Bo Hines To Reportedly Step Down As Crypto Council Director

Hines, the Executive Director of the White House Crypto Council, will step down and be succeeded by Patrick Witt, as he transitions to a private sector role while advising on AI policy alongside David Sacks.

The Executive Director of the White House Crypto Council, Bo Hines, is reportedly stepping down from his position to return to the private sector.

It marks a significant shift in the Trump administration’s cryptocurrency policy leadership.

Bo Hines To Step Down After 8 Months Leading Trump’s Crypto Council

Hines has been a central figure in shaping the Council’s stance on digital assets, stablecoin regulation, and blockchain innovation.

His tenure, which started in December, included navigating complex debates over crypto’s role in financial markets, consumer protection, and national competitiveness.

While Hines will relinquish his day-to-day leadership duties, he will remain involved with the administration as a special government employee, focusing on artificial intelligence initiatives.

In this capacity, he is expected to work alongside entrepreneur and venture capitalist David Sacks, a notable figure in both the tech and policy arenas, as the White House accelerates its AI strategy. Eleanor Terrett, host of Crypto America podcast, reported the leadership transition.

— Eleanor Terrett (@EleanorTerrett) August 9, 2025

SCOOP: @BoHines, Executive Director of the White House Crypto Council, is stepping down to return to the private sector. Hines, who previously worked as a partner at a growth equity firm before joining the Trump administration, will remain on as a special government employee…

It comes at a critical time for the crypto industry, with regulatory clarity still a work in progress and global jurisdictions moving ahead with frameworks for digital assets. With all these in the pipeline, the White House Crypto Council plays a key role in coordinating policy across federal agencies.

Hines’ deputy, Patrick Witt, is expected to assume the role of Executive Director. Witt, a well-regarded policy strategist with deep knowledge of both financial markets and emerging technologies, has worked closely with Hines on the Council’s agenda.

While his appointment signals a degree of continuity, his leadership style and policy emphasis could still bring subtle shifts.

Hines’ move reflects a growing trend of high-profile public sector leaders returning to private industry, often leveraging their government experience in advisory, investment, or executive roles.

It also highlights the increasing overlap between the crypto and AI policy spheres, two areas where technological innovation is outpacing regulatory adaptation.

The White House has not yet confirmed the official date of the transition, but sources indicate it is expected to occur in the coming weeks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

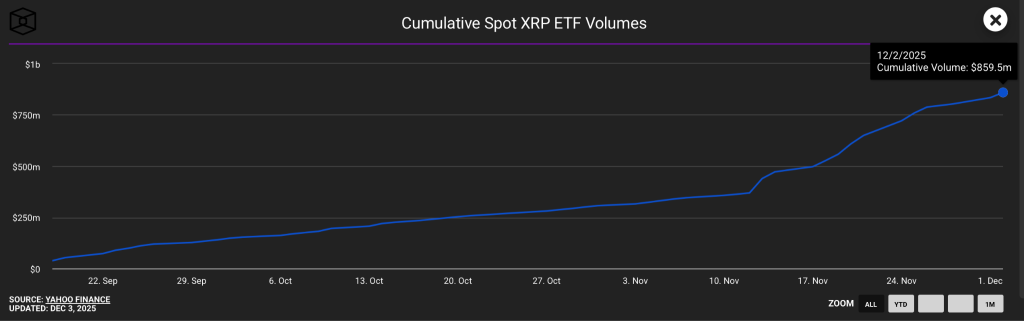

XRP ETF Flows Hit Record High—What It Means for XRP Price

Ethereum Hits New All-Time High for TPS Ahead of Fusaka Upgrade

Pi Network News: Expert Says ‘Sleeping Giant’ Fails to Wake As Stalled Protocol 23 Raises Doubts