Machine learning algorithm predicts Ethereum price on August 31, 2025

Ethereum (ETH) could be on the verge of smashing its all-time high this month, with advanced AI models forecasting prices above $5,000 by August 31, 2025.

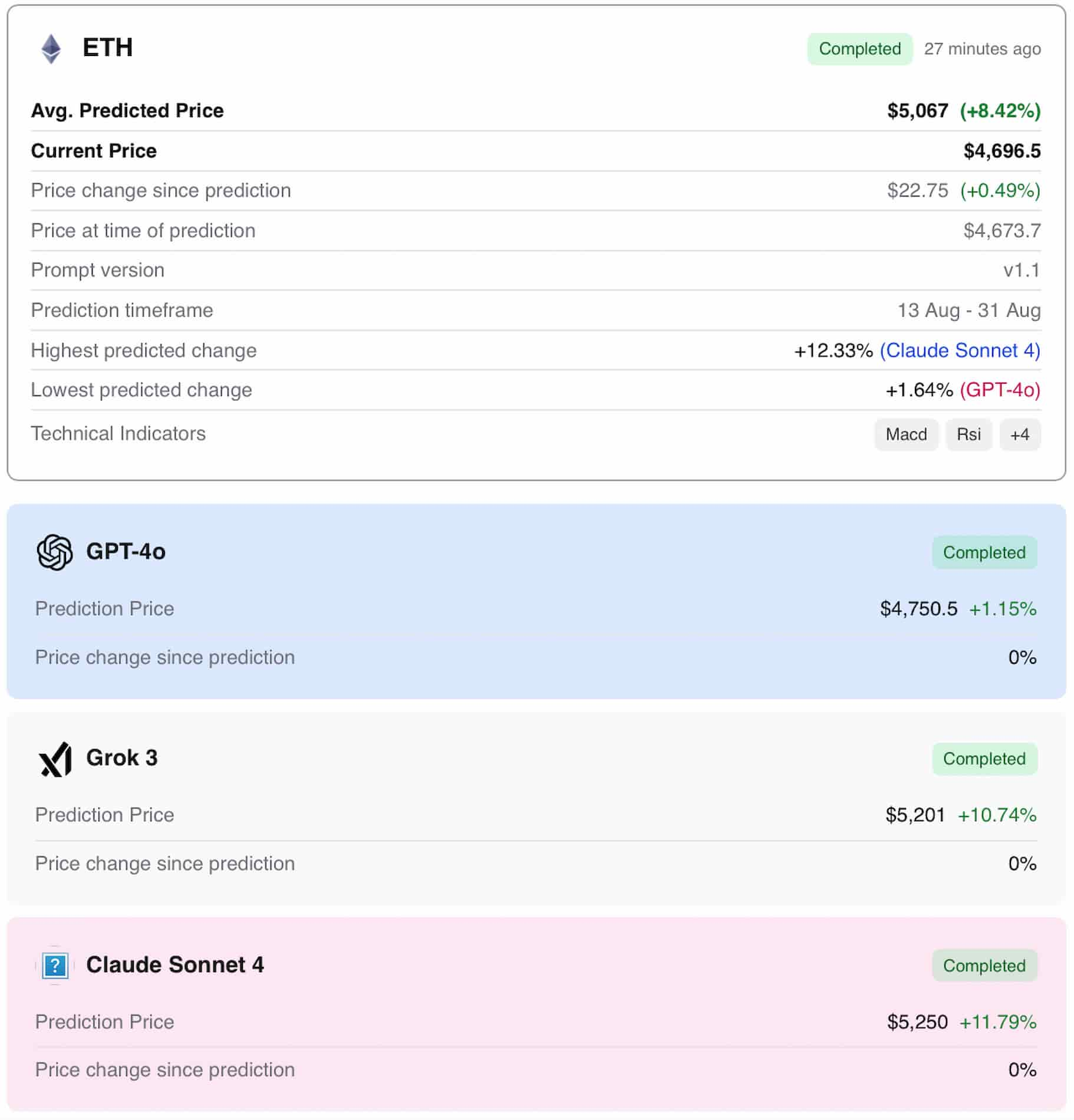

Finbold’s AI price prediction tool powered by machine learning models GPT-5, Claude 3.5 Sonnet, and Grok 3 Vision, alongside a suite of technical indicators including MACD, RSI, stochastic oscillators, and both the 50-day and 200-day moving averages, now places Ethereum’s average projected price at $5,067.

That represents an 8.42% upside from the current market level of $4,696.5.

Each of the models shows strong conviction that Ethereum will maintain its bullish momentum. Claude 3.5 Sonnet emerges as the most optimistic, projecting a price of $5,250, a 12.33% gain that would mark a clear move into uncharted territory.

