TRON is experiencing a significant breakout, with strong investor backing pushing its price towards a target of $1.11, indicating a potential 220% upside.

-

TRON’s breakout is fueled by years of quiet accumulation, leading to strong momentum toward the $1.11 price target.

-

Steady adoption and heavy buying are pushing TRON prices toward major new highs.

-

TRON’s growing ecosystem and market confidence are driving a rally that could redefine its standing among top cryptocurrencies.

TRON is experiencing a significant breakout, targeting $1.11 amid strong adoption and bullish momentum. This surge reflects solid investor backing.

| Current Price | $0.17 | 220% Upside to $1.11 |

What is TRON’s Current Price Target?

TRON’s current price target is $1.11, representing a potential 220% upside from its current trading price of $0.17. This bullish projection highlights the strong investor sentiment and market momentum surrounding TRON.

How is TRON Gaining Momentum?

TRON is gaining momentum due to its growing ecosystem and increasing adoption in decentralized applications. Analysts note that the recent price surge reflects both technical patterns and strong investor confidence, as institutional buying activity increases.

Frequently Asked Questions

What factors are driving TRON’s price increase?

TRON’s price increase is driven by strong investor backing, a growing ecosystem, and increased adoption in decentralized applications.

How does TRON compare to other cryptocurrencies?

TRON is gaining traction among top cryptocurrencies due to its solid performance and growing market confidence, especially as it targets significant price levels.

Key Takeaways

- TRON’s breakout is significant: The price target of $1.11 indicates strong market potential.

- Investor confidence is high: Heavy buying and adoption trends are driving the rally.

- Long-term outlook is positive: Continued innovation within TRON could lead to further price increases.

Conclusion

TRON is experiencing a notable breakout, with a price target of $1.11 reflecting strong investor sentiment and market momentum. The growing ecosystem and adoption trends suggest a bright future for TRON, making it a compelling option for investors looking for high-reward opportunities.

TRON is breaking out after years of buildup with strong adoption, heavy buying, and bullish momentum targeting a $1.11 surge.

-

TRON’s breakout after years of quiet accumulation is fueling strong momentum toward the $1.11 price target with solid investor backing.

-

Years of patience are paying off for TRON holders as steady adoption and heavy buying push prices toward major new highs.

-

TRON’s growing ecosystem and market confidence are driving a rally that could redefine its standing among top cryptocurrencies.

