Crypto News Today: Bitcoin, Ethereum, and White House Shake-Up

The $crypto market is seeing renewed volatility as $Bitcoin rebounds above $118,000 and $Ethereum holds near $4,200 after recent highs. In a political twist, Bo Hines, White House crypto adviser to President Donald Trump, has announced his resignation — a move that could shift the administration’s digital asset policy.

Bitcoin Holds Above $118K

After dipping to $112,600 earlier this week, Bitcoin ($ BTC ) has bounced back, currently trading just above $118,000. The recovery follows a consolidation phase and renewed buying interest near major support levels. Analysts suggest the next hurdle lies at $120,000, where strong resistance could decide the next market direction.

BTC/USD 4-hours chart - TradingView

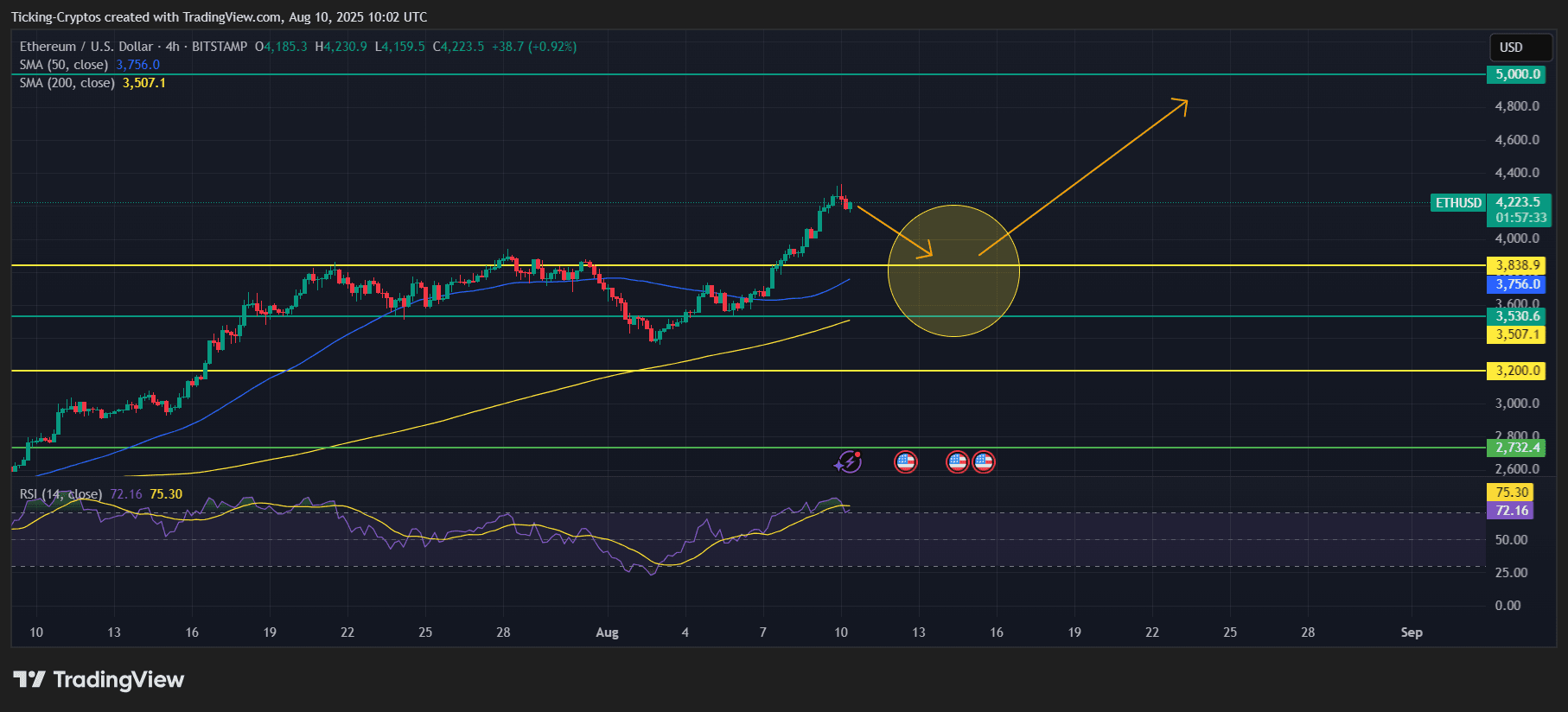

Ethereum Corrects After Breaking $4,300

Ethereum ($ ETH ) briefly broke the $4,300 level, signaling strong bullish momentum, before a minor pullback brought it to around $4,200. While the correction is seen as healthy, traders are closely watching whether $4,000 holds as a key support in the coming days. A sustained bounce from this level could set up a push toward $5,000.

ETH/USD 4-hours chart - TradingView

White House Adviser Bo Hines Steps Down

Bo Hines, who chaired the Council of Advisers on Digital Assets under the Trump administration, confirmed his departure on Saturday, saying he will return to the private sector. Late last month, Hines led a cryptocurrency working group that outlined the administration’s stance on digital asset regulation, urging the SEC to draft specific rules for the sector. His resignation raises questions about continuity in U.S. crypto policy.

Crypto Market Outlook

The market remains cautiously bullish, with Bitcoin, Ethereum, and several altcoins holding above key support zones. However, political developments and macroeconomic conditions could spark volatility ahead. Traders are advised to monitor both price action and policy headlines closely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: Fundraising Explodes by +150% in One Year

Bitcoin Drops $8B In Open Interest : Capitulation Phase ?

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025