Grok 3 Vision forecasts $5,201, implying a 10.74% increase and signaling that the uptrend could extend well beyond the psychological $5,000 threshold. Even the more conservative GPT-5 (GPT-4o variant) anticipates a climb to $4,750, which would still keep ETH comfortably above recent support levels.

ETH sees massive institutional inflow

The bullish projection comes as Ethereum’s rally accelerates on the back of record ETF inflows. On August 11 alone, Ethereum ETFs saw $1 billion in net inflows, led by BlackRock ($640 million), Fidelity ($270 million), and Grayscale ($80 million), according to Farside Investors. Over August 11–12, inflows topped $1.5 billion.

Arkham Intelligence data shows BlackRock’s wallet activity spiking, with multiple high-value ETH transfers from Coinbase Prime. Institutional appetite is growing, even as retail traders have been selling into strength; dynamic Santiment notes have historically preceded further upside.

Adding fuel to the rally, 180 Life Sciences Corp. a crypto-focused firm backed by Palantir co-founder Peter Thiel, recently disclosed holdings of 82,186 ETH (worth $349 million at $4,600), alongside a 250% surge in its share price.

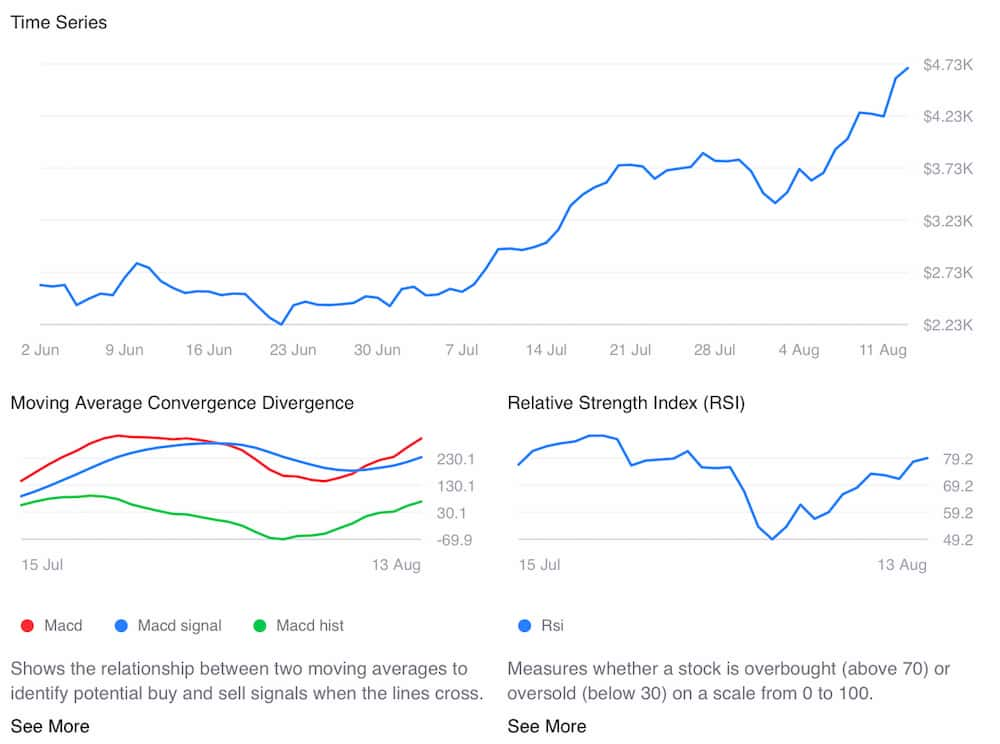

With ETH currently trading near $4,700, just 6.4% below its November 2021 peak of $4,891 momentum indicators are flashing bullish. RSI sits above 79, suggesting strong buying pressure, while MACD remains in positive territory.

If AI projections hold, Ethereum could not only reclaim but decisively break its all-time high before the end of August, setting the stage for potential price discovery heading into Q4.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is the moat of public blockchains only 3 points? Alliance DAO founder's remarks spark heated debate in the crypto community

Instead of worrying about "moats," perhaps we should focus more on how cryptocurrencies can meet the real needs of more market users faster, at lower cost, and with greater convenience.

Digital Finance Game: Unveiling the US Cryptocurrency Strategy

Glassnode: Bitcoin weakly fluctuates, is major volatility coming?

If signs of seller exhaustion begin to appear, it is still possible in the short term for bitcoin to move towards the $95,000 level and the short-term holder cost basis.

Axe Compute (NASDAQ: AGPU) completes corporate restructuring (formerly POAI), enterprise-level decentralized GPU computing power Aethir officially enters the mainstream market

Predictive Oncology officially announced today that it has changed its name to Axe Compute and will trade on Nasdaq under the ticker symbol AGPU. This rebranding marks Axe Compute's transition into an enterprise-level operator, officially commercializing Aethir's decentralized GPU network to provide robust, enterprise-grade computing power services for AI companies worldwide.