Key takeaways

- DOGE rallied by 16% last week to hit the $0.23 mark.

- The leading memecoin could rally to the $0.30 psychological mark if market momentum remains bullish.

DOGE breaks above $0.20, targets new highs

DOGE, the native coin of the Dogecoin ecosystem and the leading memecoin, performed excellently over the last seven days. The coin added 16% to its value during that period, surpassing the $0.20 mark in the process.

At press time, DOGE is trading at $0.2344 and could be set to hit the $0.30 mark for the first time since February 2025. The rally comes as the broader cryptocurrency market recorded excellent gains over the past few days.

Bitcoin, the leading cryptocurrency by market cap, hit the $122k mark earlier today after adding 3% to its value over the weekend. Ether surged past $4,300 for the first time in four years and is now targeting the all-time high price of $4,891.

DOGE targets $0.3 amid bullish momentum

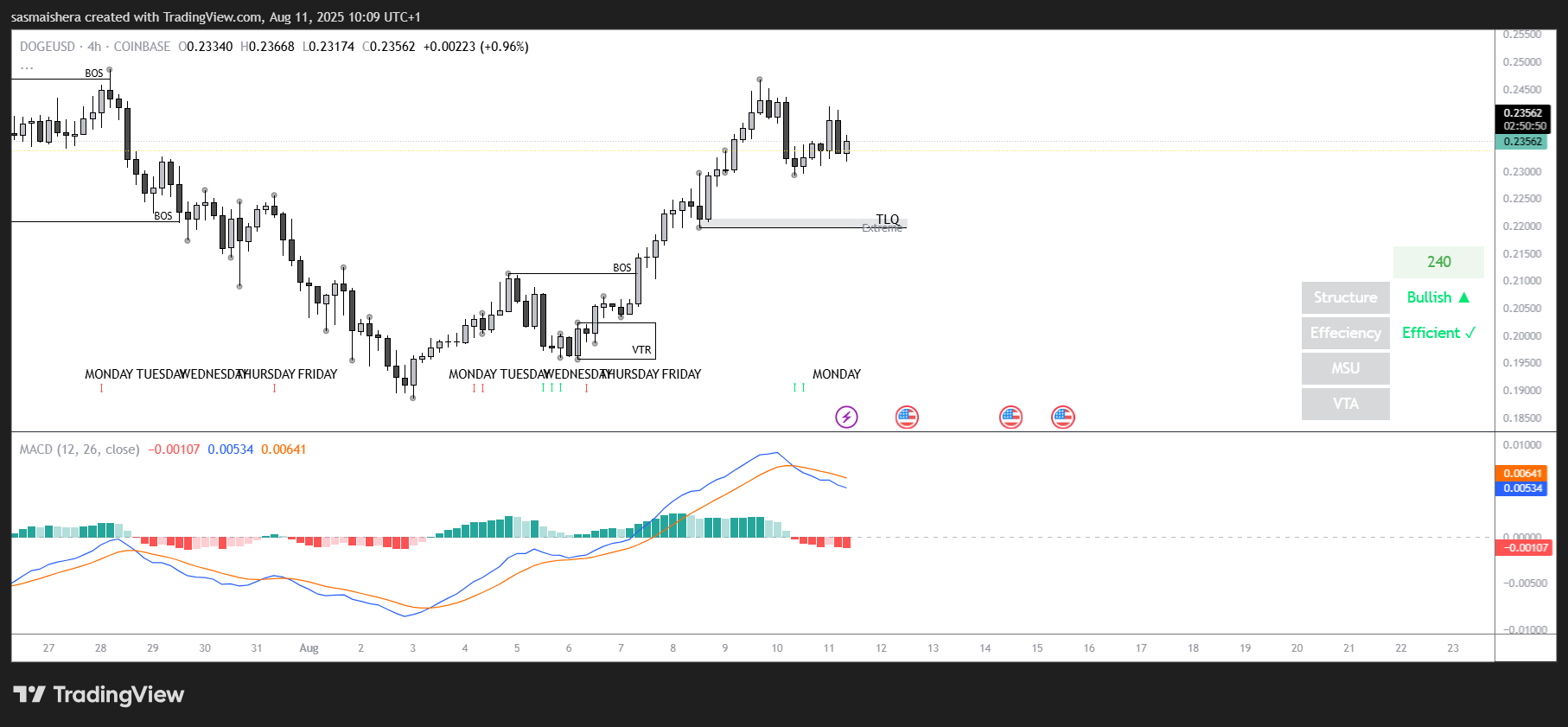

The leading memecoin could continue its rally as bullish momentum engulfs the broader market. The DOGE/USD 4-hour chart is bullish and efficient, suggesting that traders could be gearing up to push the price higher.

The MACD lines have crossed into positive territory while the RSI of 66 shows that buyers are currently in control of the market. If the market momentum persists, the DOGE/USD pair could cross the first major resistance level at $0.2865 over the coming hours or days. An extended bullish run would pave the way for DOGE to surpass the $0.30 mark for the first time since February 2025.

However, the market might show signs of exhaustion, resulting in a bearish trend. If that happens, DOGE could retest the first major support level and its 4H TLQ at $0.2208. Failure to hold this support level could see DOGE drop further towards the Break of Structure (BOS) around $0.2098.