Key Notes

- Solana rallied 17% in a week, breaking above $180 for the first time in August 2025.

- 8M SOL worth $1.4B withdrawn from staking in 5 days, adding to short-term market supply.

- SOLUSD technical indicators show next major overhead resistance now lies at the $202 mark, bullish momentum sustains above 20-day MA. .

The Solana price finally broke above $180 on Saturday, Aug 9, 2025, after multiple failed attempts since the start of the month.

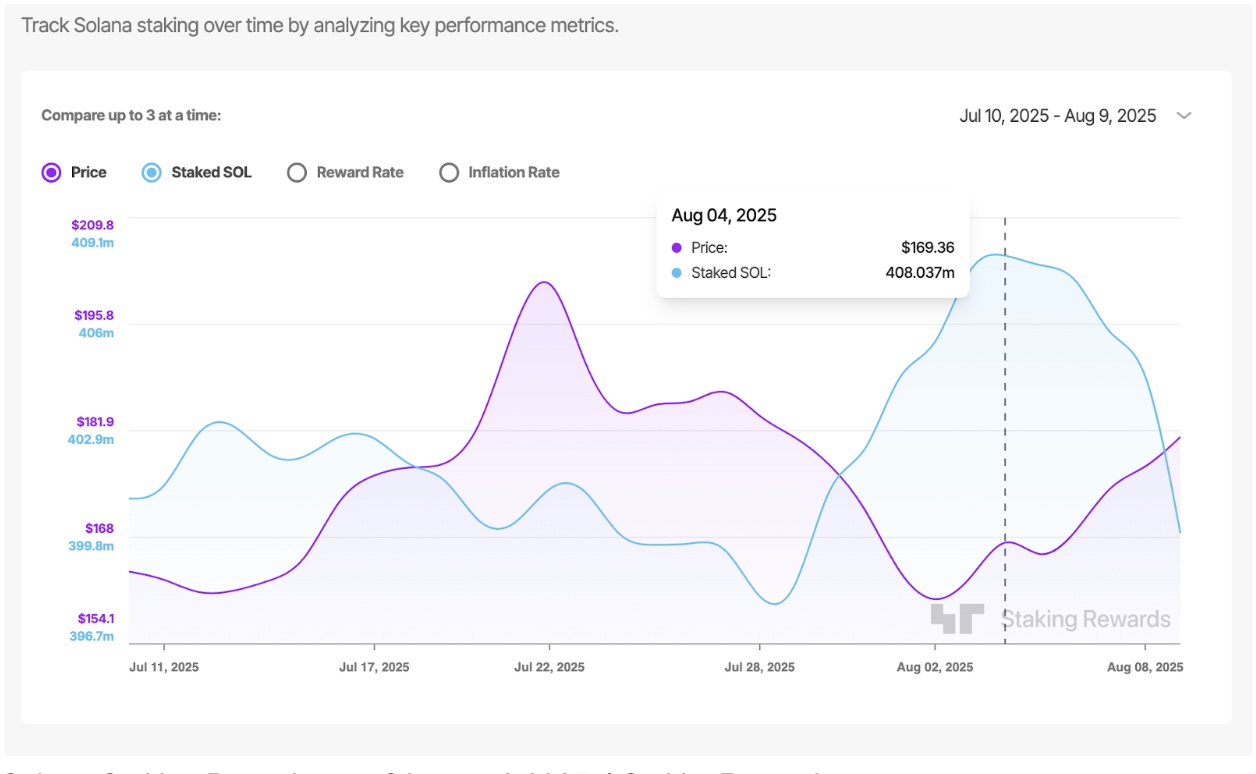

The 17% rally over the past week has coincided with 8 million SOL staking withdrawals, suggesting investors are shifting toward short-term speculative trades amid heightened market optimism. According to blockchain analytics platform StakingRewards.com , staking deposits fell from 408.04 million SOL on Aug 4 to 399.93 million SOL at press time.

Solana Staking Deposits as of August 9 2025 | StakingRewards.com

At the current price of $180, the withdrawn SOL represents over $1.4 billion reintroduced into the active market supply . While this liquidity boost likely helped push SOL above $180, it also brings potential short-term risks, an oversupply that could accelerate a sharp pullback if current bullish sentiment weakens.

Solana Price Forecast: Can Bulls Push Towards $202?

In the last three days, Solana price has risen 14%, adding another 2% intraday on Aug 9 to touch $182, its highest level in August 2025.

Technical indicators show the daily candle closing above the 20-day moving average, a setup that often signals the potential start of a fresh rally leg. If bullish momentum holds and appetite for short-term plays, fueled by the $1.4 billion staking withdrawals, remains high, SOL price could target the next major overhead resistance at $202, marked by the upper Bollinger Band.

Solana Price Forecast | TradingView

For this bullish forecast to be validated, SOL must post multiple consecutive daily closes above the 20-day MA.

On the downside, if market sentiment weakens, the recent oversupply could trigger rapid selloffs. In such a scenario, SOL may quickly retrace toward support levels around $165–$170 before attempting another breakout.

next