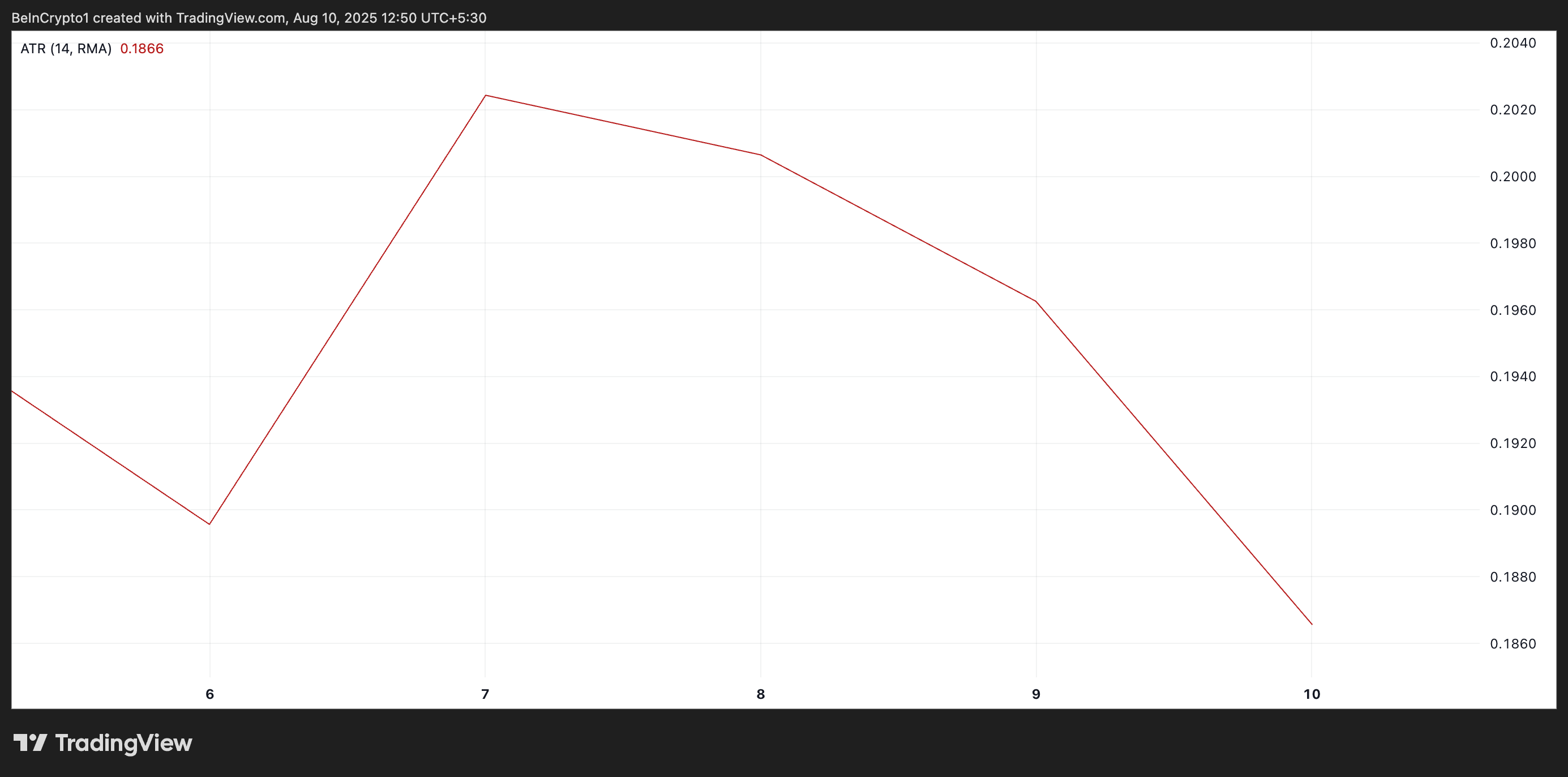

The decline in volatility is evident in XRP’s Average True Range (ATR), which has dropped by 10% since August 7. The ATR measures the degree of price fluctuation over a set period, and a falling ATR signals calmer market conditions with less volatility.

XRP Average True Range. Source:

TradingView

XRP Average True Range. Source:

TradingView

While periods of low volatility suggest market stability, it can also mean traders are becoming less active, often a precursor to a sharp breakout in either direction.

