Bitcoin nears $122 and Ethereum returns to 2021 levels

- Bitcoin hits $121.852 with a 3,33% daily increase

- Ethereum rises to $4.294,66 (+1,47% in the last 24 hours)

- Trump Considers Including Cryptocurrencies in 401(k) Plans

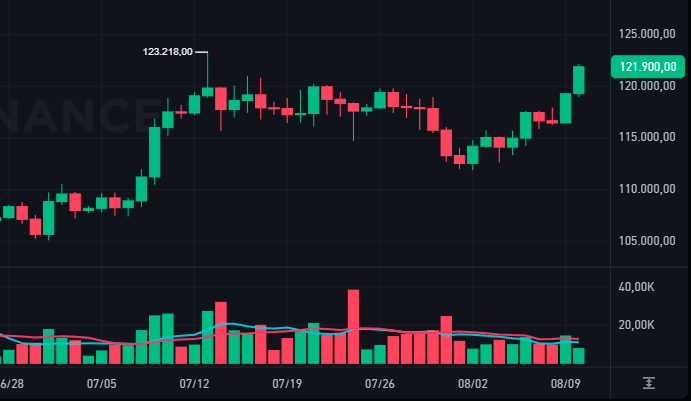

Bitcoin started the week trading near $122.000, registering a 3,33% increase in the last 24 hours and reaching $121.900 on Sunday night. Ethereum also stood out, with its price confirmed at $4.294,66, representing an appreciation of approximately 1,47% in the last 24 hours, reaching its highest level since December 2021.

This movement was driven by positive macroeconomic factors and consistent demand from the institutional sector. A key driver was the signing by current U.S. President Donald Trump of an executive order directing the Department of Labor to explore the inclusion of cryptocurrencies, private equity, and other alternative assets in 401(k) retirement plans.

Augustine Fan, head of insights at SignalPlus, noted that the move could potentially expose millions of retirement accounts to cryptocurrencies, generating significant buying pressure.

Bitcoin ETFs also reported net inflows of $253 million last week, sustaining strong demand even after Bitcoin recently hit an all-time high. Ethereum spot ETFs saw even larger inflows—totaling $461 million last week—outpacing Bitcoin ETFs.

Min Jung, an analyst at Presto Research, highlighted an unofficial acquisition of 52.809 ETH by SharpLink Gaming, reinforcing the presence of large-scale purchases by institutional players. He warned that upcoming macroeconomic indicators—especially the consumer price index (CPI) and producer price index (PPI)—could influence the outlook, as the Federal Reserve still maintains the likelihood of a September rate cut is contingent on these data.

Ethereum co-founder Joseph Lubin stated in an interview with CNBC that he believes ETH could surpass Bitcoin "within the next year or so, especially with these treasury companies driving things." At Bitcoin's current market cap, to achieve this feat, Ethereum's price would need to reach around $20.000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SociFi dream shattered? Farcaster pivots to focus on the wallet track

Past data has shown that the "social-first strategy" is ultimately unsustainable, as Farcaster has consistently failed to find a sustainable growth mechanism for a Twitter-like social network.

Crypto tycoons spend eight-figure annual security fees, just to avoid incidents like Bluezhanfei's experience.

No one understands security better than the crypto industry leaders.