ZORA price surges over 55% supported by whale accumulation, but risks remain

ZORA crypto soared to a new all-time high on Aug. 11 as whale interest surged, but looming signs suggest the rally could run out of steam soon.

- ZORA hit an all-time high of $0.139 and is up 160% this month.

- Whale wallet holdings for ZORA have risen over the past 7 days.

According to data from crypto.news, Zora ( ZORA ) rallied to an all-time high of $0.139 on Monday, Aug. 11, with its market cap rising to over $436 million at press time. At this price, it currently stands over 160% from this month’s low and roughly 1,600% above its lowest point in July.

Why did ZORA rally?

ZORA’s rally appears to be driven by renewed interest from whale investors .

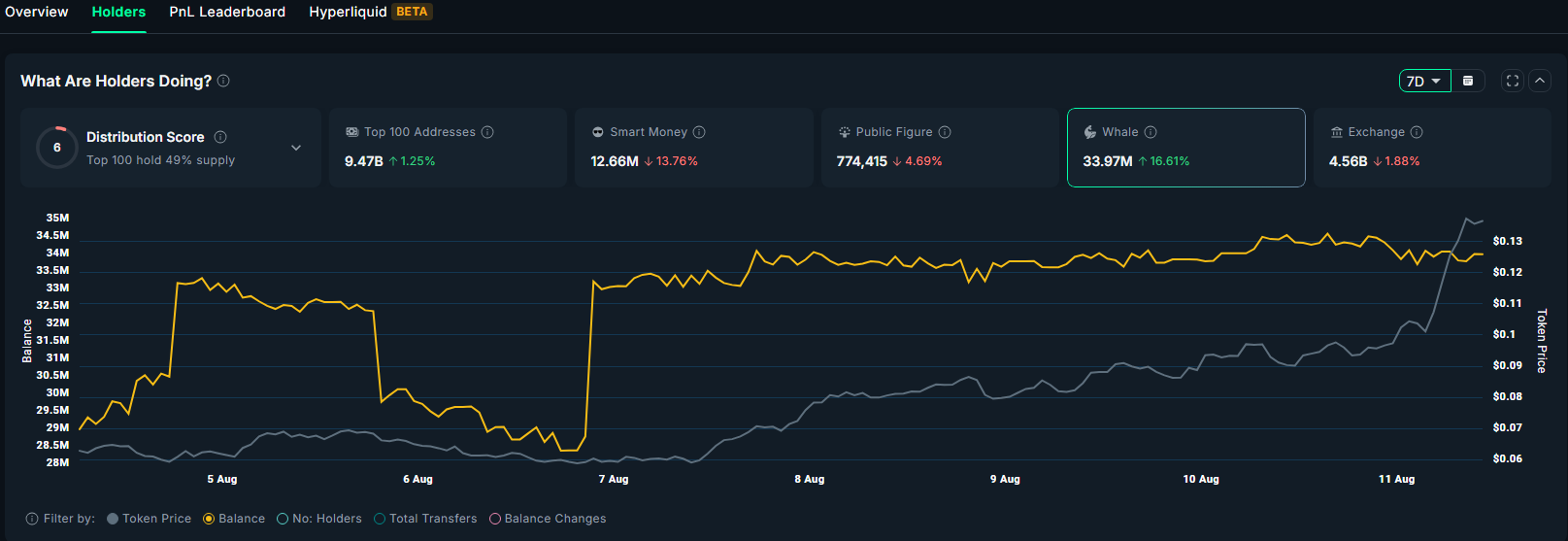

Data from Nansen shows that the total balance held by whale wallets has risen 16.4% since Aug. 4, climbing from nearly $29 million to $33.9 million. This sharp increase in large-holder investment often signals growing confidence from influential market participants.

Source: Nansen

Source: Nansen

In many cases, retail traders interpret such moves as a bullish cue, prompting them to enter the market in hopes of making profits from such rallies.

Another factor that seems to be supporting ZORA’s rally is its growing momentum in the Base ecosystem , where the token plays a central role in a new “creator coin” economy. On the Base app, every social post automatically triggers Zora’s smart contracts to mint a unique ERC-20 token linked to that content. These tokens become instantly tradable, with creators earning a share of the supply and transaction fees.

Since the app’s relaunch, this model has generated over 2 million creator coins, attracted nearly 3 million traders, and driven about $512 million in trading volume data from Dune show.

The rapid adoption of the creator coin system drives consistent on-chain activity and reinforces ZORA’s value as a core revenue engine within the Base ecosystem, giving investors a tangible growth narrative to price in.

ZORA price at risk as funding rate flips negative

However, the ongoing ZORA price jump faces some potential risks that may impede its ongoing rally.

According to CoinGlass , open interest in ZORA futures has surged 47% in the past 24 hours, showing a sharp rise in leveraged trading. At the same time, the weighted funding rate has turned negative, meaning short sellers are paying long holders.

This shift points to a build-up in bearish bets, with traders increasingly expecting the token’s price to fall from current levels.

More signs of this bearish tilt appear when looking at where traders are positioning themselves in ZORA’s futures market. The long/short ratio was below 1 at the time of writing, indicating that short positions outnumber longs. This imbalance can amplify selling pressure if sentiment worsens.

Unless demand from whales and retail traders stays strong enough to absorb that pressure, ZORA may find it difficult to maintain its gains near record highs, especially since crypto assets often face short selling after hitting new peaks as early investors lock in profits.

ZORA price analysis

ZORA has been forming a rounded-bottom pattern since early July, a bullish formation that often marks the shift from a downtrend to an uptrend. On the 4-hour chart, the neckline sits at $0.095, with the bottom at $0.052. The token broke above the neckline yesterday, confirming the pattern.

At the same time, ZORA broke out of an ascending parallel channel, another bullish structure characterized by higher highs and higher lows. Such breakouts typically signal strengthening upward momentum.

ZORA price, Aroon and RSI chart — Aug. 11 | Source: crypto.news

ZORA price, Aroon and RSI chart — Aug. 11 | Source: crypto.news

Following these breakouts, ZORA surged past the rounded-bottom target of $0.139 before pulling back to $0.133 at the time of writing. Momentum indicators remain largely positive, with the Aroon Up at 92.86% and the Aroon Down at 0%, showing that recent highs are being formed while lows are distant.

However, the Relative Strength Index is at 81, deep in overbought territory, and has begun to turn lower. This suggests that buying momentum is weakening and that a price correction may be on the horizon.

If a pullback occurs, the first major support sits near $0.10, which aligns with the 61.8% Fibonacci retracement level. A break below this zone could lead to a deeper decline toward $0.073, a support level that has held for several weeks.

On the other hand, if ZORA rebounds from $0.10 and turns it into support, the bullish trend could resume, potentially pushing the price toward the $0.15 psychological resistance level and setting a new all-time high.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gain Insight into Cryptocurrency’s Promising Future for 2026

In Brief The next major crypto bull cycle will start in early 2026. Institutional investors and regulation drive long-term market confidence. Short-term shifts show investors favoring stablecoins amid volatility.

Stunning $204 Million USDT Transfer Ignites Market Speculation