Lido (LDO) Jumps 58% in Five Days as Active Addresses Hit Two-Year High

Lido DAO’s LDO token surged 12% to a six-month high amid rising network activity and strong investor interest. Bullish sentiment now targets $1.68, with $1.85 in sight if momentum holds.

LDO, the native token of Ethereum’s largest decentralized staking platform, Lido, is today’s top gainer. Its price has climbed by 12% amid the broader uptick in crypto trading activity over the past 24 hours.

LDO trades at a six-month high of $1.50 at press time, with on-chain metrics suggesting the token could be poised for further gains.

LDO Rockets 58% in Five Days as Demand Grows

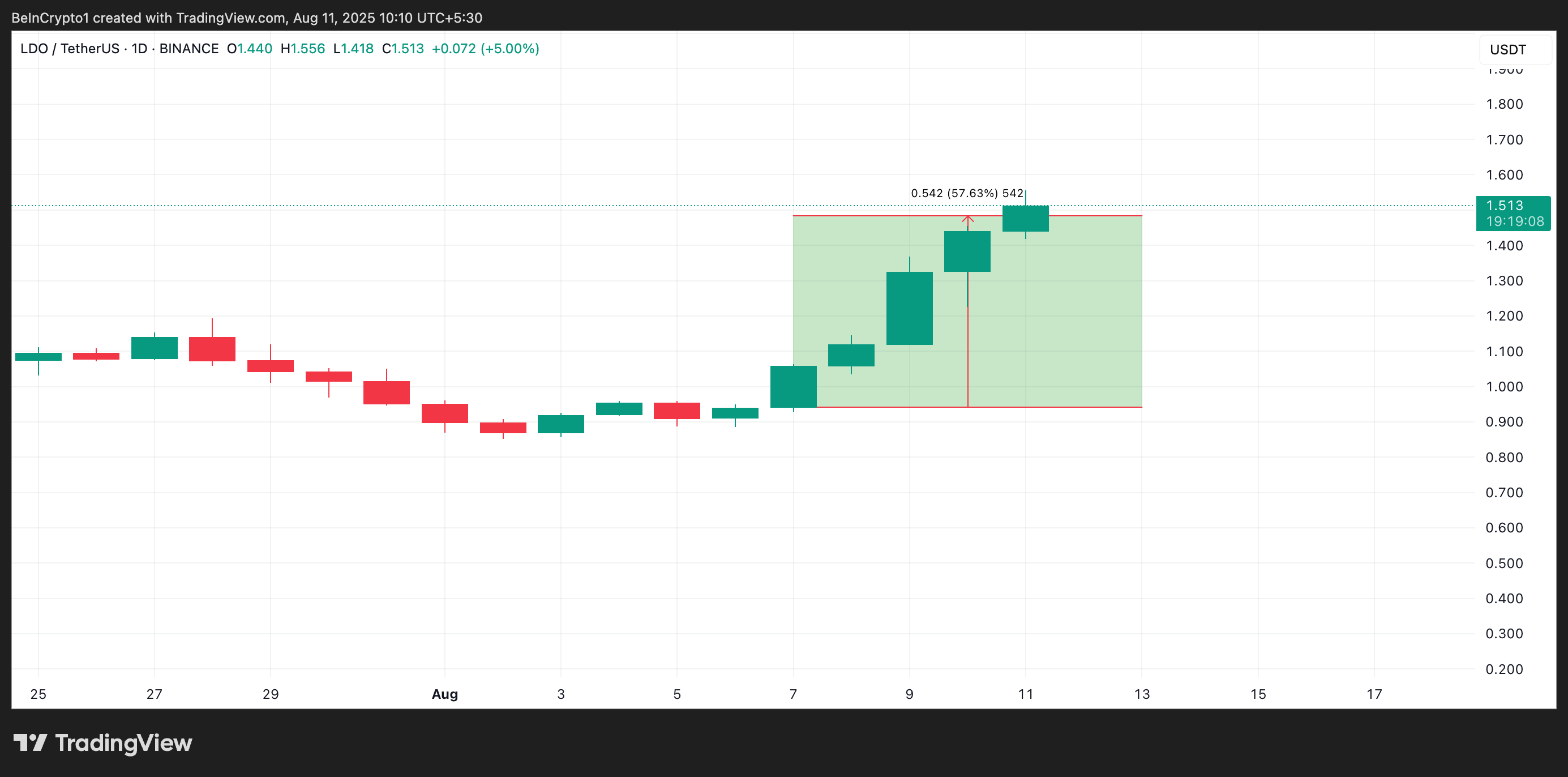

Readings from the LDO/USD one-day chart reveal that the token has maintained a strong upward trajectory over the past five trading sessions, each closing at a fresh daily high. Over this period, LDO’s price has climbed by 58%, reflecting the rally’s strength.

