Date: Mon, Aug 11, 2025 | 05:50 AM GMT

The cryptocurrency market is in bullish mode as Ethereum (ETH) breaks above the $4,300 level for the first time since 2021. This 21% weekly surge has sparked a broad rally, with major altcoins — including Ondo (ONDO) — riding the wave higher.

ONDO has posted an impressive 13% weekly gain, but what’s really catching traders’ attention is the emergence of a bullish Cup and Handle pattern that could be setting the stage for a powerful breakout.

Source: Coinmarketcap

Source: Coinmarketcap

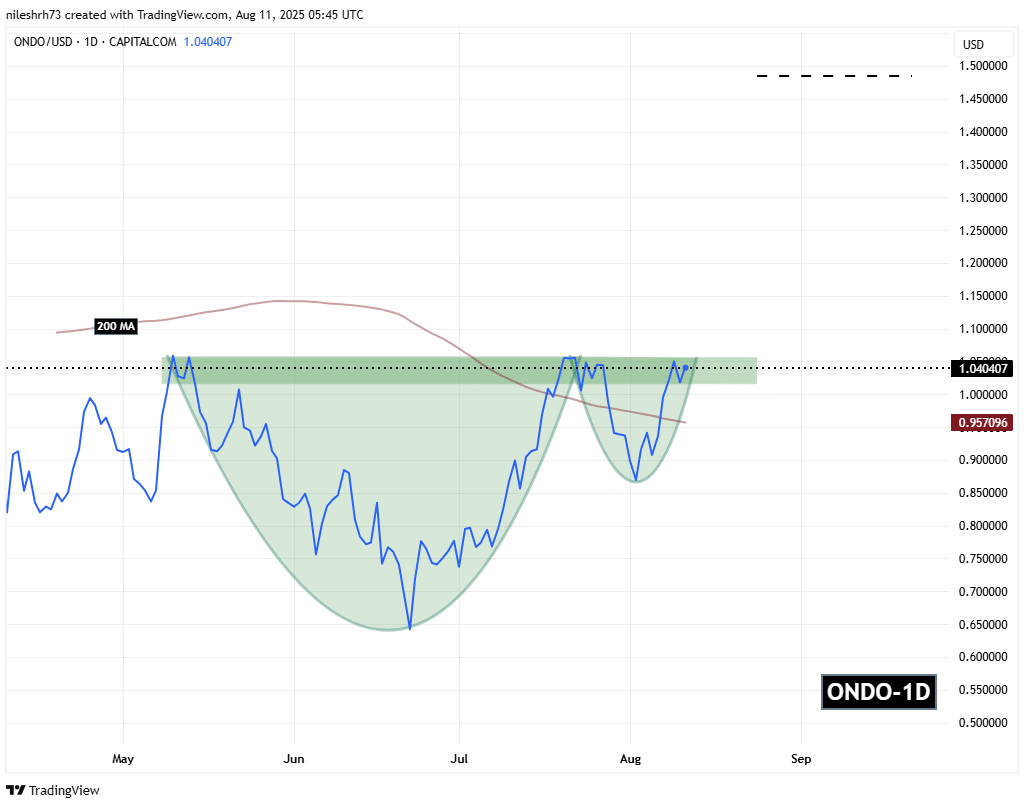

Cup and Handle Pattern in Play

The “cup” began forming months ago, starting with a drop from the $1.06 area in late April, bottoming near $0.64 in mid-June, and then recovering in a rounded formation. After reclaiming the $1 zone, ONDO entered the “handle” phase — a short, controlled pullback that likely flushed out weaker positions before bulls stepped back in.

Ondo (ONDO) Daily Chart/Coinsprobe (Source: Tradingview)

Ondo (ONDO) Daily Chart/Coinsprobe (Source: Tradingview)

Over the past few sessions, ONDO has bounced sharply from the handle’s lower boundary near $0.87, climbing back to retest a key neckline resistance between $1.01 and $1.06.

What’s Next for ONDO?

ONDO is now pressing against this critical neckline zone, with the 200-day moving average hovering just below— adding another technical support. A decisive close above $1.06 could confirm the Cup and Handle breakout, potentially unlocking a measured move toward $1.48 — an upside of nearly 43% from current levels.

Volume will be a key factor. A breakout backed by strong buying pressure could draw in momentum traders and accelerate gains. Conversely, rejection at this level could see ONDO retest short-term support near $0.95–$0.97 before attempting another push higher.