Bitcoin Rebound Holds $116K but Faces Fragile Zone, Warns Glassnode

Bitcoin’s record-breaking rally above $123,000 in mid-July has given way to a choppy and uncertain phase. The price has slipped to $116,191 as of press time, showing minimal change over the past 24 hours but up 0.65% over the week.

In Brief

- Bitcoin enters thin liquidity gap, facing resistance near $116,900 amid slowdown.

- Short-term holder profitability slips to 70%, signaling cooling but steady sentiment.

- Cost basis at $106K remains supportive, aligning with historical bull market patterns.

Liquidity Gap and Emerging Resistance

More notably, the pullback has pushed BTC into a thinly traded “air gap” between $110,000 and $116,000 , an area where few coins have historically changed hands. This lack of liquidity leaves the market vulnerable to sharper swings, yet it may also present accumulation opportunities for patient buyers.

According to Glassnode data, the decline from the all-time high has left many new investors holding coins purchased above $116,000 . This cluster of supply has become a significant overhead barrier.

Attempts to reclaim it have so far failed, with $116,900 now acting as a decisive resistance level. Unless demand strengthens enough to break this threshold, Bitcoin risks drifting toward the lower bound of the gap near $110,000.

Still, some buyers have stepped in. Data from late July to early August shows roughly 120,000 BTC acquired after the drop to $112,000.

This rebound pushed prices beyond $114,000, indicating restrained buy-the-dip activities. The turnover in this price range is, however, quite thin, so very active buying would be essential to develop a solid foundation to take the next step up.

Investor Sentiment and Profitability Shifts

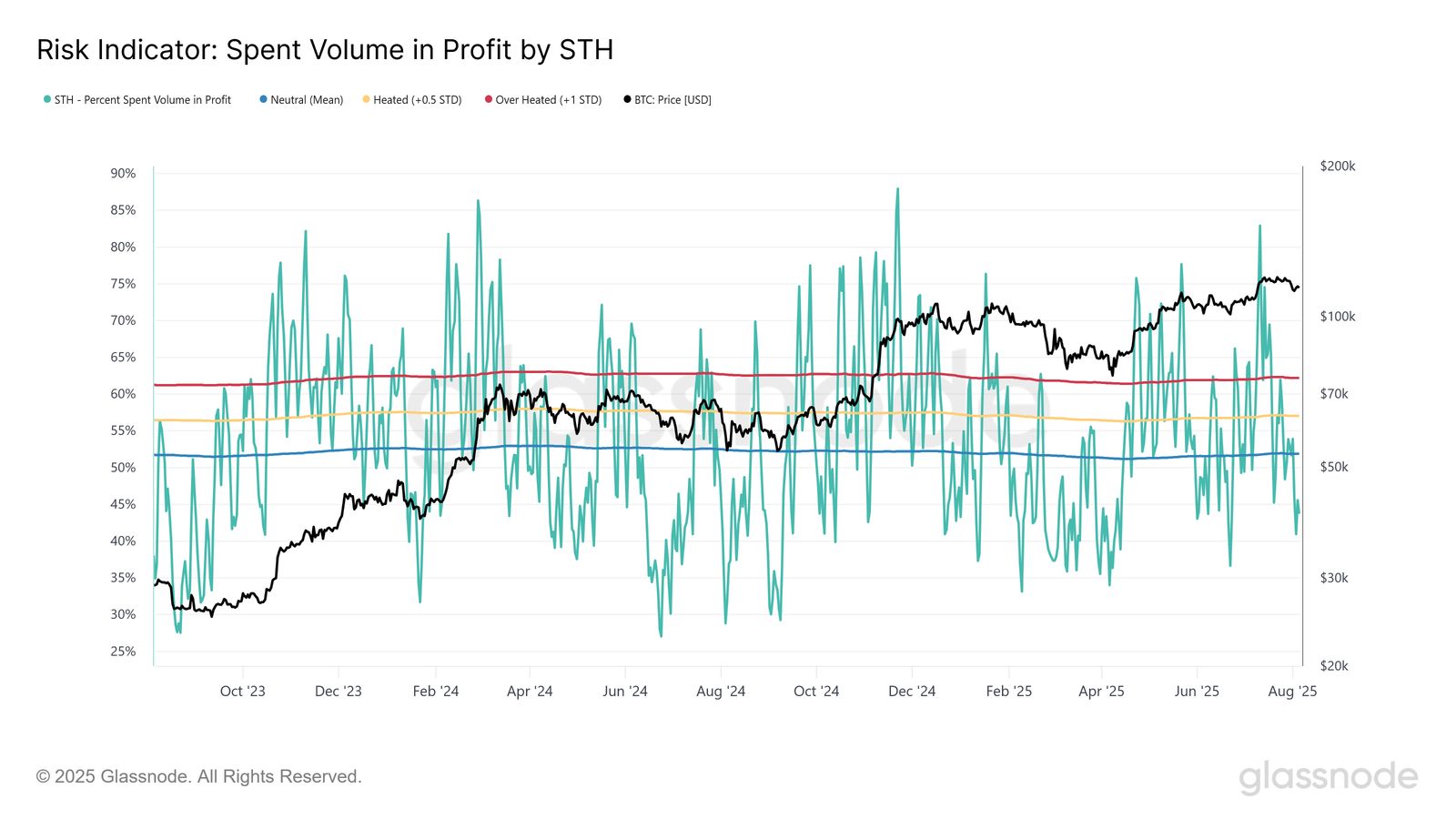

Short-term holder (STH) profitability has cooled from 100% to about 70%, a typical mid-line in prior bull runs. While this pullback hasn’t triggered panic selling, confidence could weaken if more coins slip into loss. Interestingly, the share of STH coins being sold for profit has dropped to 45%, below neutral levels, suggesting a balanced market mood.