LDO Price Analysis. Source:

TradingView

LDO Price Analysis. Source:

TradingView

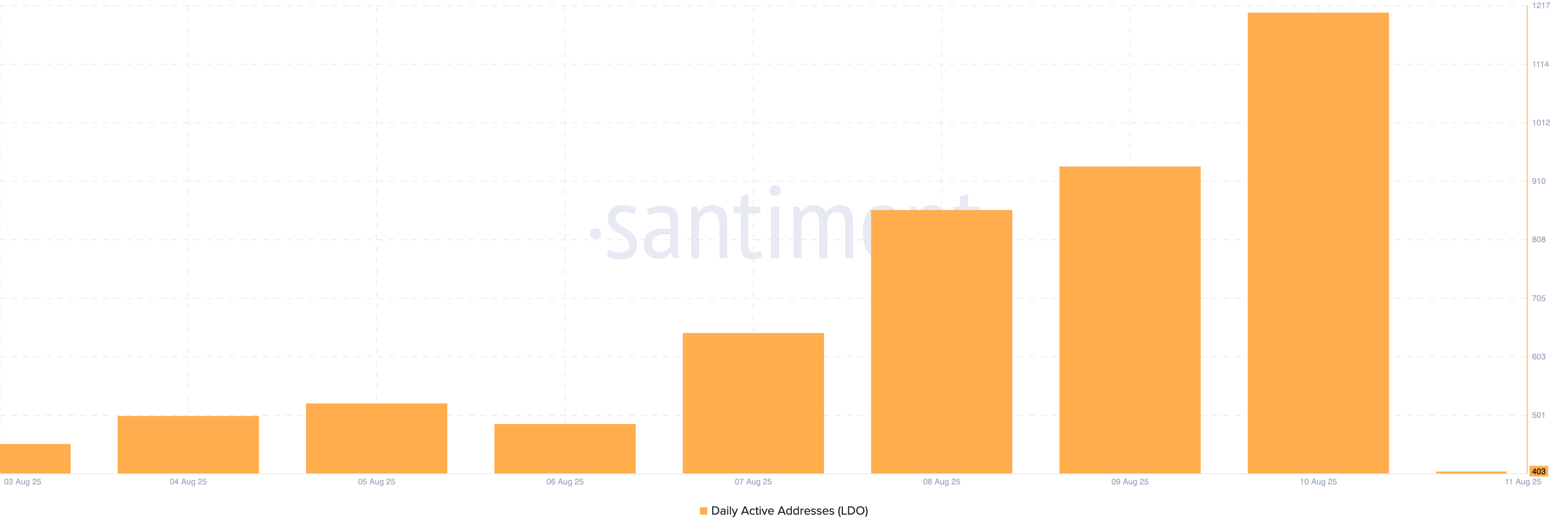

On-chain data further confirms this bullish outlook. According to Santiment, there has been a significant uptick in the count of daily active addresses involved in LDO transactions over the past week. This signals heightened network activity and growing investor participation.

According to the data provider, active address count surged to a two-year high of 1,205 on August 10, marking the strongest daily demand for LDO in over 24 months.

LDO Daily Active Addresses. Source:

Santiment

LDO Daily Active Addresses. Source:

Santiment

This surge in engagement suggests that market confidence in LDO’s momentum is building and could continue to hold steady.

