Global Crypto ETPs Attract $572M Inflows, Led by Bitcoin and Ethereum Products

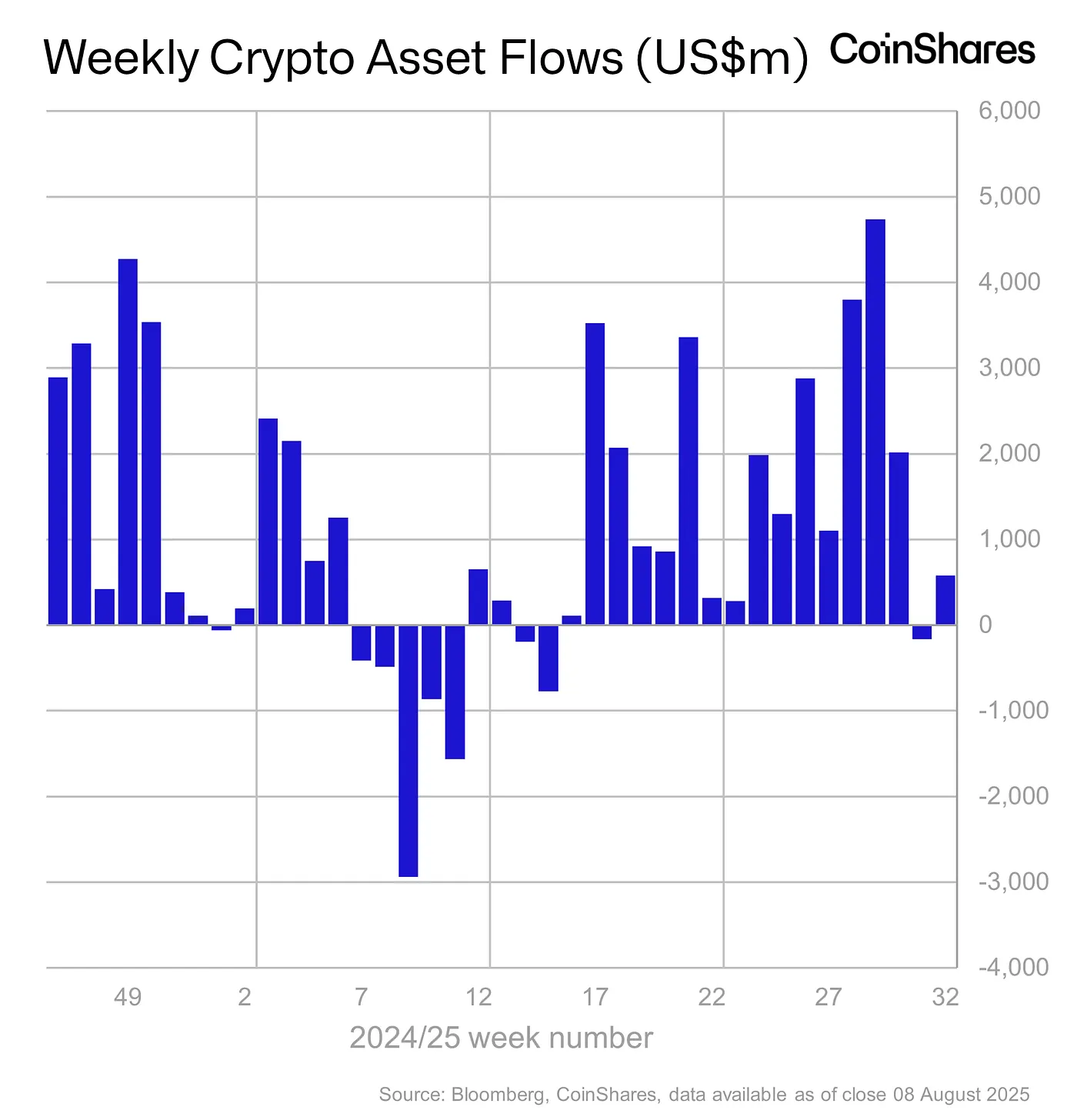

Global crypto exchange-traded products (ETPs) recorded $572 million in inflows during the trading week ending Friday, according to data from European digital asset manager CoinShares.

Global crypto exchange-traded products (ETPs) recorded $572 million in inflows during the trading week ending Friday, according to data from European digital asset manager CoinShares.

The strong demand comes amid improving market sentiment and growing institutional participation in digital assets .

Bitcoin-backed investment products remained the primary beneficiary, securing $520 million in net inflows for the week. The flagship cryptocurrency’s market dominance and its role as the most accessible institutional gateway into crypto continued to attract asset managers.

Source

:

CoinShares

Source

:

CoinShares

Ethereum products also saw renewed interest, pulling in $21 million in inflows. The second-largest cryptocurrency has been buoyed by optimism surrounding the potential approval and launch of spot Ethereum ETFs in the United States, as well as broader adoption of its blockchain for stablecoin settlements and tokenized assets.

Other altcoin-linked ETPs recorded mixed performance. Solana products drew $8 million in inflows, reflecting sustained interest from investors seeking exposure to high-throughput blockchains. Meanwhile, multi-asset ETPs saw net outflows, suggesting some investors are consolidating positions into top-tier digital assets.

The inflows mark the fourth consecutive week of positive net investments into crypto ETPs, signaling a shift in institutional appetite after months of cautious positioning. CoinShares analysts attributed the momentum to falling interest rates expectations, weakening U.S. dollar strength, and growing clarity on regulatory pathways for crypto-based financial products in key markets.

Trading volumes in crypto ETPs surged to $2.3 billion for the week, well above the year-to-date weekly average. Analysts say this uptick underscores a resurgence in market activity, with asset managers and professional traders positioning ahead of potential catalysts in the coming months.

CoinShares noted that while market volatility remains a factor, the steady inflows suggest that institutional investors are increasingly treating digital assets as a core component of diversified portfolios.

Despite recent price volatility in Bitcoin and Ether, institutional appetite appears to be strengthening, with digital assets increasingly seen as a strategic component of diversified portfolios.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CARV In-depth Analysis: Cashie 2.0 Integrates x402, Transforming Social Capital into On-chain Value

Today, Cashie has evolved into a programmable execution layer, enabling AI agents, creators, and communities not only to participate in the market, but also to actively initiate and drive the building and growth of markets.

Trump Takes Control of the Federal Reserve: The Impact on Bitcoin in the Coming Months

A once-in-a-century major transformation is taking place in the U.S. financial system.

Gensyn launches two initiatives: A quick look at the AI token public sale and the model prediction market Delphi

Gensyn previously raised over 50 million dollars in total through its seed and Series A rounds, led by Eden Block and a16z, respectively.

Verse8's Story: How to Support Creative Expression in the Age of AI

Creativity will continue to increase in value through collaboration, remixing, and shared ownership.