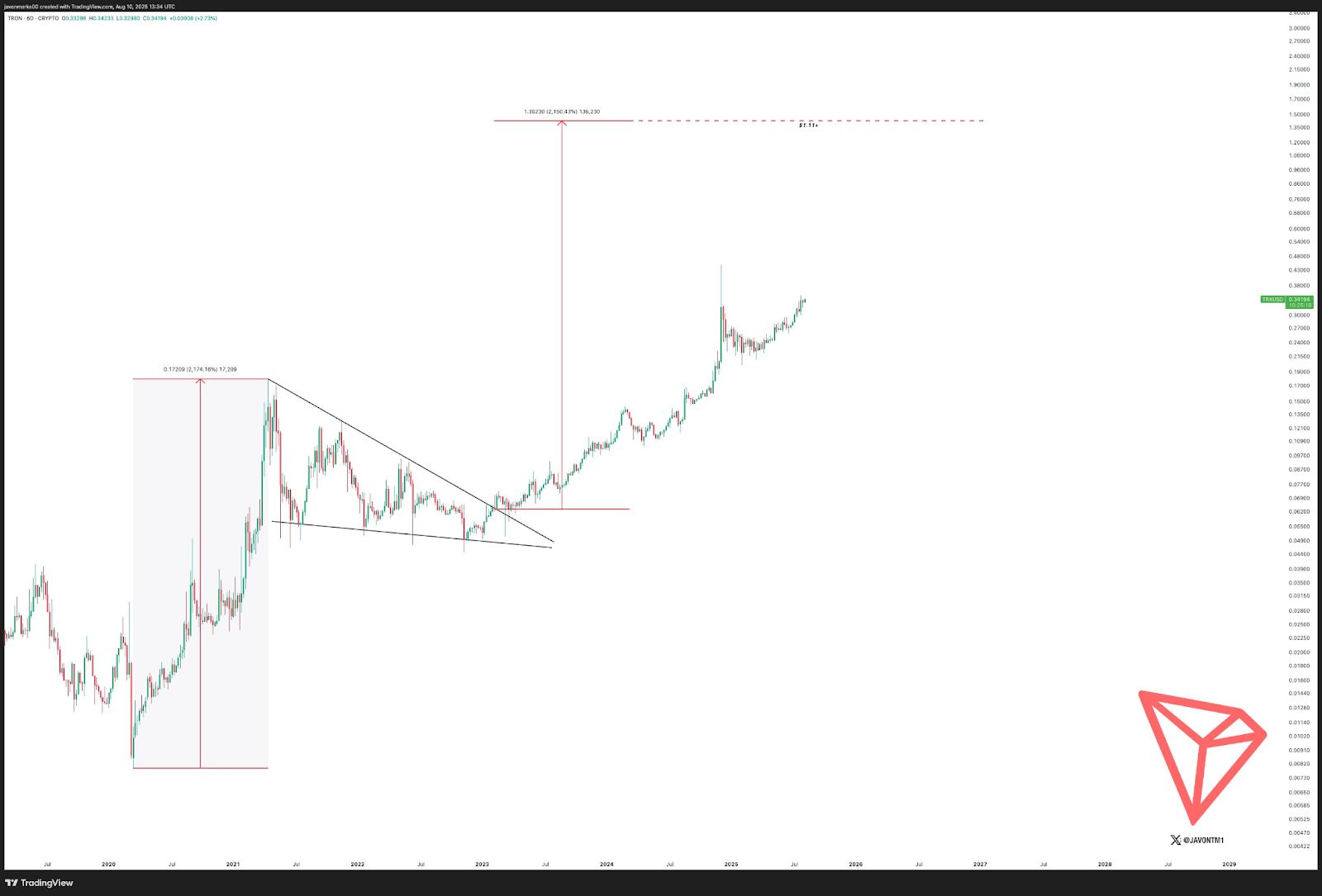

TRON (TRX) is showing strong momentum as analyst project a surge toward the $1.11 mark, signaling a potential 220% upside from current levels. This projection comes from technical analyst Javon Marks, who points to chart patterns confirming years of accumulation and a decisive breakout.

At around $0.17, TRON’s pricing right now indicates that the rise is still going strong. The change is important for traders looking for high-reward chances in blockchain projects that are becoming more popular.

Apart from the optimistic outlook, TRON’s track record demonstrates its ability to withstand market turbulence. A decline followed the cryptocurrency’s initial notable highs during the 2017–2018 bubble. TRX created a falling triangle pattern throughout the multi-year consolidation phase that followed that decline.

Source: Javon Marks

This phase allowed long-term investors to quietly accumulate tokens despite broader market pessimism. Consequently, this structural base prepared TRON for a powerful upside when the breakout finally occurred.

From Consolidation to Breakout

Moreover, the breakout above the descending resistance line marked a turning point for TRON. Prices surged from $0.02 to current levels in a rally that regained the previous all-time high zone.

This sharp rise reflects growing investor confidence and steady blockchain adoption. Additionally, trading volume patterns indicate institutional-level buying, further confirming a strong market foundation.

The optimistic outlook for TRON is not just technical, though. The growing ecosystem of the blockchain keeps drawing in developers and users, especially in decentralized applications. This expansion increases the probability of maintaining higher valuations. Therefore, assuming adoption trends pick up speed and momentum continues, the $1.11 aim seems doable.

Long-Term Targets and Market Implications

Looking ahead, Marks highlights $1.36 as a longer-term resistance level. Reaching that point would require strong market conditions and continuous innovation within the TRON network. Furthermore, the asset’s current technical posture positions it as a case study in patient accumulation strategies. Investors who held through the consolidation phase are now seeing significant gains.

TRON’s price jump shows that strong blockchain projects can bounce back even after long periods of slow growth. This rally could also lift investor confidence in other altcoins, helping push the whole crypto market higher in the coming months.