Additionally, the short-term holder cost basis remains at $106,000, comfortably below the current price. Historically, holding above this line has aligned with continued bull market conditions, even after sharp corrections.

Bitcoin ETF Outflows and Futures Cooling

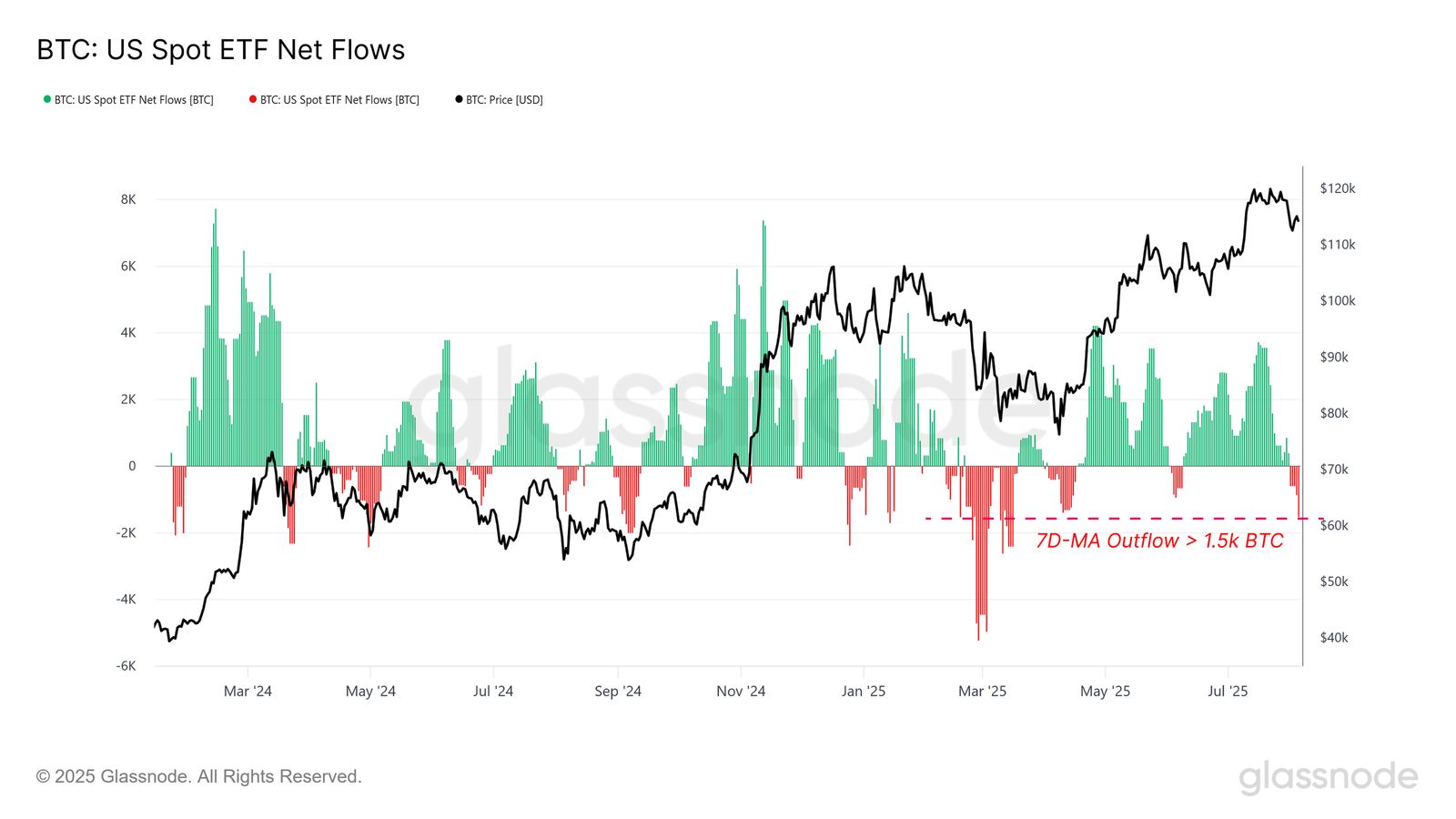

Extraneous demand signals indicate a degree of weakness. On August 5, BTC ETFs recorded a netted outflow of 1,500 BTC, which was the largest since April. Despite these instances being relatively short-lived, prolonged withdrawals may indicate a larger change of sentiment.

Less enthusiasm is also evident in futures markets. In perpetual swaps, funding rates have dropped below 0.1%, meaning that the bulls are less eager to pay a premium on leverage. This indicates a more conservative approach by speculative traders in the short run.

As a result, Bitcoin is at a critical juncture . Recovery of $116,900 might reflect new bullish strength whereas a miss of the same might signal further depreciation toward $110,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science

Mars Morning News | ETH returns to $3,000, extreme fear sentiment has passed

The Federal Reserve's Beige Book shows little change in U.S. economic activity, with increasing divergence in the consumer market. JPMorgan predicts a Fed rate cut in December. Nasdaq has applied to increase the position limit for BlackRock's Bitcoin ETF options. ETH has returned to $3,000, signaling a recovery in market sentiment. Hyperliquid has sparked controversy due to a token symbol change. Binance faces a $1 billion terrorism-related lawsuit. Securitize has received EU approval to operate a tokenization trading system. The Tether CEO responded to S&P's credit rating downgrade. Large Bitcoin holders are increasing deposits to exchanges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

The central bank sets a major tone on stablecoins for the first time—where will the market go next?

The People's Bank of China held a meeting to crack down on virtual currency trading and speculation, clearly defining stablecoins as a form of virtual currency with risks of illegal financial activities, and emphasized the continued prohibition of all virtual currency-related businesses.