The crypto market capitalization has surged to $4.1 trillion, driven by Bitcoin’s recent gains and strong institutional adoption.

-

Bitcoin’s price has climbed 2.6% in the last 24 hours, currently trading above $121,000.

-

Ethereum has outperformed Bitcoin, gaining nearly 20% over the past week.

-

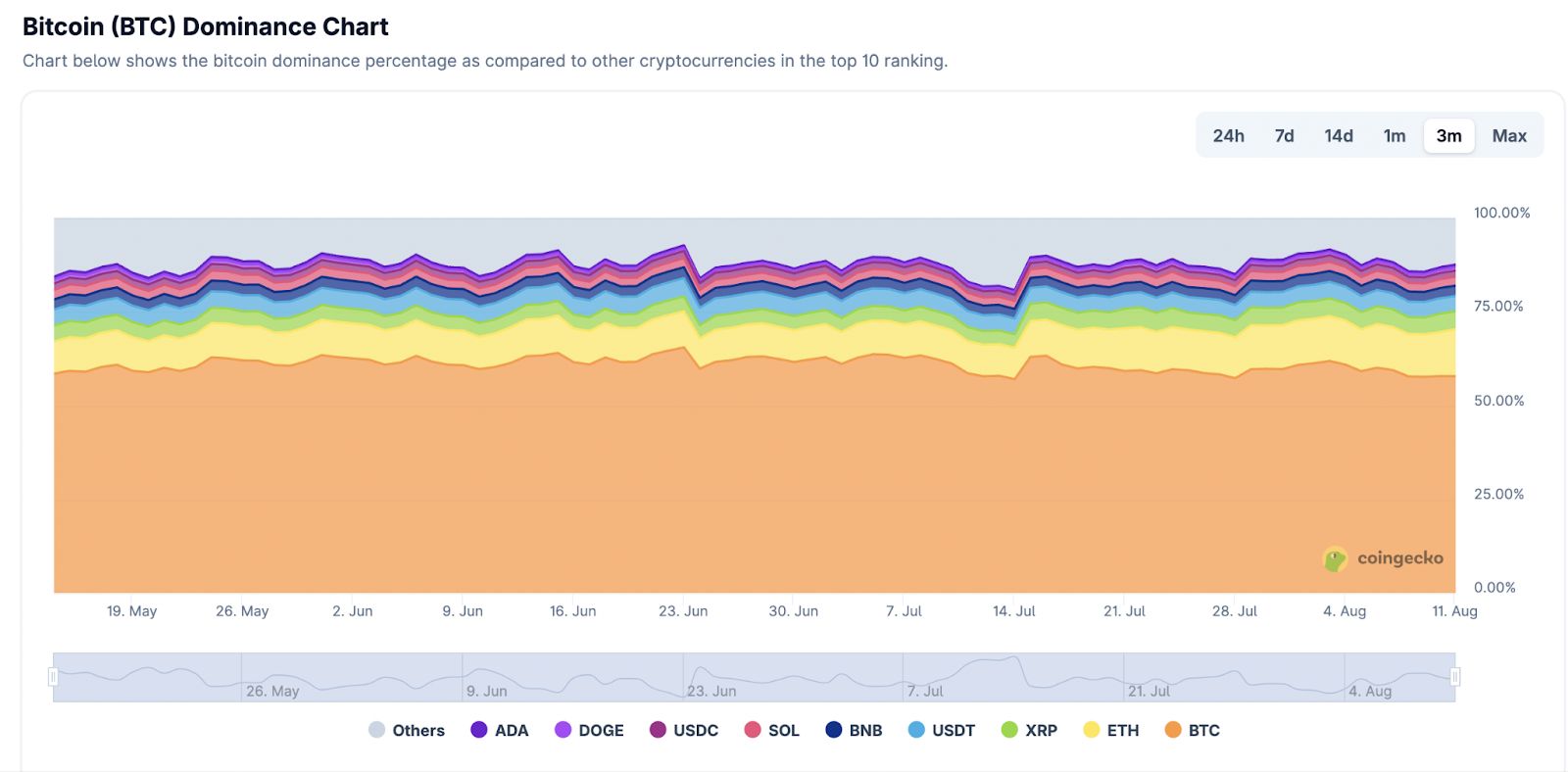

Bitcoin’s dominance remains high at 58.9%, affecting altcoin performance.

The crypto market has reached a new high of $4.1 trillion, driven by Bitcoin’s gains and institutional interest, marking a significant recovery.

| Bitcoin (BTC) | $121,280 | +2.6% |

| Ethereum (ETH) | $4,257 | +20% |

What is Driving the Recent Surge in the Crypto Market?

The recent surge in the crypto market is primarily attributed to Bitcoin’s strong performance, which has lifted the total market capitalization to $4.1 trillion. Bitcoin’s price is currently at $121,280, reflecting a 2.6% increase in the last 24 hours.

How is Institutional Adoption Impacting Bitcoin and Ethereum?

Institutional adoption has significantly impacted both Bitcoin and Ethereum. Bitcoin ETFs have seen inflows of $247 million last week, indicating strong institutional interest. Ethereum has also gained traction, with its price climbing nearly 20% over the past week, now trading at $4,257.

Frequently Asked Questions

What factors are contributing to Bitcoin’s price increase?

Bitcoin’s price increase is driven by strong institutional buying and positive market sentiment, leading to a surge in its value.

How does Ethereum’s performance compare to Bitcoin?

Ethereum has outperformed Bitcoin recently, gaining nearly 20% in the last week, indicating strong market interest.

Key Takeaways

- Market Recovery: The crypto market capitalization has reached $4.1 trillion, marking a significant recovery.

- Bitcoin’s Dominance: Bitcoin holds a 58.9% market share, impacting altcoin performance.

- Institutional Interest: Growing institutional adoption is driving the recent price increases for both Bitcoin and Ethereum.

Conclusion

The crypto market’s resurgence to a $4.1 trillion valuation highlights the growing institutional interest in Bitcoin and Ethereum. As Bitcoin maintains its dominance, the potential for altcoin growth remains, keeping investors optimistic about future trends.

-

The crypto market has seen steady gains, driving the total market capitalization to new highs.

-

Bitcoin’s recent performance has reignited investor confidence.

-

Ethereum’s significant gains indicate a broader market recovery.

The crypto market has surged to $4.1 trillion, driven by Bitcoin’s gains and institutional interest, marking a significant recovery.

Bitcoin’s Dominance Stalls Altseason

Despite Bitcoin’s strong performance, its dominance at 58.9% has stalled the anticipated altseason. Analysts note that the current market dynamics differ from previous cycles, where Bitcoin’s gains typically led to altcoin rallies.

Analysts are hopeful that with Ethereum’s strong gains and modest positive signals from other altcoins, a broader rally could still be on the horizon.