Michael Saylor Dismisses Ethereum Treasury Concerns While Maintaining Bitcoin Focus

Strategy executive chairman Michael Saylor expressed no concern about growing institutional interest in Ethereum and other cryptocurrencies. The Bitcoin advocate maintained his commitment to the digital asset during a Bloomberg interview Friday.

"I think there is an explosion of innovation across the entire crypto economy," Saylor stated. He added that developments are "good for everybody in the digital asset space." According to Saylor, he remains "laser-like focused" on Bitcoin despite market changes.

Saylor noted that companies holding Bitcoin rose from 60 to 160 over six months. Strategy controls 628,791 Bitcoin worth approximately $74.15 billion. Bitcoin dominance currently stands at 60.18% of the total crypto market.

Growing Ethereum Treasury Trend Gains Momentum

The comments come as Ethereum treasury companies attracted $11.77 billion in corporate holdings. Rapid accumulation by treasury firms helped push ETH above $4,000 for the first time in eight months.

BitMine leads with 833,100 ETH worth $3.2 billion in holdings. SharpLink Gaming and The Ether Machine control $2 billion and $1.34 billion respectively. Fundamental Global filed a $5 billion shelf registration for Ethereum accumulation.

We previously reported that 15 US states moved forward with Bitcoin reserve plans, showing government interest in digital asset treasuries. Standard Chartered analysts believe Ethereum treasury firms could expand holdings to 10% of total ETH supply.

Market Competition Heats Up Between Digital Assets

Bitcoin maintains dominance despite Ethereum's corporate treasury growth reaching new heights. Analysis shows Bitcoin holding 64% market share while Ethereum captures specialized institutional use cases.

The trend reflects different investment approaches between the two assets. Bitcoin serves as digital gold for inflation protection and monetary sovereignty. Ethereum attracts companies seeking programmable smart contract functionality and staking rewards.

Institutional adoption patterns show Bitcoin appeals to treasury diversification strategies. Ethereum draws firms focused on tokenization and decentralized finance applications. Market observers expect both assets to coexist as complementary rather than competing investments.

This dual approach allows institutions to balance monetary preservation with technological innovation. The growing corporate treasury market provides legitimacy for both Bitcoin and Ethereum adoption strategies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Volatility Weekly Review

BTC Volatility Weekly Review (November 10 - 17): Key indicators (from 4:00 PM Hong Kong time on November 10 to November 17...)

Q3 earnings season: Diverging strategies among 11 Wall Street financial giants—some are selling off, while others are doubling down

Technology stocks led by Nvidia have become a key reference signal for global capital allocation strategies.

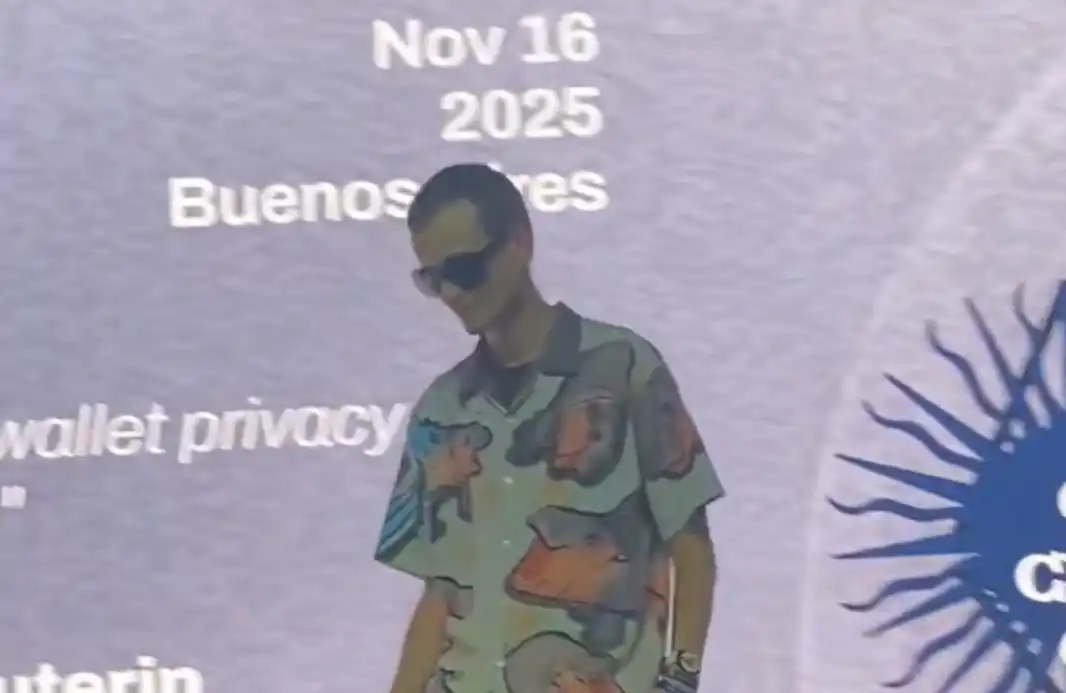

Highlights from the Ethereum Argentina Developers Conference: Technology, Community, and Future Roadmap

While reflecting on the past decade of infrastructure development, Ethereum clearly outlined its key priorities for the next ten years at the developer conference: scalability, security, privacy, and institutional adoption.

Compliance Privacy: What is Kohaku, Ethereum’s Latest Major Privacy Upgrade?

Vitalik once said, "If there is no privacy transformation, Ethereum will fail."