World Liberty Financial weighs $1.5B public company to hold WLFI tokens

World Liberty Financial, the Trump family-backed crypto venture, is exploring the creation of a publicly traded company to hold its WLFI tokens, with a fundraising target of roughly $1.5 billion.

The structure of the deal is still being finalized, but major investors in technology and crypto have been approached, and discussions are said to be progressing quickly, according to a Friday report from Bloomberg.

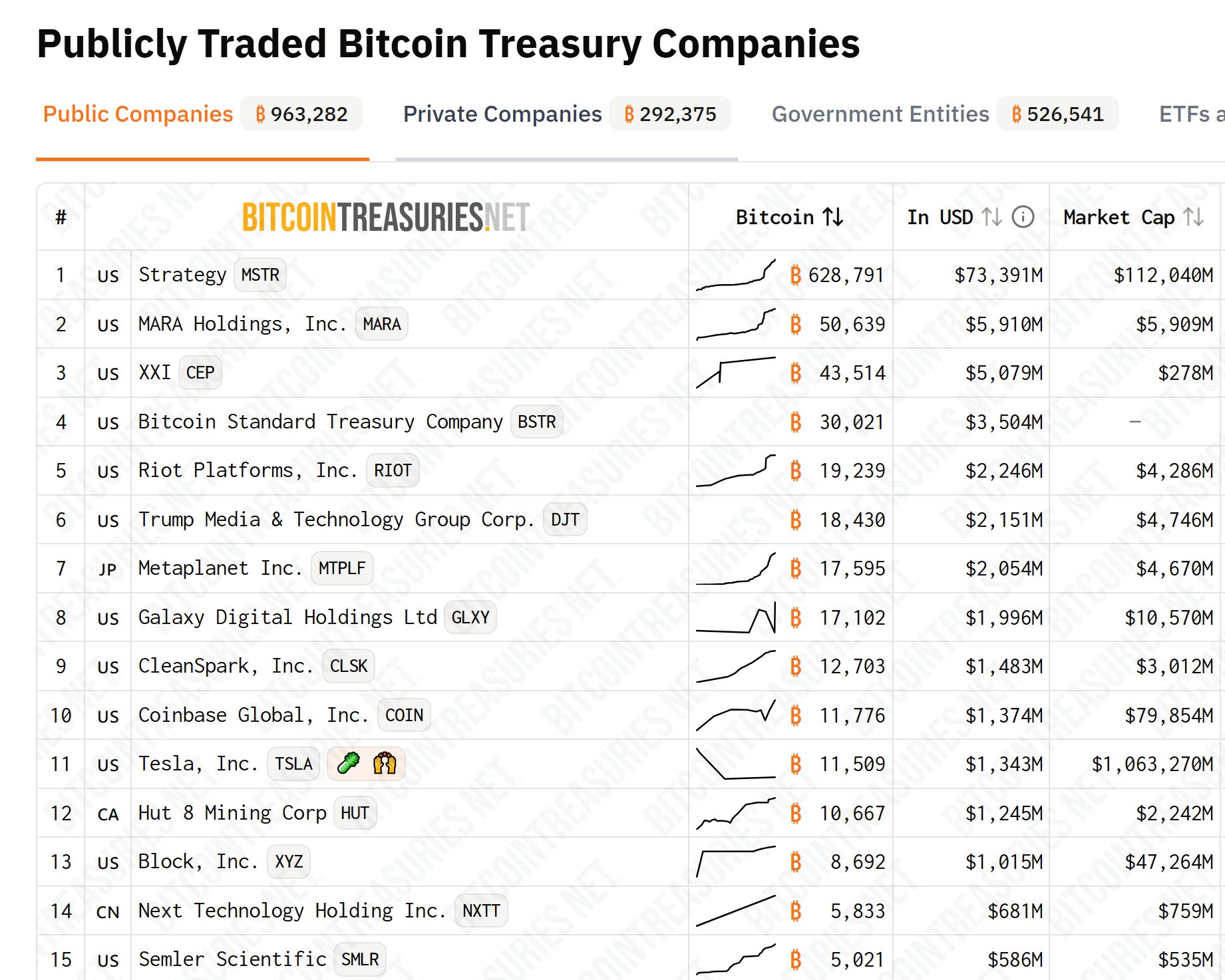

The move would place World Liberty among a growing wave of digital-asset treasury companies, which are publicly traded firms holding crypto reserves. These companies have raised an estimated $79 billion in 2025 for Bitcoin purchases alone, per the report.

World Liberty, whose website names Donald Trump as “co-founder emeritus,” launched last year with plans for a crypto-lending app and currently offers USD1, a dollar-backed stablecoin.

World Liberty’s treasury firm to mirror Strategy

The report, citing investor materials, said that the World Liberty treasury vehicle would be a shell company already listed on the Nasdaq, which the venture has acquired.

The approach mirrors strategies pioneered by Michael Saylor’s MicroStrategy , now rebranded as Strategy, which transformed itself into a Bitcoin holding company in 2020. Strategy has since amassed over $72 billion in Bitcoin and reached a market cap of nearly $113 billion.

The success of Strategy’s stock as a proxy for Bitcoin has inspired a rush of copycats, from a Japanese budget hotel chain to new treasury firms for Ether

ETH$4,196, LitecoinLTC$123.87, SuiSUI$3.82and other altcoins. Trump Media, another family-linked venture, bought $2 billion in Bitcoin earlier this year for its own treasury.

Top 15 Bitcoin treasury firms. Source: BitcoinTreasuries.Net

Top 15 Bitcoin treasury firms. Source: BitcoinTreasuries.Net

Trump reports $5 million from WLFI token earnings

In June, Trump disclosed earning $57.4 million from his stake in World Liberty Financial. In his 2025 public financial disclosure, filed with the Office of Government Ethics, Trump reported holding 15.75 billion WLFI governance tokens. The filing attributes the income to token-related activities.

World Liberty Financial has raised about $550 million through fundraising rounds, positioning itself as a DeFi and stablecoin platform aiming to challenge traditional finance. High-profile backers include Tron founder Justin Sun, who invested $30 million for 2 billion tokens , and Web3Port, which contributed $10 million in January.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What’s going on with restaking?

A deep review of EigenLayer's journey in restaking: the pitfalls encountered and the achievements of EigenDA have all paved the way for the new direction of EigenCloud.

Is the 69 million FDV + JUP staking exclusive pool HumidiFi public sale worth participating in?

An overview of tokenomics and public offering regulations.

Why is the short seller who made $580,000 now more optimistic about ETH?

The truth behind Bitcoin's overnight 9% surge: Is December the turning point for the crypto market?

Bitcoin strongly rebounded by 6.8% on December 3 to $92,000, while Ethereum surged 8% to break through $3,000, with mid- and small-cap tokens seeing even larger gains. The market rally was driven by multiple factors, including expectations of a Federal Reserve rate cut, Ethereum’s technical upgrades, and policy shifts. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.