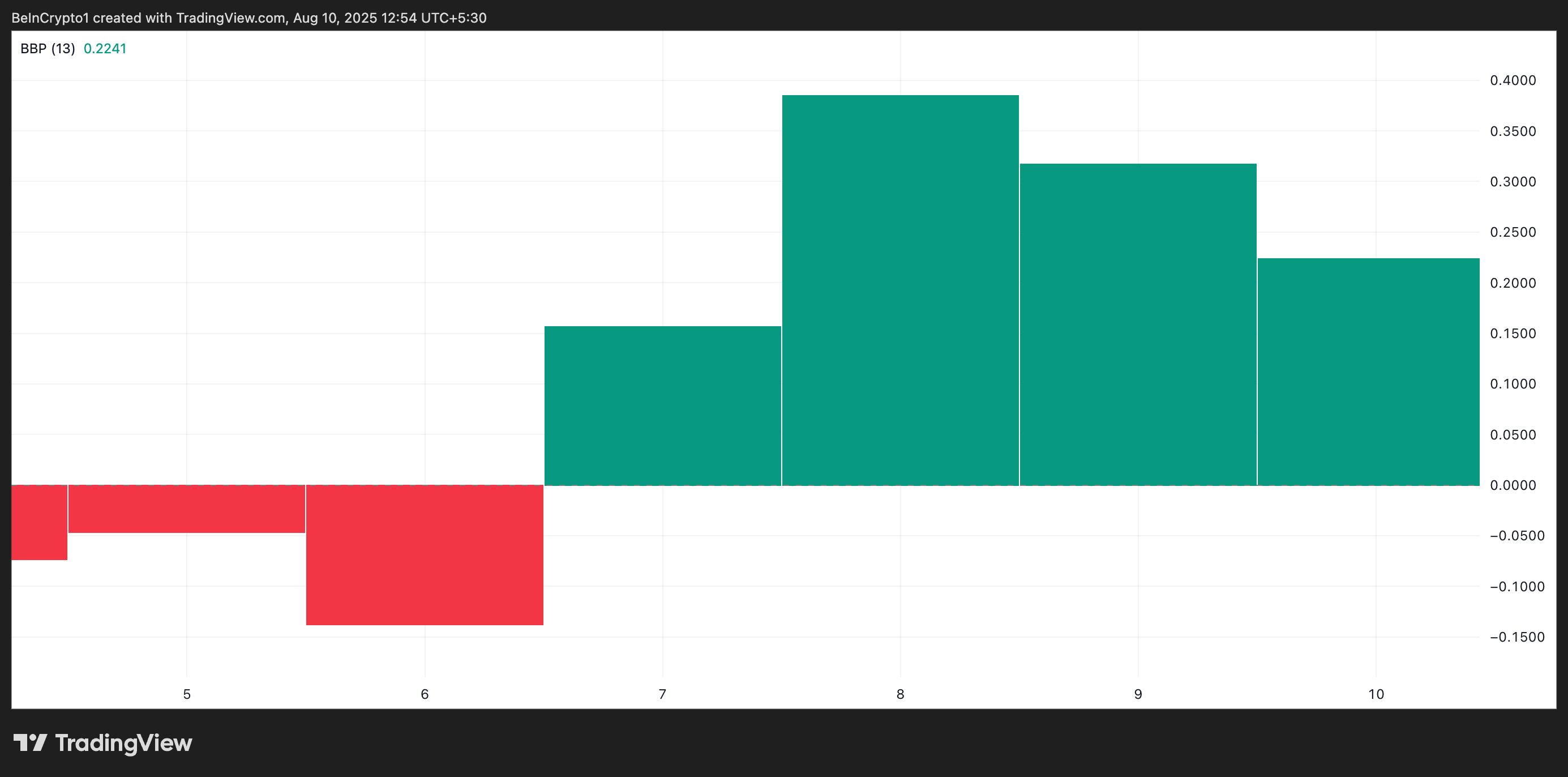

Furthermore, XRP’s Elder-Ray Index strengthens the case for a potential bearish breakout. This indicator measures the strength of buyers (bull power) and sellers (bear power) by comparing price movements against a moving average.

On XRP’s daily chart, the Elder-Ray Index has been posting green histogram bars, representing bullish strength, that have steadily diminished in size over the past few days.

XRP Elder-Ray Index. Source:

TradingView

XRP Elder-Ray Index. Source:

TradingView

This contraction points to a loss of buying momentum and creates an opening for sellers to assert control and drive XRP’s price lower.

XRP Faces Make-or-Break Moment Between $3.22 and $3.66

Strong sell-side pressure could trigger a break below support at $3.22. If this happens, XRP’s price could deepen its decline and fall to $2.99.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, XRP could push above the price wall at $3.33 if new demand resurfaces. A successful breakout could open the door for a rally toward $3.66.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

OracleX Global Public Beta: Restructuring Prediction Market Incentive Mechanisms with "Proof of Behavior Contribution"

OracleX is a decentralized prediction platform based on the POC protocol. It addresses pain points in the prediction market through a dual-token model and a contribution reward mechanism, aiming to build a collective intelligence decision-making ecosystem. Summary generated by Mars AI The content of this summary is produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Bitcoin is not "digital gold"—it is the global base currency of the AI era

The article refutes the argument that bitcoin will be replaced, highlighting bitcoin's unique value as a protocol layer, including its network effects, immutability, and potential as a global settlement layer. It also explores new opportunities for bitcoin in the AI era. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

Bitcoin 2022 bear market correlation hits 98% as ETFs add $220M

Fed rate-cut bets surge: Can Bitcoin finally break $91K to go higher?