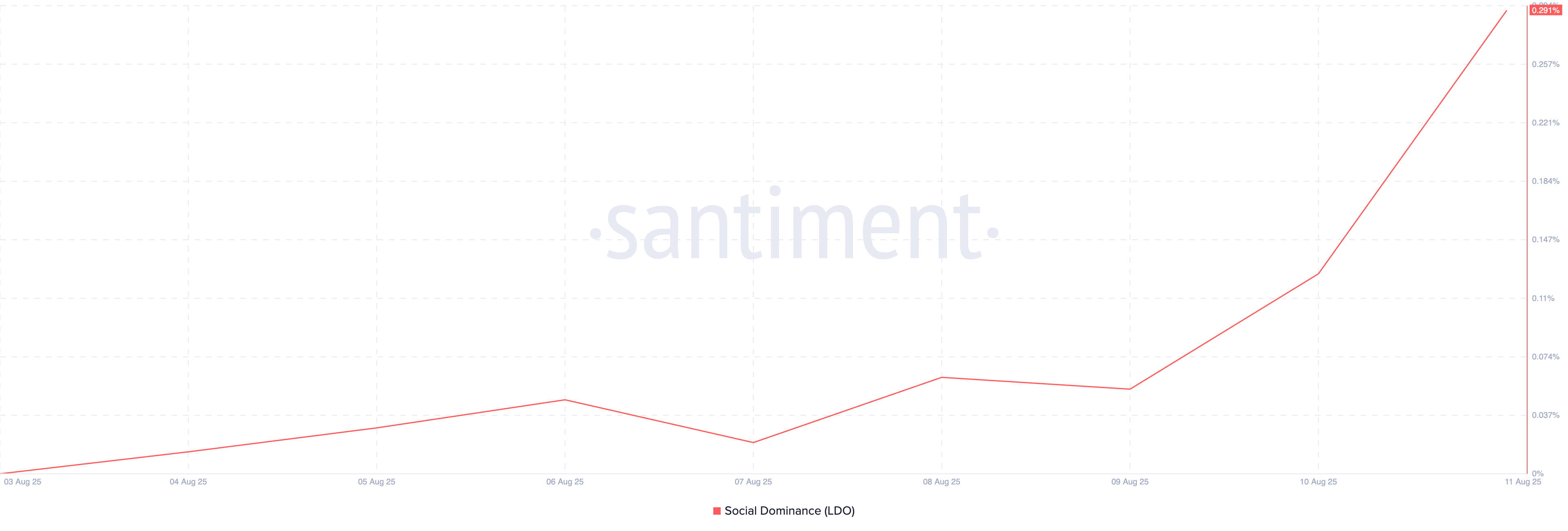

Moreover, LDO’s social dominance—a metric that tracks the percentage of crypto-related discussions focused on the asset—has rocketed to a yearly high. Per Santiment, this currently stands at 0.29%, confirming that there is notable online chatter about the token.

LDO Social Dominance. Source:

Santiment

LDO Social Dominance. Source:

Santiment

The rise in LDO’s social dominance shows it has captured significant attention within the broader market conversation. This growing buzz can be a precursor to increased retail activity and can help fuel short-term price momentum.

LDO Rally Heats Up: Can Bulls Hold Support to Target $1.85?

Continued buying pressure and favorable on-chain sentiment could further drive LDO’s rally, pushing its price past $1.55. A successful breach of this resistance could propel the altcoin to $1.77.

LDO Price Analysis. Source:

TradingView

LDO Price Analysis. Source:

TradingView

However, if sellers regain control and begin to take profit, LDO risks losing some of its gains and falling to $1.33.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Rebound Alert: What’s Next for Bitcoin, Ethereum, XRP and Solana Prices?

OracleX Global Public Beta: Restructuring Prediction Market Incentive Mechanisms with "Proof of Behavior Contribution"

OracleX is a decentralized prediction platform based on the POC protocol. It addresses pain points in the prediction market through a dual-token model and a contribution reward mechanism, aiming to build a collective intelligence decision-making ecosystem. Summary generated by Mars AI The content of this summary is produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Bitcoin is not "digital gold"—it is the global base currency of the AI era

The article refutes the argument that bitcoin will be replaced, highlighting bitcoin's unique value as a protocol layer, including its network effects, immutability, and potential as a global settlement layer. It also explores new opportunities for bitcoin in the AI era. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

Bitcoin 2022 bear market correlation hits 98% as ETFs add $220M